Research Report

Fighting What's Different Differently: Retention in the Grocery Front Line

Grocery is an industry with high employee turnover. It’s always been high, but has gotten worse and is a material drain on profitability. While it has come back off the covid peak, recovery seems to be behind its peer industries.

Fixing this requires acknowledging what’s different and tackling it differently. Some long-standing problems must also be addressed in a more effective way. We examine the FIVE MAJOR ACTIONS grocers can take that will make a real difference to employee retention!

Included in the plan is a simple diagnostic test that you can use to understand how these issues apply to your stores, regions, and banners. It’s intended to be a tool to help you assess where you are in your journey to making your industry a desired career choice for today’s employee. Please access the survey here.

Summary of Key Messages

Grocery is an industry with high employee turnover. The problem is not new, but has been accelerating - the grocery employee turnover rate has grown twice as fast as the average US industry in recent years.

In a low margin industry, this is a challenge we cannot afford. It absorbs as much as 10-20% of the industry profit. The current model is not sustainable.

The challenge is not a market one. The post-covid ‘great resignation’ is largely over, although older workers have come back to the workforce more slowly. What is different is that there are more opportunities out there, and they are easier than ever to find.

The world has changed around grocery faster than grocery has changed as an industry. Grocers have been slow to acknowledge the challenge that the growth of gig work and work from home has had on worker expectations.

Fixing this requires acknowledging what’s different and tackling it differently, while also attacking some long-standing problems in a more effective way.

There are five things grocers can do that will make a real difference to employee retention:

- Recruit employees who are likely to be loyal.

- Challenge the assumptions that make the job less appealing.

- Deploy your marketing muscle internally - sell the benefits of working in grocery.

- Recruit, train and reward great managers.

- Be responsive, so you can meet employees’ reasonable needs.

We have created a simple diagnostic test that you can use to understand how these issues apply to your stores, regions, and banners and start to identify improvement areas. These are questions any CEO should be asking of their HR team.

“We are in the people business; we just happen to sell groceries.”

Anthony Hucker

CEO of Southeastern Grocers

Context of the report

“We are in the people business; we just happen to sell groceries.” Anthony Hucker, CEO of Southeastern Grocers and one of the members of The Coca‑Cola Retailing Research Council is font of using this phrase. It’s become a touchstone of the way he runs his business.

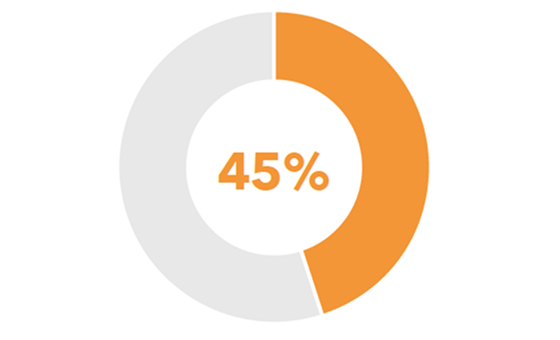

But the grocery business faces a challenge. It is running out of people. With an employee turnover rate of over 50%, higher than almost any other industry in the US, it is unsurprising that labor shortage has leapt to the top of grocery CEO agendas.

At a time when grocery margins are stretched, this is a challenge we cannot afford – absorbing as much as 10-20% of the profit and elevating labor to the top of the strategic agenda.

As this pressure on staffing increases, the temptation just to hire anyone increases. “We’ve simplified checks, streamlined training. You can just walk in now and we’ll give you a job” said one worried CEO. People less suited to grocery, getting less training and support – that just puts pressure on everyone else, so they leave even faster. It’s not a sustainable model.

This is a crisis.

But what kind of crisis is it? Is it a grocery crisis or does it spread more widely across retail and allied industries?

Is it a temporary blip, a covid hangover, or something more structural, perhaps based on generational changes? And, once we’ve understood the problem, how do we tackle it? What can be done to make grocery retail a place where Americans want to work?

This report, commissioned by the Coca‑Cola Retail Research Council of North America, seeks to answer these questions. It aims to provide a blueprint on what can be done to change grocery employment in North America. The report includes proprietary research and insights from the Council members and their companies, the leading grocers in North America. Alongside this report are a set of diagnostic tools that provide practical focus areas which individual companies (within grocery, but also in the wider retail landscape) and the industry can use to make sure grocers remain in the people business.

Understanding the scale of the challenge

Grocery has an acute and structural labor issue.

