Research Report

Playbook for Success

After spending countless hours and several reports focused on a number of shopper research studies, this report pulls all that learning together into a practical “Playbook for Success.”

This playbook provides everything learned from thousands of interviews and studies from major shopper marketing studies into three easy steps that can be directly applied to any sized c-store:

- Do the basics – Research revealed there were a few easy-to-fix areas that retailers can implement to attract many customers who don’t see convenience retail an existing shopping option.

- Define your turf – While c-stores are excellent at meeting the “grab and go” shopper need, they can beef up two specific areas to push their business growth to the next level.

- Attract new trips – The key to attracting new trips is more than just promotion. This report identifies four platforms or growth opportunities that will help you target and serve customers beyond the grab-and-go occasion.

Introduction

17,000

Shopper interviews

10

Different retail channels

8

Months of analysis

29

Cities

In 2012, the NACS/Coca‑Cola Retailing Research Council hit the books...hard. We sifted through mountains of shopper research1 to learn more about convenience shopping occasions, what shoppers were looking for, and their level of satisfaction in finding it.

Those interviewed ran the gamut from shoppers who love their convenience store and shop there frequently, to those who shop there occasionally, go only in a pinch, or wouldn’t go on a dare. What we learned from these current, former, and potential customers, is that they have unmet needs that represent growth opportunities for C-store operators.

This Playbook for Success synthesizes this shopper research into an actionable program that can help any C-store operator who wants to grow their business. It offers:

- A three-step program for growing your business

- Tools to help you decide where to start and how to measure success

- Four growth platforms that reach beyond “grab and go” needs to attract new business

The three action steps are flexible and adaptable. The first two apply to all convenience retailers and all convenience shoppers. The third involves developing a specialty that reaches beyond serving grab-and-go needs to attract new business. Every retailer will start in a place that makes sense for their stores, and every retailer’s path will be unique to their strengths and circumstances.

Testing is an important phase of Council work. We want to confirm how effective the new growth platforms are in leading shoppers to spend more at convenience stores, so we are encouraging retailers to conduct pilot tests in 2013. We’ll share the results of those pilots— conducted by Council members and other volunteers— in early 2014.