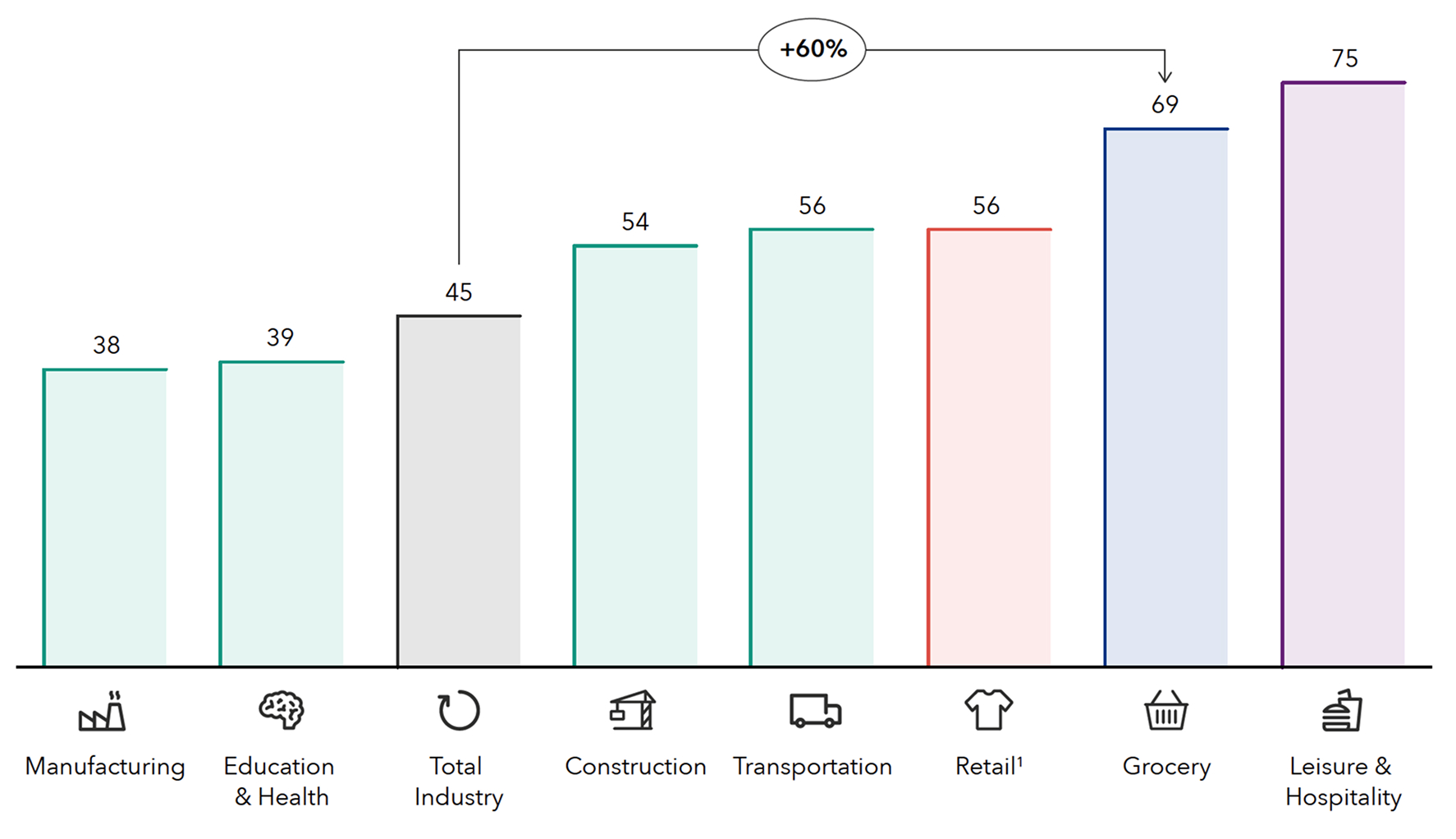

Grocers have one of the highest turnover rates of any US industry. Industry turnover has increased more than other industries since Covid, and the challenge is felt widely across employee groups and retail locations.

Turnover rate by industry, 2023F

(% Total employees)

Source: BLS, JOLTS, FMI, CCRRC NA Council Member Data, OC&C analysis.

1. Includes all retail sectors – motor vehicles, building materials, food and beverage, furniture and home, GM, health and personal care, gas stations, clothing and accessories, sporting goods, music, misc.

And the rate of growth in employee turnover in the last five years is twice as high in grocery compared to hospitality or the rest of retail. While the industry is coming off its covid peak where turnover was almost 80%, the trend rate is still much higher than it was in 2017, when it was (a still high) 62%.

This challenge is not felt evenly across individual companies or even within stores. Large chains have higher colleague turnover than smaller chains, younger employees are more likely to quit than older employees, cashiers are less stable than meat cutters.

At a time where grocery is challenged on multiple fronts (price inflation, squeezed disposable incomes, increasing volatility), high turnover is adding significantly to the pain.

The full extent can be hard to see because the costs of turnover aren’t always visible. They manifest in lower service levels, lower productivity, higher training costs, increased demands on management. Taken together these costs can be as much as 10-20% of a grocer’s total profit.2

Turnover rate by grocery role

20%

Meat cutter

95%

Cashier

78%

Bakery clerk

85%

Stocking clerk

Turnover rate by company size

87%

Large chains

34%

Small chains

Source: CCRRC NA Council Member Data.

2. Total cost of turnover accounts for the varying cost of turnover and turnover rates by role (e.g., full-time vs part-time and for varying tenures) informed by CCRRC Council Member data and applied to total industry profit.

What has gone wrong?

While turnover has always been high, it has gotten worse because the world has changed around us faster than grocery has changed as an industry. Employees’ expectations have consistently increased while grocers have not embraced the need (and opportunity) to give employees more.

Employees don't see the benefits of grocery as a career, when they perceive more and better options out there.

Change in number of employees, 2017-22

+5m

Total US economy

+13m

Gig economy

Flat

Grocery

Source: BLS

And while the world has been changing, grocers have not stepped up their communication. Employees don't see the benefits of grocery as a career, when they perceive more and better options out there.

Turnover has furthermore been exacerbated because our most loyal group of employees, the older worker, have been slower to come back after covid.

US Labor force participation rate, 2023 vs 2019

20-24 years old

down 0.8%pts

25-54 years old

up 0.7%pts

55+ years old

down 1.7%pts

Total labor force

down 0.6%pts

Source: Federal Reserve Bank of St. Louis.

What will distinguish an employee retention winner?

Working with the council members, and a ‘shadow council’ consisting of the chief people officers and heads of operations from grocers across North America, we identified the five elements of a winning plan to improve recruitment and retention in grocery.

Winning at retention in grocery means:

- Recruiting employees who are likely to be loyal

- Challenging the assumptions that make the job less appealing

- Deploying your marketing muscle internally - sell the benefits of working in grocery

- Recruit, develop and reward great managers

- Be responsive, so you can meet employees’ reasonable needs

1: Recruit employees who are likely to be loyal

Retention starts with recruiting the right people. Older workers are a particularly attractive demographic as they are growing in the workforce, and loyal once recruited.

Older workers are structurally more stable because they are less likely to move locations, more aware of what they are looking for in a job, less confident that if they quit there is another job out there for them.

But the fact that they are more loyal is not the only reason to think positively about older workers. They are also a growing demographic (now over 30% of the population), and while they have been slower to come back into the workforce after covid, that covid legacy is behind us now. While many grocers have specific programs targeting young people (college tuition initiatives for example) the equivalent for older workers is less common. Despite this, they are increasingly drawn to grocery, growing from 18% share of grocery employees in 2018 to 23% by 2022. Indeed, many studies suggest that older workers are ultimately more productive, and stores staffed with older workers can be more profitable.

But reaping the benefits of recruiting this ‘grey gold’ has a number of implications for your organization – you will need to think about:

- Looking beyond your traditional recruitment channels.

- Fostering a workplace culture that respects and values experienced team members.

- Tailoring your package to the requirements of older workers (e.g., greater autonomy at work, tailored benefits and extra focus on working conditions).

- Appropriate onboarding to build their confidence in a new role.

Source: BLS, US Census.

Grocery employee turnover rates by generation (%)

Gen Z

Gen X&Y

Boomer+

Source: CCRRC NA Council Member data.