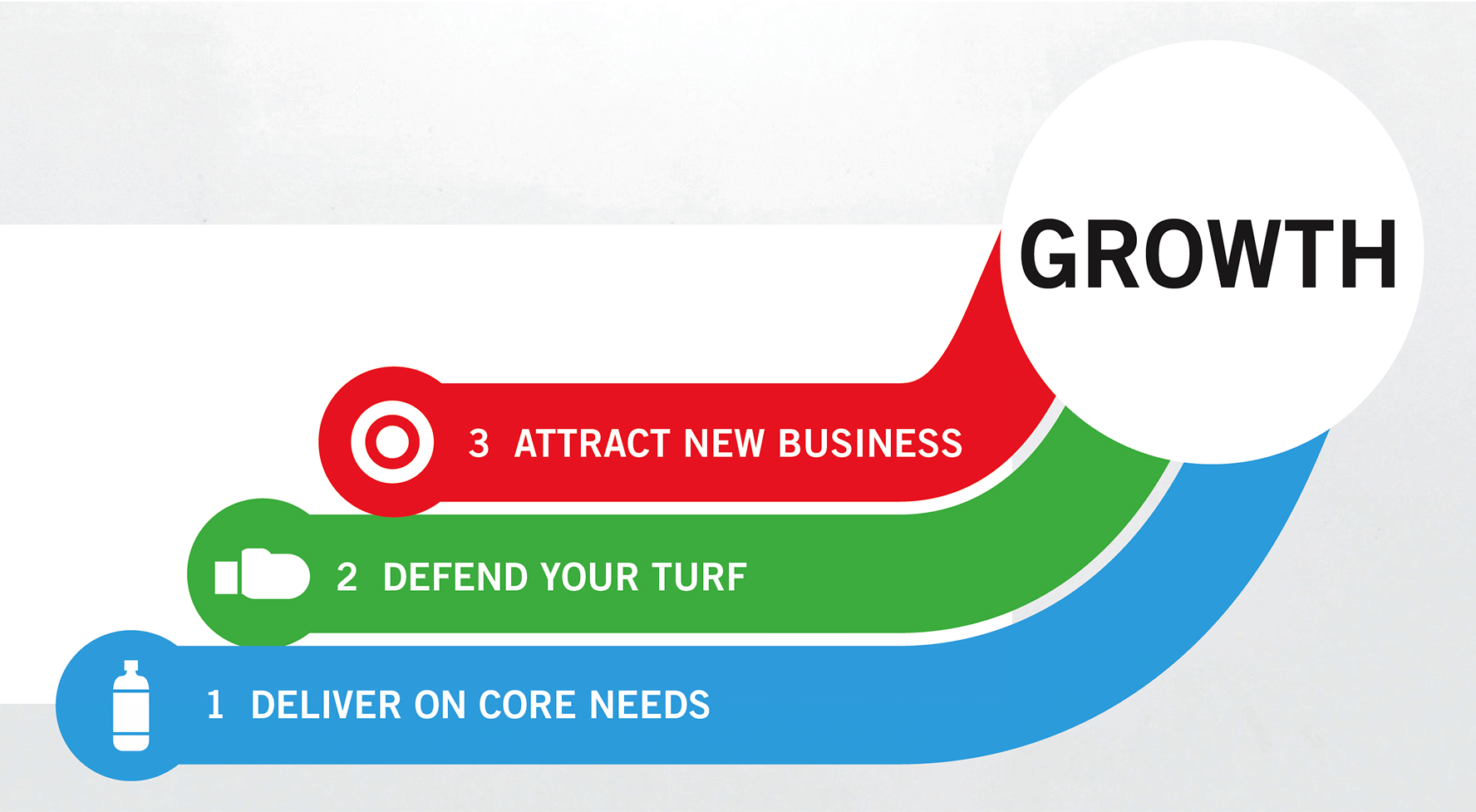

3 action steps

- Deliver on core needs

- Defend your turf

- Attract new business

Where are the opportunities?

Polish the fundamentals

To earn more business from current customers and capture new ones who’ve been passing you by.

Serve unmet needs

To attract new business by reaching beyond grab-and-go to serve unmet shopper needs.

Enhance service to your core customers

To capture bigger, more loyal spending from your core grab-and-go customers.

What do shoppers say?

According to the extensive shopper research we analyzed for this Playbook, shoppers want more than convenience retailers are giving them. The message that came through repeatedly in these surveys was, “I’d shop at convenience stores more if certain conditions were met.” This is good news. Shoppers are telling us that there is room to grow if we do a better job of delivering on their needs and expectations. Here’s what they told us.

Give me the fundamentals!

Convenience stores are not meeting some basic shopper needs.

There is still a great deal of growth potential in simply improving on the basics.

Emerging competition for convenience shopping, especially the dollar store, is doing a better job at consistently providing three fundamentals that customers expect: a clean, safe environment, frustration-free shopping, and consistent value. Unless these minimum requirements are met every single time, shoppers flee and often won’t give you another chance.

In fact, on one key item — the need for a clean, safe environment — the research shows that convenience stores performed more poorly than any other retail channel.

This weak reputation for delivering on the basics creates a vulnerability for stores that aren’t keeping up, and it may cause guilt by association for other convenience retailers who may be “tarred with the same brush.” Shoppers are clearly telling us that better delivery on core needs is the first opportunity for us to grow our businesses.

Give me a c-store when I’m hungry or thirsty!

When it comes to beverages and ready-to-eat food occasions, convenience stores dominate, but improving service is a big opportunity.

Convenience retailers have a strong reputation for value in price paid for food and an unmatched variety in both food and beverage choices. However, improved service is a big opportunity.

Customers still give the channel poor ratings on consistency of service, staff friendliness, and courtesy. Convenience retailers significantly under-perform in these two areas against competitive retail service outlets.

Defending our grab-and-go turf from other channels by improving service while emphasizing our broad choice of beverages and food-to-go is the second opportunity for us to grow our businesses.

Give me more!

Shoppers have needs that go beyond the grab-and-go occasion — and C-stores who deliver on them can attract new business.

We’ve translated these unmet needs into four growth platforms that retailers can use as a template for attracting new business. We’ll dive deeper into them later in the Playbook.

Fresh value fast

I’m pressed for time, but I still want to get something decent to eat at a good value.

Family time

I want to take the kids out for a treat that won’t break the bank.

My time

I’m rushed all day. I need a place where I can take my time, browse and decompress.

Female friendly

I’ll shop your store if it’s safe, nice, and the people make me feel comfortable.