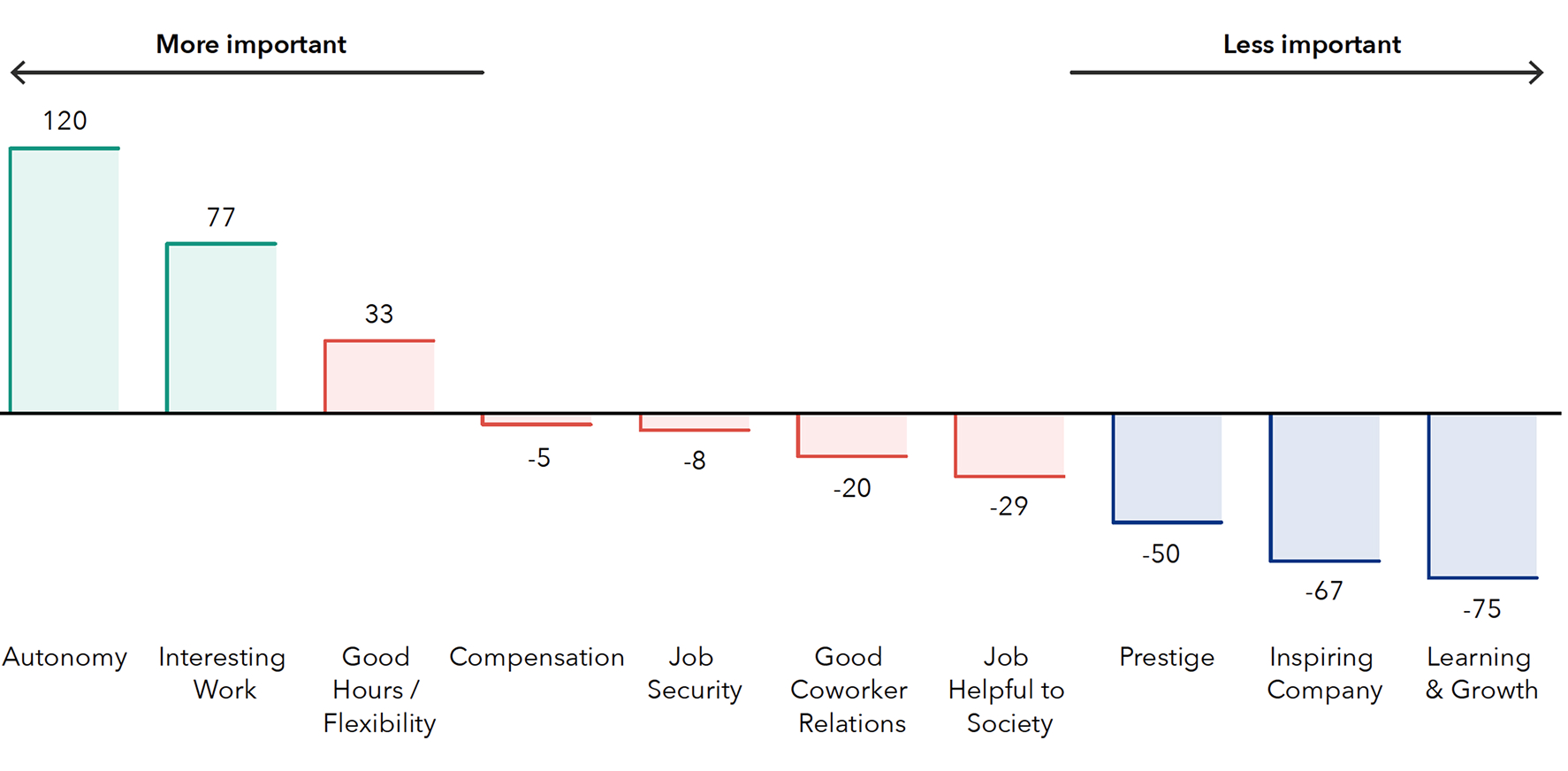

Relative importance of factors to over 62s vs. 25-34 year old workers

(% Difference in those selecting as top employment priority)

Source: CCRRC NA Council Member data.

The key is to search for employees with the right attitude. Employees with a clear and stable set of expectations of what they are looking for, and a good understanding of how grocery can deliver on that.

2: Challenge the assumptions that make the job less appealing

Gig employment and the growth in working from home have changed employee expectations about flexibility. Employees now have the opportunity to work in a way that is better for them.

For workers, leaving has never been easier with strong competition from the gig economy and online recruiters making alternatives highly visible – grocers urgently need to respond to this evolution.

Good news! The supermarket industry with its scale operations and long operating hours has the potential to compete if executed correctly. In a typical big box supermarket, there is more than just hours flexibility. There are multiple roles that can help develop a diverse skillset as well as much opportunity for progression, which are forms of flexibility many employers lack (particularly in the wider retail landscape).

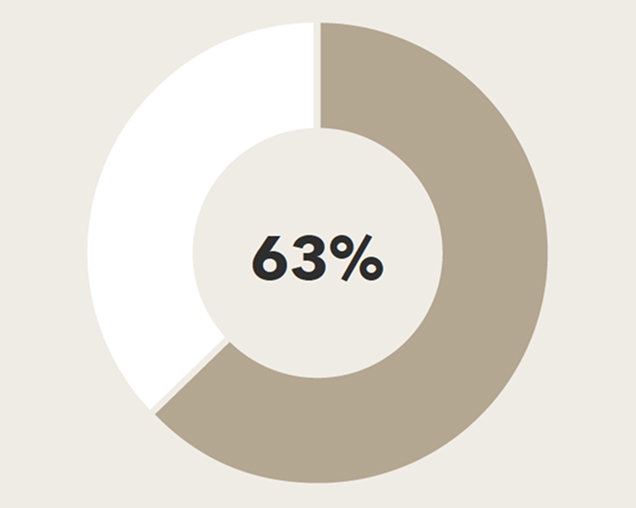

Motivations for choosing gig employment

63% of those working in the gig economy say flexibility was the number one reason they chose it.

Source: Legal & General.

Furthermore, when grocery employees complain about lack of flexibility, what they are often worried about is the lack of opportunity to work more hours, not the specific hours available. This is a major perceived appeal of gig work. Almost half of gig workers state they are attracted to gig working because they feel that you can always put in extra hours as needed. While it isn’t always simple to allow extra hours, because of pre-existing labor agreements, grocers should track whether they are meeting employees need for hours and prioritize this alongside other more efficiency focused metrics.