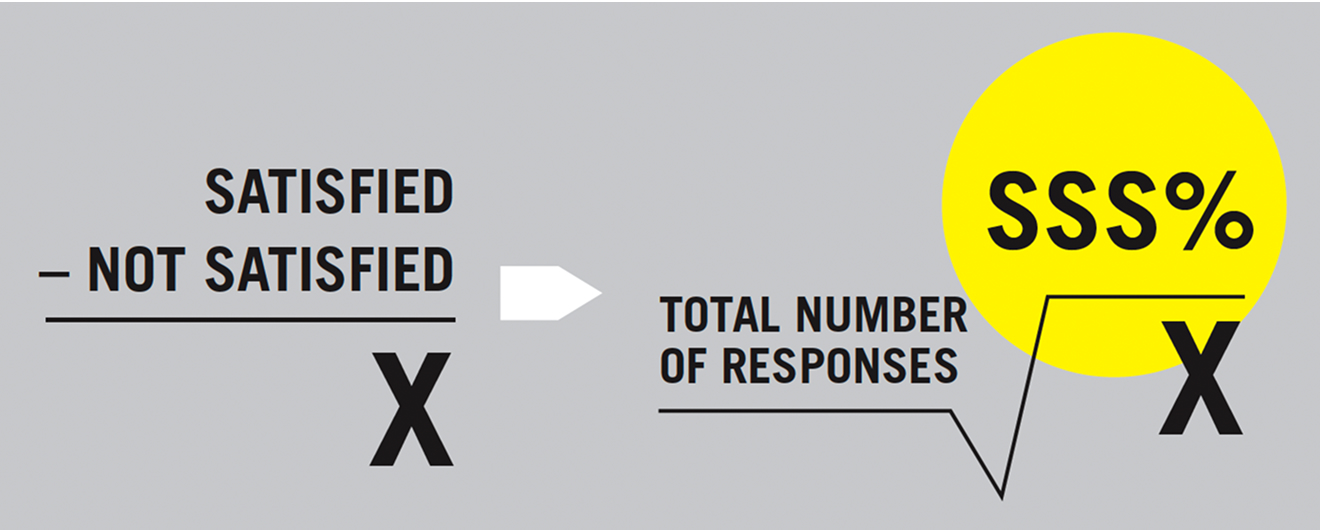

Shopper satisfaction tool

NACS/CCRRC has devised a tool to help you measure shopper satisfaction. It involves a brief customer survey you can use to determine your “Shopper Satisfaction Score” on a range of dimensions. First, use the tool to identify which growth step you’re ready to tackle. Then, use it to measure the effectiveness of the changes you put into play.

It begins by breaking down shopper needs into metrics we can understand and do something about. The shopper needs below are grouped as they relate to Steps 1 and 2.

Methodology

A

Ask a sample of 100 to 200 shoppers: Based on your experience this visit, rate our performance on each attribute on the right, using a 1–10 scale (10 is high).

Based on 30,000 transactions per store per month, you would want to survey 200-350 randomly selected individuals to adequately represent your customers.

B

Cluster responses into three groups:

- NOT SATISFIED (all ratings of 1–6)

- INDIFFERENT (all ratings of 7 or 8)

- SATISFIED (all ratings of 9 or 10)

C

Determine your Shopper Satisfaction Score:

Subtract the number of “Not Satisfied” responses from the number of “Satisfied” responses. Then divide by the total number of responses. The resulting score is your SSS%.

D

Interpret the results:

To set expectations: Results can be low. Median first-time scores are 16% — and yes, it’s possible to generate a negative score!

The Playbook

Step 1: Deliver on core needs

Start here if your satisfaction score is below 40%.

Council research has consistently shown that core shopper needs must be met before any other higher level needs may be addressed. Delivering on the three core needs identified at right is your minimum cost of entry to even be considered as a retail choice.

If your stores are not meeting any of the core needs, stepping up to fill that need will encourage non-customers to give you a try. If you’re doing a good job meeting these needs, but not consistently, you still have opportunities to gain additional spend from current customers.

Take a fresh look at not only what you are doing, but how your performance compares with the competition. Your customers have this same choice. Your competition is all the places that a customer can meet their needs for that particular shopping occasion — other C-stores, drug stores, fast food retailers, grocery stores, dollar stores, etc.

This step actually holds the most potential business growth of any step outlined in this report since getting the basics right is the foundation for everything else in building your business. It is also the hardest to do since it requires attention every day.