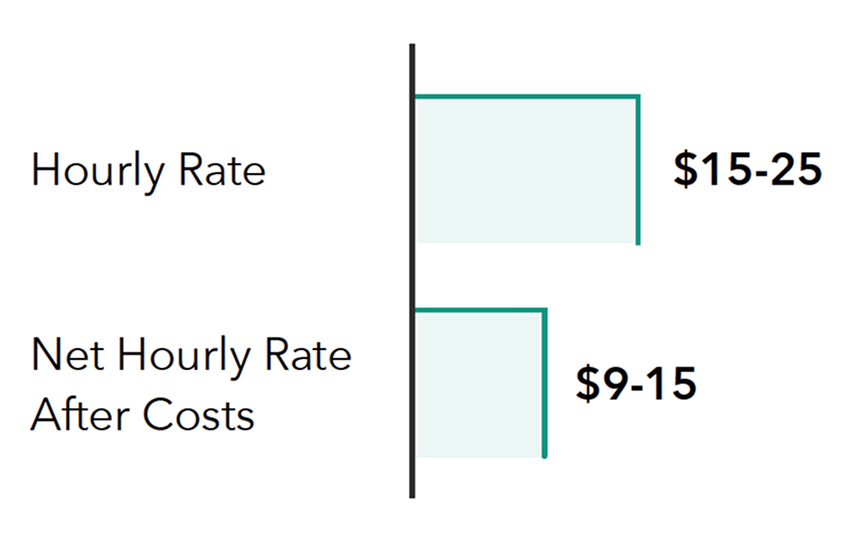

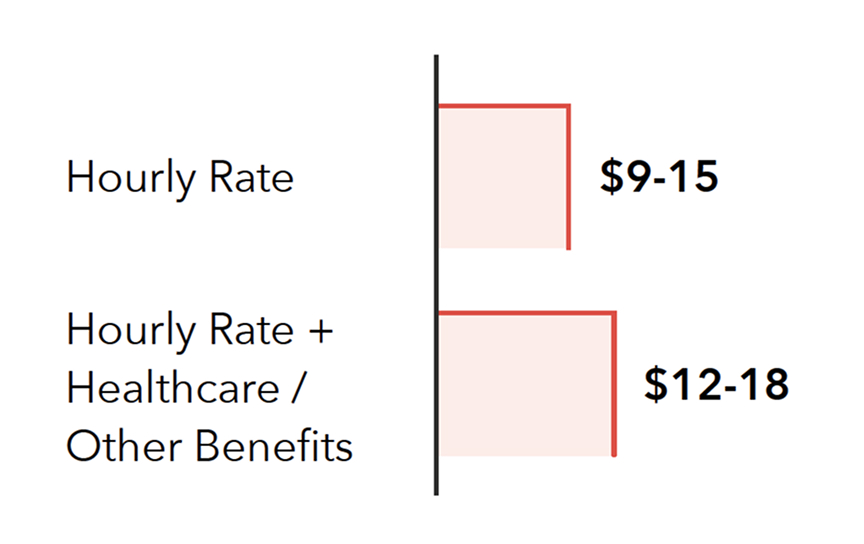

Ultimately, more hours can lead to more full-time employment. While there are constraints on the industry here too, the concern that full-time employees, once the impact of benefits is taken into account, are too expensive relative to part-time is reconsidered. Once the impact of churn and productivity is taken into account, and recognizing that only up to half of full-time employees actually take up their benefits, the difference in cost between full time and part time workers is less than 10%. This is significantly less than headline figures of over 30%.

The solution is a mix of flexible scheduling technology (e.g., allowing employees to swap shifts, ideally also between stores) and empowering local managers to work with employees on finding the right working model for them (including for those who want extra hours). Other gig-style initiatives could include flexible pay (e.g., weekly) and more autonomous task-based staffing in certain areas of the business.

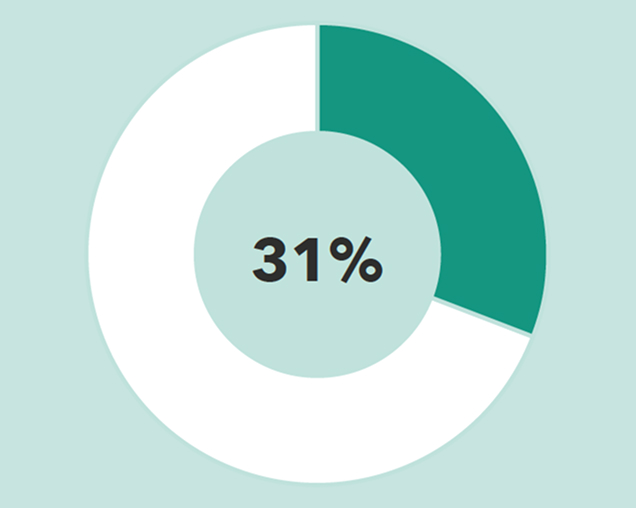

Top up earnings

Insufficient pay drove 31% of grocery staff turnover.

Source: CCRRC NA Council Member Data.

How to improve flexibility

Shift swap

Internal marketplace for shifts so colleagues can get extra work or give back committed shifts

Store swap

Allowing colleagues to choose between multiple stores, to give them more choice of hours

Flex pay

Acceleration of pay to allow to deliver cash faster, in line with gig economy payment cycle

'Gig' tasks

Staffing 'productivity' tasks in gig style, rethinking division and recruitment of non-service roles

3: Deploy your marketing muscle internally - sell the benefits of working in grocery

Reasons to stay in grocery are opaque. Grocers need to accentuate the positives and deploy marketing muscle to communicate the benefits better.

While grocery work can be demanding, it offers a range of unique benefits that can be emphasized to attract and retain employees. Pay, flexibility, job security, progression, community, variety and development are all worth shouting about.

Pay is particularly misunderstood – once benefits are included, pay can be better than gig economy roles, and with the prospect of rapid escalation as careers progress.

Compensation comparison

Gig economy

Grocery employee

Source: BLS, OC&C Analysis, Press search.

Common misconceptions about working in grocery

1: “Working at a grocery store isn’t flexible enough.”

Grocery offers full time and part time employment alongside round-the-clock opening hours, which translates to increased options and flexibility.

More grocers are enabling tools like shift swaps and cross-store staffing.

2: “There is no opportunity for progression.”

Opportunities to work your way up from the shop floor, and many in HQ have come from stores – but this is not well communicated:

We don’t clearly explain that you can grow in the job...(the information) is only available if you log into the system.

Recruiter

Major Grocery Chain

3: “There is not enough money in grocery."

Salary progression in grocery is attractive (e.g.: >100% increase from entry-level to managerial/supervisor roles1)

People don’t know what you can earn - we pay managerial roles really well. We would keep a lot more people if they knew.

Recruiter

Major Grocery Chain

4: “Grocery jobs are boring and mundane.”

It is a customer-facing role with ample opportunity for social interactions.

The role serves a bigger purpose, where employees are part of a larger team working together to serve the local community.

5: “You don’t learn enough.”

Grocery offers a diverse set of transferable skills, particularly given the variety of roles on offer - from service facing (learning social / customer interaction) skills to team working and leadership skills.

Grocery employees have found success in multiple industries across, hospitality, leisure, CPG and beyond.

1. Based on average salary listed on Payscale and Salary.Com.

Source: Forbes, CNBC, Desk Research, OC&C analysis.

On top of this, grocery stores are essential businesses, providing job stability even during economic uncertainty. Working in a grocery store offers opportunities to develop customer service, organizational, and teamwork skills. And grocery career paths offer significantly more opportunity (and variety) vs other retail and hospitality.

To communicate all these benefits, grocers need to talk to current and potential employees with the same skills as they do for customers and there are simple steps that can be taken during the recruitment process itself:

- Trial shifts or experience days.

- Employee referral schemes.

- Employee testimonials in store and on job boards.

- Tailored communications to employees about existing benefits.

- Proactive conversations about progression opportunities.

Critically, starting these activities earlier, from recruitment and onboarding to the first few weeks of shifts will set up employees with better expectations of the job and for more successful retention from the start. Solving for the first 90 days of retention (when it is most challenged) will make a meaningful difference to overall turnover rates and costs for grocers.

Frontline turnover rates by employee tenure

132%

First 90 days

47%

1-3 years

32%

4-7 years

Source: CCRRC NA Council Member Data.

4: Recruit, develop and reward great managers.

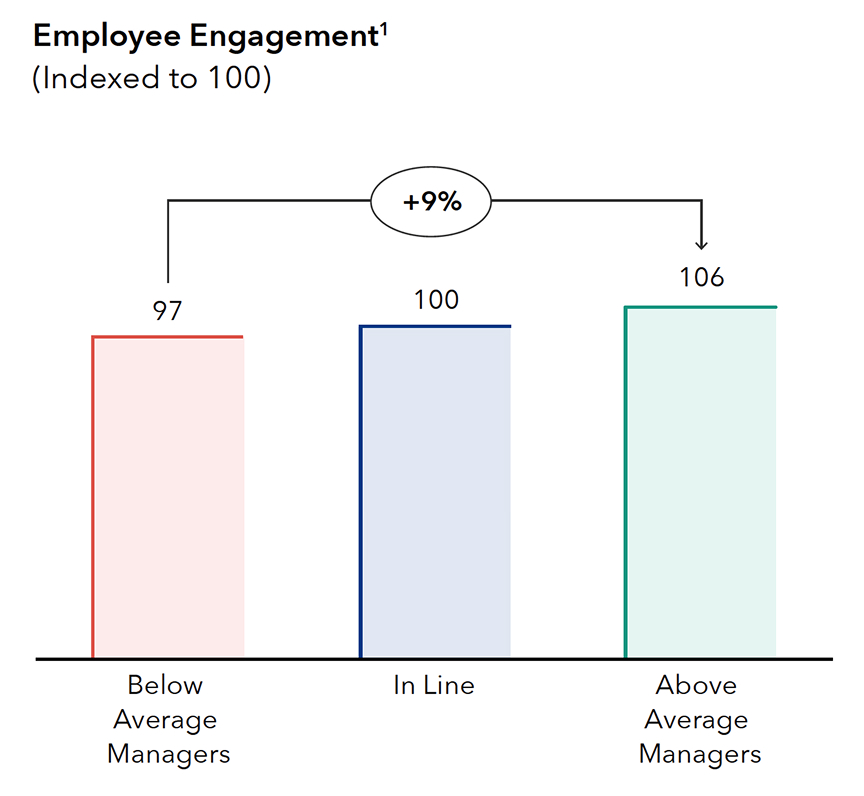

Better leaders improve engagement and retention, at both the store and corporate levels. You can never give up on focusing on this.

Effective managers inspire, motivate, and support their teams, fostering a positive and productive work environment. Grocery businesses must prioritize the recruitment and development of strong managers. Providing ongoing training and recognition for managers who excel in employee retention efforts will have a ripple effect throughout the organization, with satisfied and engaged employees seeing significantly lower turnover rates (and providing a better customer experience too).

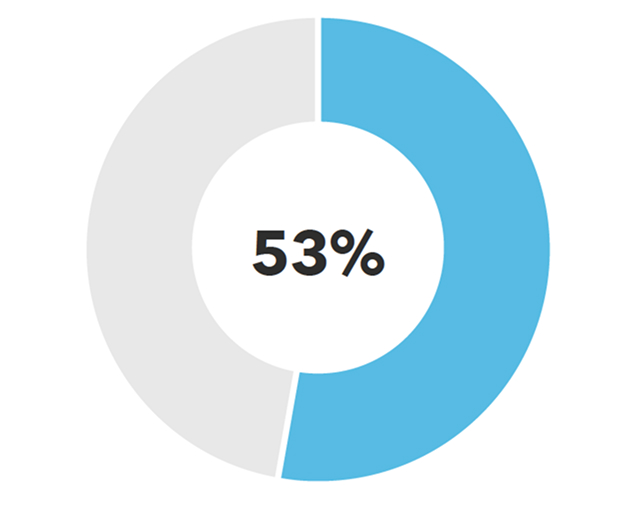

53% of employees have left their retail job because they felt under appreciated at work.