If you take any corrective action in your store, use the Shopper Satisfaction Tool on page 10 to verify it has made a difference with shoppers before you move on to your next objective.

Cleanliness & safety

I feel very comfortable shopping in your store.

Frustration free

Items are always in stock and I don’t have to wait.

Consistent value

A place where I get good value for money.

Be honest with yourself...

Can you improve your delivery on core needs?

1: Clean and safe surroundings

Are your restrooms clean and well-maintained?

Are the interior and exterior well-lit?

Are employee uniforms and grooming neat and tidy?

Is safety training and performance part of your program?

2: Frustration-free shopping

Do you offer a good selection of products?

Do you have a replenishment program that ensure items are consistently in stock?

Do you provide clear visual cues that help the shopper?

Is all the equipment used by customers in good working order -- fuel dispenser, credit card machines, etc.?

Is it easy to get in and out of your parking lot?

Are transactions designed to be simple and quick?

Are your employees trained to know how to do their jobs?

3: Good value for your money

Are your prices in line with the competition?

Do you have special pricing or offers that encourage your customers to buy more?

Are your price labels easy to read and accurate?

Step 2: Defend your turf

Start here if your satisfaction score is between 40 and 70%

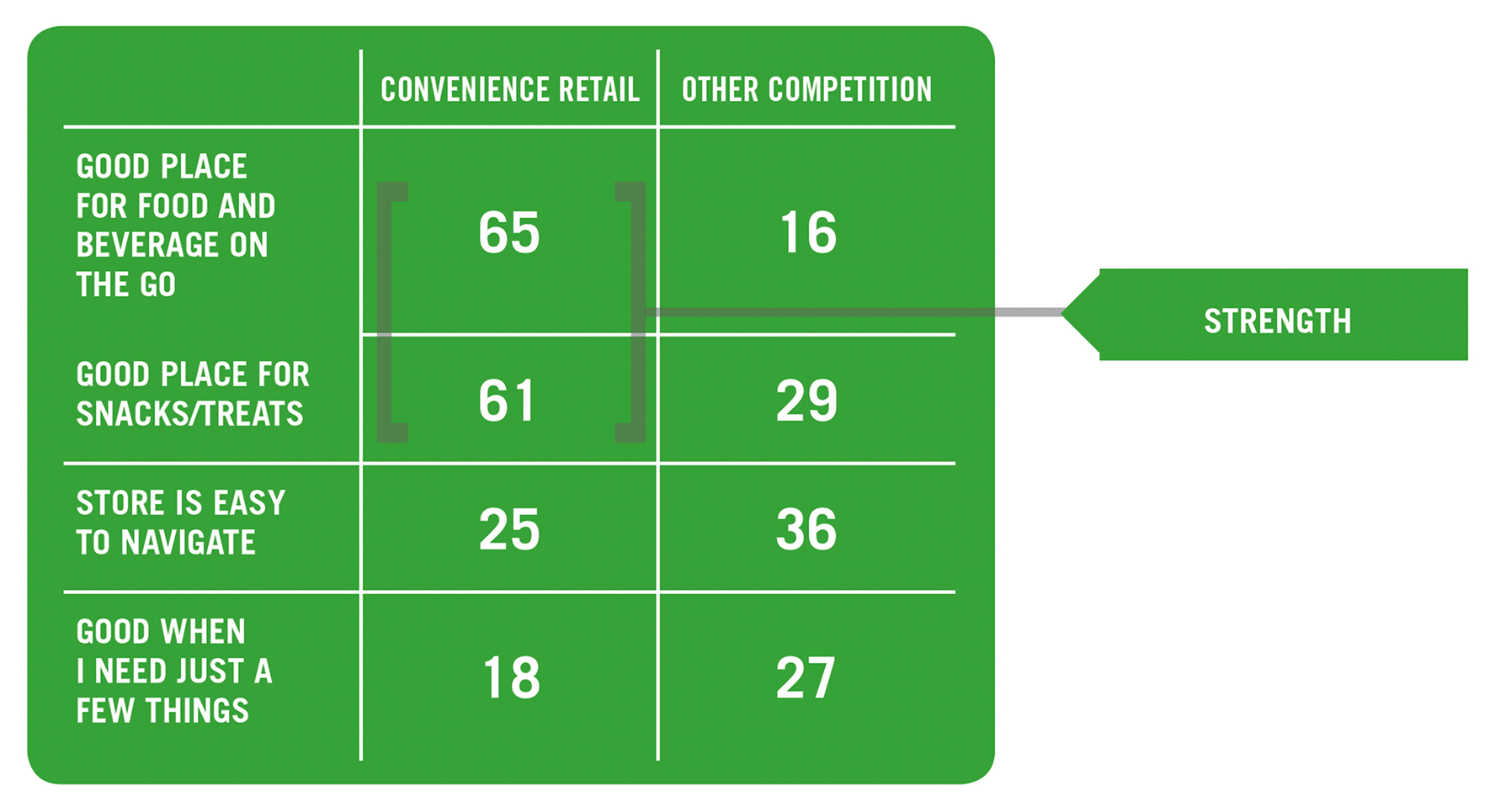

Convenience retailers have some real strengths in terms of how we are perceived in grab-and-go, but we must defend our turf from other retailers who are recognizing this opportunity and improving their ability to serve this need.

According to the research, no other retail channel matches c-store performance for “grab-and-go.” But the research also shows that dollar and drug stores are doing a better job in some dimensions.

What do shoppers want from their grab and go occasion? The research says:

Grab and go

This is all about fulfilling my immediate needs to quickly and easily grab a snack, a beverage, or a fill-in item that’s located on my normal route.