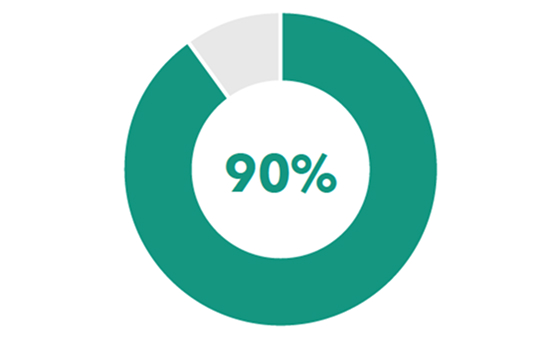

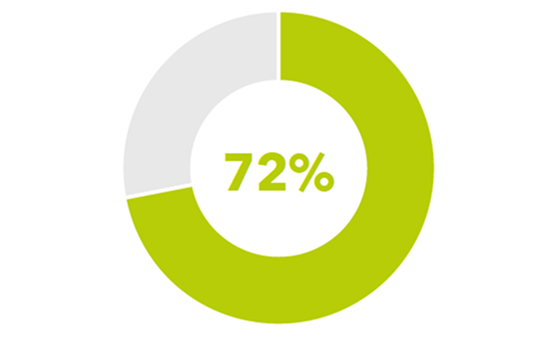

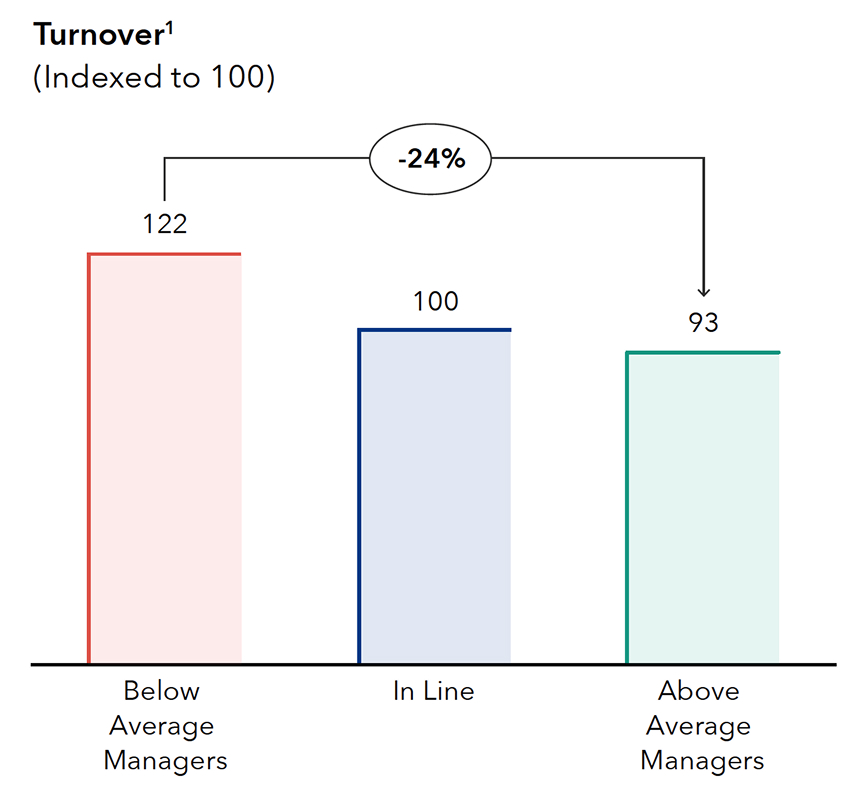

Better leadership leads to higher employee engagement...

Which, in turn, results in lower turnover rates

1. Calculated using average satisfaction and turnover rate by manager rating and indexed to managers performing in line. Source: CCRRC NA Council Member Data.

Don’t leave this to chance – better leadership should be recruited for, but it also needs to be trained and developed:

- Attract the right type of leaders, hiring based on traits of loyalty and empathy, and looking for leaders who are committed to developing people.

- Deliver regular leadership training (consider external support) to support the development of your managers.

- Retain your great managers by showing them appreciation and actively supporting their career progression.

- Adapt your incentives to encompass frontline engagement and retention metrics more broadly, with an open feedback loop to drive improvement and resolution.

- Track the right retention metrics, both centrally and in-store, and feed this into policy.

- Better yet, to have successful store managers delivering better on retention, accountability needs to be owned by central leadership as well as stores. Consider how each function can play its part in simplifying the work and improving employee experience, to create common goals that benefit retention.

- Don’t ignore poor management styles and/or reward them for their “what” (goals) if their “how” (leadership competencies) is not aligned to the organization’s values.

5: Be responsive, so you can meet employees’ reasonable needs.

The ongoing productivity drive within the industry, compounded with the tighter labor market in recent years, has made the job tougher.

Colleagues tell us stores feel more efficiency-oriented and individual. They miss the social aspects, sense of connection and purpose that used to come from more collaborative working and time to engage with customers and colleagues.

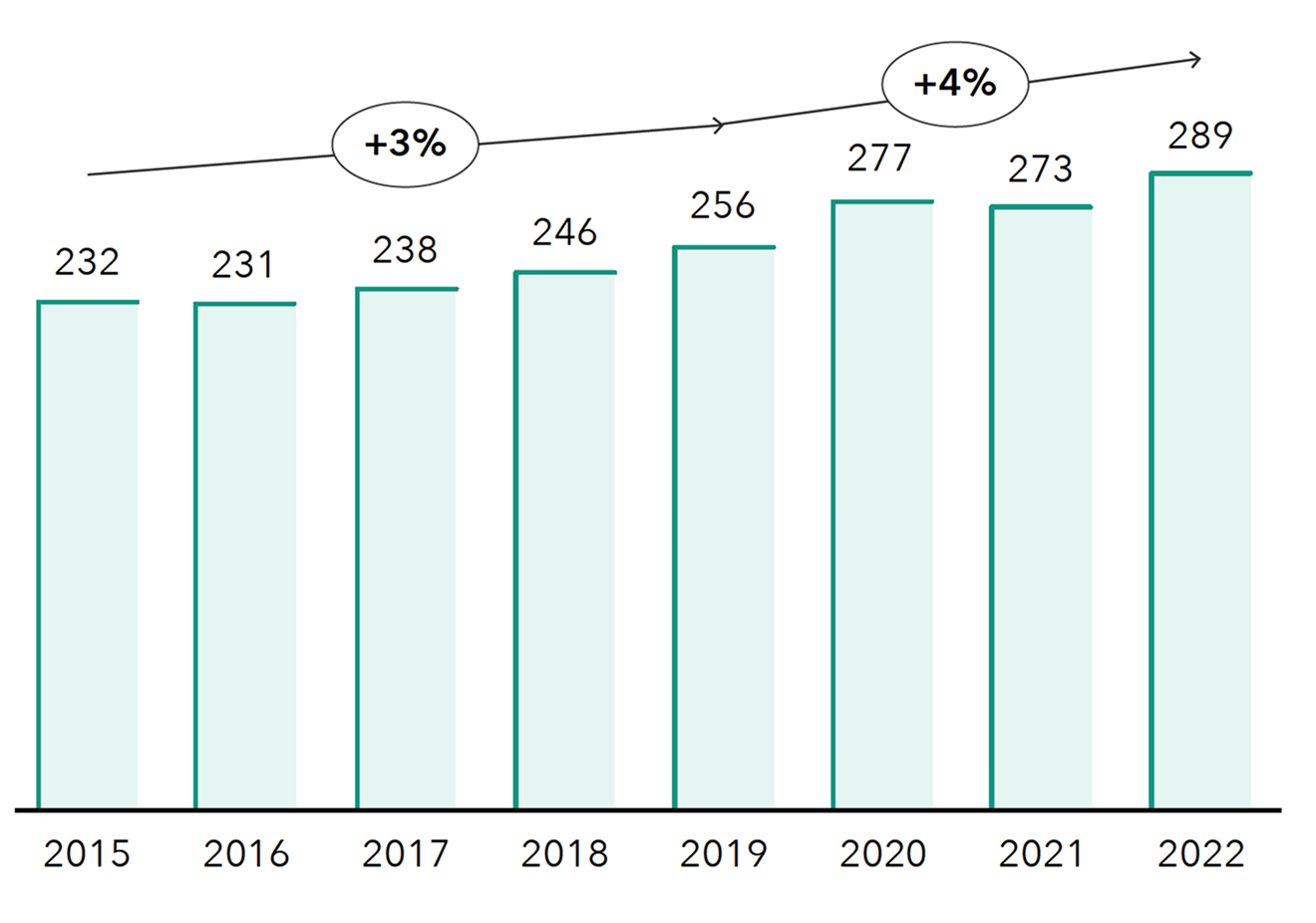

Grocery output per employee has increased c.3-4% per annum since 2015, with employment remaining flat but sales increasing year-on-year.

CPI-adjusted revenue per employee, 2015-22

($k per employee annually)

Source: Federal reserve, BLS, US census.

8 in 10 of retailers have reported increased incidents of violence and aggression in the past year.

Source: National Retail Foundation.

And while there is joy in serving customers, they can be difficult and stories about violence can deter workers.

Showing colleagues that you care makes all the difference. Meeting reasonable needs, such as providing a safe and clean working environment, understanding when the pace of work is too high and actively listening to employee feedback, can go a long way in retaining a satisfied workforce. When colleagues feel valued, respected, and supported in their roles, they are more likely to stay committed to the organization and feel engaged in its success.

The most critical steps are:

Monitor and communicate: Monitor, measure and address employee relations cases — where there’s smoke, there’s fire. Ensure better tracking of employee satisfaction while on the job and reasons for churn if they leave; make sure employees know how to raise an issue they need support with.

Prevent burnout: Ensure you have an Employee Assistance Program (EAP) that serves the needs of your employees and is well communicated. Make sure your leadership culture allows employees to flag when the pace is getting too high. Consider options for more collaborative working (allows more collective thinking and engagement and creates a sense of connection between employees) and automate tasks where possible to free up employee time to engage with customers (which is why most of them joined you in the first place!).

Tackle customer challenges: Build the right support through A.I. that addresses common customer challenges and remove the burden off the frontline. Facing directly into the challenge can help employees feel better about the situations they face. This requires employee training and sharing of experiences between employees. For more serious safety concerns, create support groups for affected employees and consider stronger partnerships with e.g., the local police.

Burnout

Nearly 40% of retail workers state that that they feel anxious at work because of goals set by their manager…

…And high anxiety drove 22% of grocery staff turnover.

Customers

Working with customers is the number one reason why employees want to work in retail, with 53% stating it as the most fulfilling part…

…But difficult customers also drive 10% of grocery staff turnover.

Winning at retention in grocery means:

- Recruit employees who are likely to be loyal.

- Challenge the assumptions that make the job less appealing.

- Deploy your marketing muscle internally - sell the benefits of working in grocery.

- Recruit, train and reward great managers.

- Be responsive, so you can meet employees’ reasonable needs.