Defending the grab-and-go occasion

In the food service area, convenience retailers have a competitive advantage in terms of their reputation for offering value for price paid and for unmatched variety in ready-to-go foods and beverages, compared to shoppers’ other options for food on the go.

We can build on these strengths and move to correct what shoppers see as a weakness by improving the quality of food, looking for ways to make our offers a little more unique, and improving service.

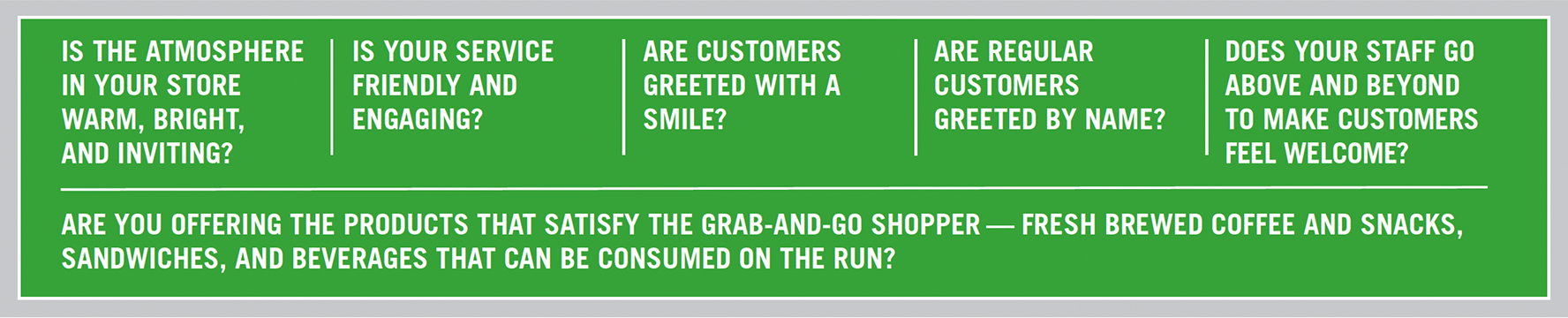

Hospitality and variety are key components

The research also shows that many convenience shoppers are looking for a place to escape, even for just a few minutes, from the pressures of everyday life. Hospitality and variety can be incredibly effective tools when it comes to defending your turf. A smile, a greeting, a surprise offering — these can make your grab-and-go shoppers’ day a little better. They can also make a big difference in whether these customers choose your store again and again over other alternatives.

Don’t let competitors eat your lunch

Are you offering hospitality and variety?

Step 3: Attract new business

Start here if your satisfaction score is above 70%

If you’re already delivering on core needs, and if you’ve taken steps to defend your “grab-and-go” turf from competitors, you’re ready for Step 3 — attracting new business. From the research, the Council identified four significant opportunities for convenience retailers to serve customers beyond the grab-and-go occasion.

These growth platforms outline how unmet shopper needs cluster into four shopping occasions. Each platform adds some new feature, service, or both, to appeal to customers beyond the basics of convenience shopping.

There’s no single “right way” to build out the four growth platforms. Each retailer will need to interpret the platforms based on their own strengths and circumstances, and test how well their interpretation works with shoppers. The Council plans to publish results from platform pilot tests in early 2014.

Fresh value fast

Family time

My time

Female friendly

Choosing a platform

It’s important to choose one platform and execute it effectively. There are overlapping opportunities among the platforms, but establishing a strategic position and sticking to it is important. When you cherry-pick elements from different platforms, you run the risk of trying to be everything to everyone, standing for nothing, and doing nothing particularly well.

To choose a platform, start by asking what is it that makes your business successful? Is your staff a little friendlier than most? Do you offer some unique and popular products that help bring customers back to your store on a regular basis? Maybe something else makes your store stand out.

Ask yourself these questions to get started:

What do customers really like about your store and how has that helped to make your business successful?

What differentiates you from local competition?

Where do you generate the most traffic in your stores? Put another way, what categories “work” for your customers?

Identify what you’re good at in the minds of your shoppers and then look to see how to build on your strengths by adopting one of the new growth platforms. Consider which growth platform is consistent with your current business and opportunities.

Fresh value platform

On this occasion, shoppers want to feel as if they are taking care of themselves. They don’t want to be forced to sacrifice food quality, even though they are in a hurry. They want a better alternative to fast food— ideally fresh, made-to-order items, with toppings they personally select.

In a nutshell

Fresh value fast is all about providing reasonably priced, better, healthier alternatives to traditional fast food.

Who you’re up against

QSRs, sub shops, grocery store delis

Target shopper

Working men and women, ages 18 and over

Target occasion

Morning commute, lunch break

Is fresh value fast for you?

Is there a large concentration of working adults in your market?

Do you have (or can you acquire) the capabilities to improve your food service product quality and taste?

Do you offer the broadest selection of drinks in the market?

All indicators point to foodservice as an essential element of future c-store success

According to the research, foodservice offers an area of substantial growth. When it comes to food options, customers have become more discerning, demanding, and if possible, even more strapped for time. Chains like Chipotle, Paneras, and Five Guys have taught consumers that fresh food can be obtained at a good value. So now it’s up to us to improve the C-store game. Focusing on fresh food, quality, and taste is key.

How you can deliver

- Atmosphere: Clean, well-lit, up-to-date décor, pleasant aroma, small inside seating area or outside tables

- Service: Professional, friendly, efficient

- Product: Freshly prepared sandwiches, subs, a salad/soup station, ethnic foods, and a variety of coffees

To sum up

You can provide a Fresh Value Fast offering in your store but it will take some investment and operational changes. Start small, and then build from there. Once you plant the idea with customers that you’re a good choice for a breakfast or lunch destination, they will reward you with their business on a regular basis.

Family time platform

On this occasion, families are looking for an inexpensive way to connect and have fun. Think about becoming an alternative to ice cream and yogurt shops for families.

In a nutshell

Family time involves offering something for everyone in the family. The obvious target is families on a budget, and the occasion is a family treat.

Who you’re up against

QSRs, ice cream and yogurt shops

Target shopper

Families with children under 18

Target occasion

Treats/snacks with kids

Is family time for you?

Is there a large concentration of families in your market?

Are your stores a place where parents are comfortable bringing their children for a treat?

Can you offer promotions that appeal to families with children?

How you can deliver

- Atmosphere: Clean, safe, and kid-friendly. Small seating areas or benches can give families a place to connect for a few minutes and share a snack or a treat

- Service: Friendly and professional

- Product: Single-serve ice cream/bars, confections, frozen beverages for kids; hot and frozen coffee for parents; healthy snack options like fresh fruit, yogurt parfaits, etc.

To sum up

Families are looking for an affordable, easy way to spend time together and connect. Offering treat options that satisfy both children and adults allows C-stores to be destinations for families.

When we saw the Family Time growth platform, I knew we wanted to do something with it. One Saturday last September we built an event around the idea. We had eye-catching activities for the kids, and gave away a lot of food, drinks, and snacks for the entire family. Our family time event was a great way to get people who didn’t even know we existed to stop by and have some fun with us. It was a great way to meet new customers and build new trips.

Rahim Budhwani

6040 LLC

My time platform

On this occasion, shoppers are looking for a little time for themselves in their busy day. They sometimes want to browse, and not feel rushed. Once they’ve made their selections, however, they want to check out and depart quickly.

In a nutshell

Don’t rush this shopper when they want to browse, but get them out fast when they’re read to go.

Who you’re up against

Other c-stores, dollar, drug, and grocery stores

Target shopper

General market

Target occasion

Refreshment, snacking, foodservice, household fill-in

Is my time for you?

Can your store become a place where people spend a little more time? Is it well-lit, warm, and inviting?

Do you have an opportunity to expand a variety of offers in several high-penetration categories so customers will be tempted to stop and browse the selection?

Would you be willing to provide seating so shoppers who want to linger a while can do it?

If shoppers stay a little longer, will that cause congestion in the lot?

How you can deliver

- Atmosphere: Warm colors, bright/well-lit (preferably natural light), easy to navigate, shelves organized, logical layout

- Service: Efficient, attentive, but not intrusive

- Product: Limited Time Offers, sales/promo items like two-for-ones prominently displayed

To sum up

Look for ways to make your store a relaxing break for shoppers. Efficient operations and a relaxed atmosphere, prominently featured specials, and an environment where they can browse or maybe check email without pressure.

’My time’ really resonates with me, because it’s clear that people are starving today for time. They want to have a sense of control over it.

Allison Moran

RaceTrac

These customers don’t want to feel pushed, they need to relax and want to have a little fun when they’re shopping.

Brad Call

Maverick

Female friendly platform

Above all, women want a place that feels comfortable and safe with a professional staff that doesn’t infringe on their personal space. They are also motivated by the reward of having a break in their day — time to check their email or enjoy a cup of coffee before rejoining the fray.

In a nutshell

Female friendly involves making women shoppers feel safe and comfortable.

Who you’re up against

Malls, coffee shops, drugstores

Target shopper

Women

Target occasion

Morning commute coffee, afternoon/evening coffee/snack break

Is female friendly for you?

Are you getting your fair share of female shopping visits?

Are your stores well-lit, and are they attractive enough to be comfortable for females to stay a little while?

Would you be willing to provide seating so shoppers can linger a little?

If shoppers stay a little longer, will that cause congestion in the lot?

How you can deliver

- Atmosphere: Safe, modern, well-lit

- Service: Professional, cordial without being intrusive, efficient

- Product: Variety of fresh coffees (affordable alternative to Starbucks), gourmet sandwiches/breakfast sandwiches (ciabatta), bagels, etc.

To sum up

Look for ways to make women feel comfortable and pampered.

The more we talked about the new growth platforms, the more it became apparent that we were missing the boat with women. When we talked to some of the women who worked for us, they told us that it was true. We’ve made some changes based on their feedback, and we’ve already seen some positive results.

Fran Duskiewicz

Nice ‘N Easy

Additional Resources

These recent NACS/CCRRC studies have used shopper research to identify new growth opportunities for the industry.

Using Shopper Research to Grow C-Store Sales

Shopper Forward: Benefits of Emphasizing Safety at Your Store

Finding the Way Forward: A Practical Roadmap for Capturing Emerging Opportunities in Convenience Retail

The NACS Coca‑Cola Retailing Research Council

Hank Armour

NACS

Brent Blackey

Holiday Companies

Dave Carpenter

J.D. Carpenter Cos.

Carol Jensen

Wawa, Inc.

Allison Moran

RaceTrac

Art Stawski

Loaf ‘N Jug

Alan Beach

7-Eleven

Rahim Budwani

6040 LLC

Fran Duskiewicz

Nice ‘N Easy Grocery Shoppes

Dae Kim

NACS

Eduardo Padilla

OXXO

Brad Williams

Mid-Atlantic Convenience Stores (MACS)

Alain Brisebois

Alimentation Couche-Tard Inc.

Brad Call

Maverik

Dough Fritsch

IGA

Karl Kruse

Hy-Vee

Glenn Plumby

Speedway

Who We Are

The NACS Coca‑Cola Retailing Research Council is ccomposed of convenience industry leaders from around the world. It conducts studies on issues that help retailers respond to the changing marketplace. The unique value of these studies rests with the fact that retailers define the objective and scope of each project and “own” the process through the release of the study and its dissemination to the broader retail community.

Our Mission

To identify big issues facing convenience retailers, do research that uncovers ways to deal with them, and then encourage retailers to use these new ideas to improve their business.

Acknowledgements

The Council wishes to thank Susan Lindsay and her communications team for translating this work into a clear and accessible report, and Bill Bishop of Willard Bishop and Brick Meets Click, for his guidance and counsel as the facilitator and coordinator of this project for the Council.