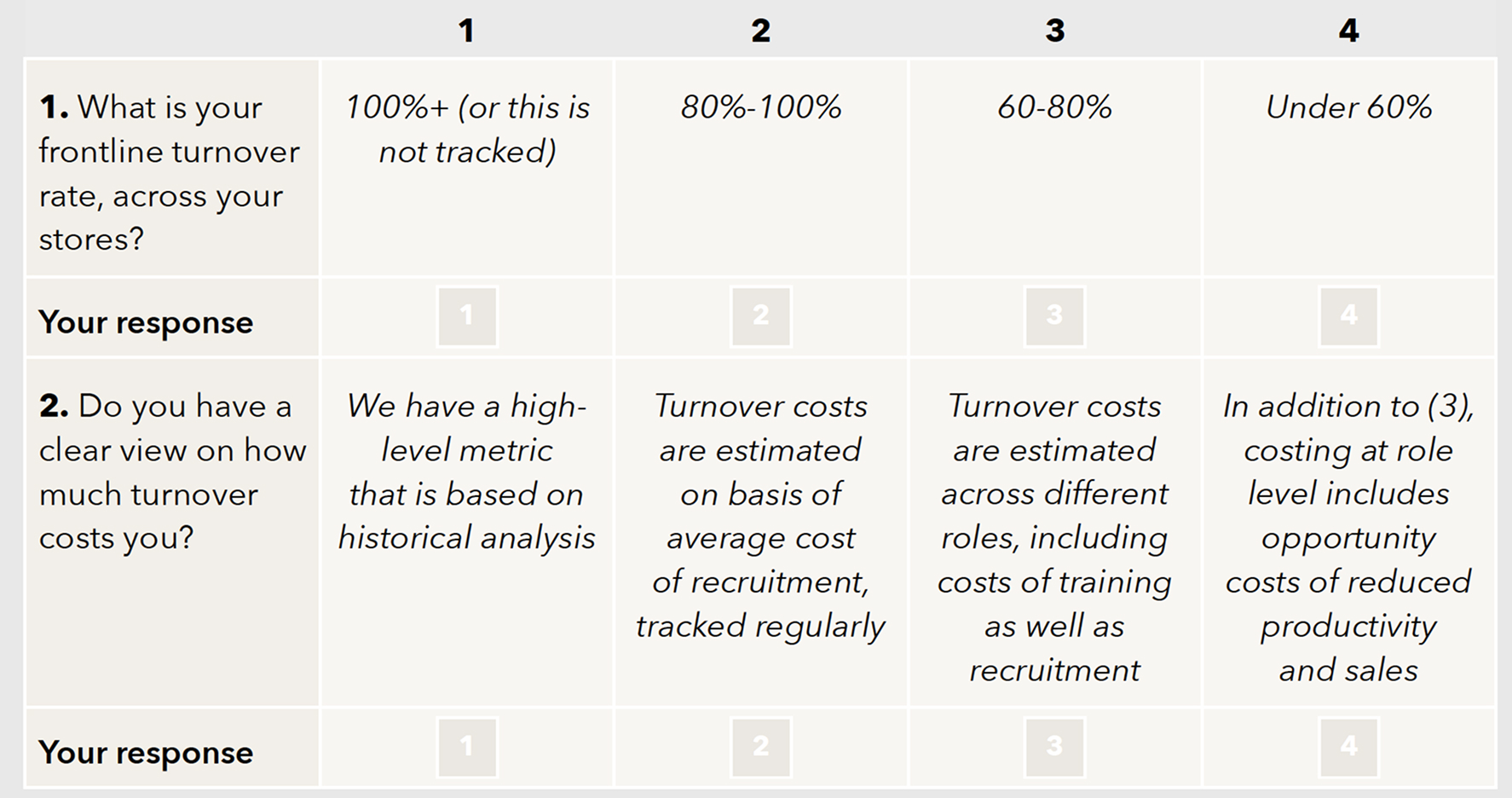

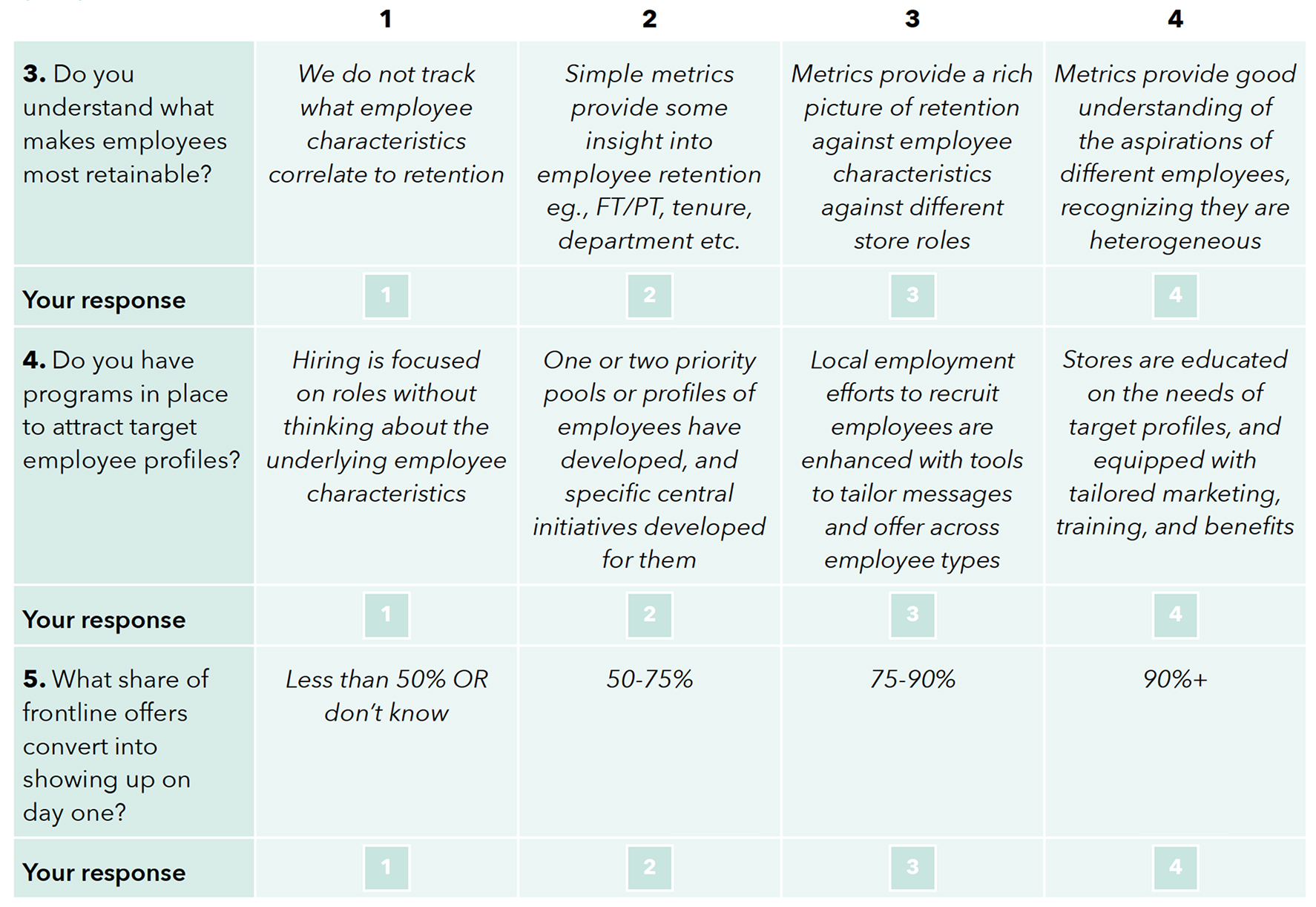

Where is the call for action greatest within your organization?

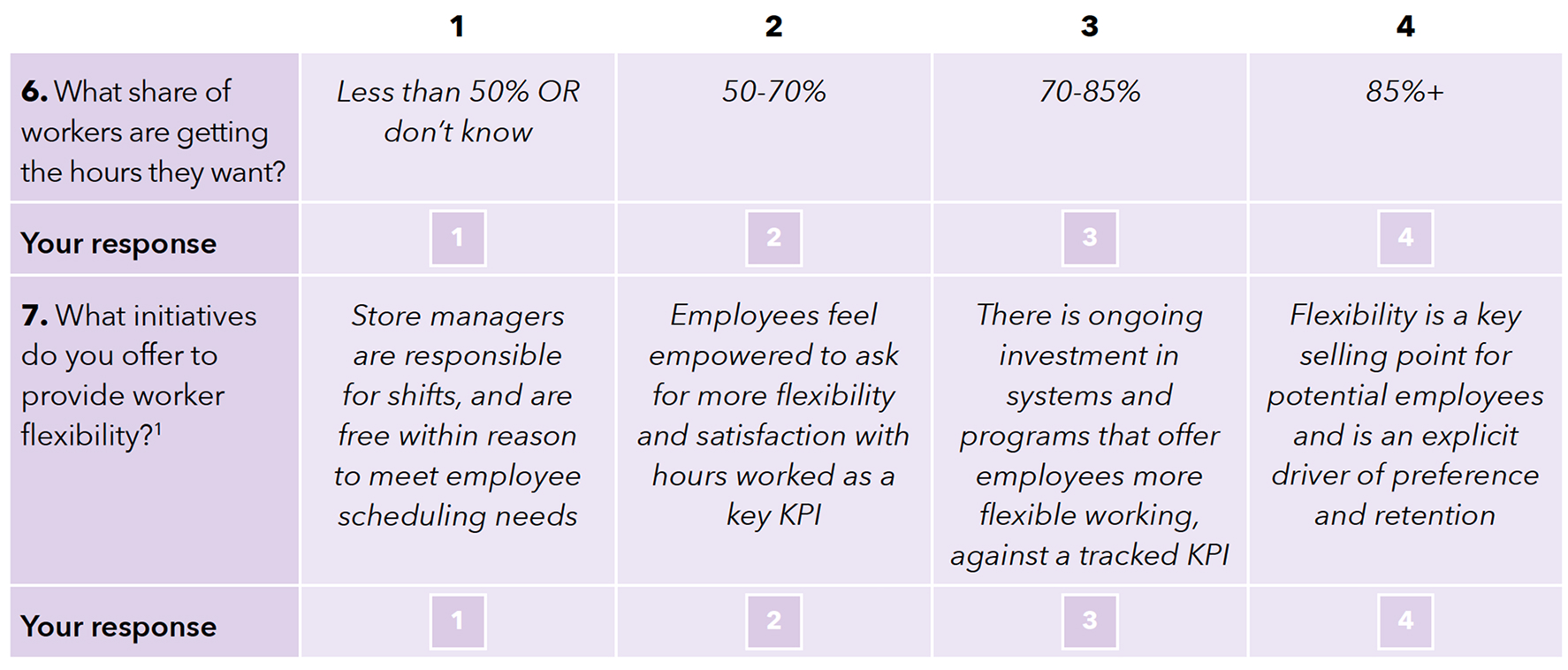

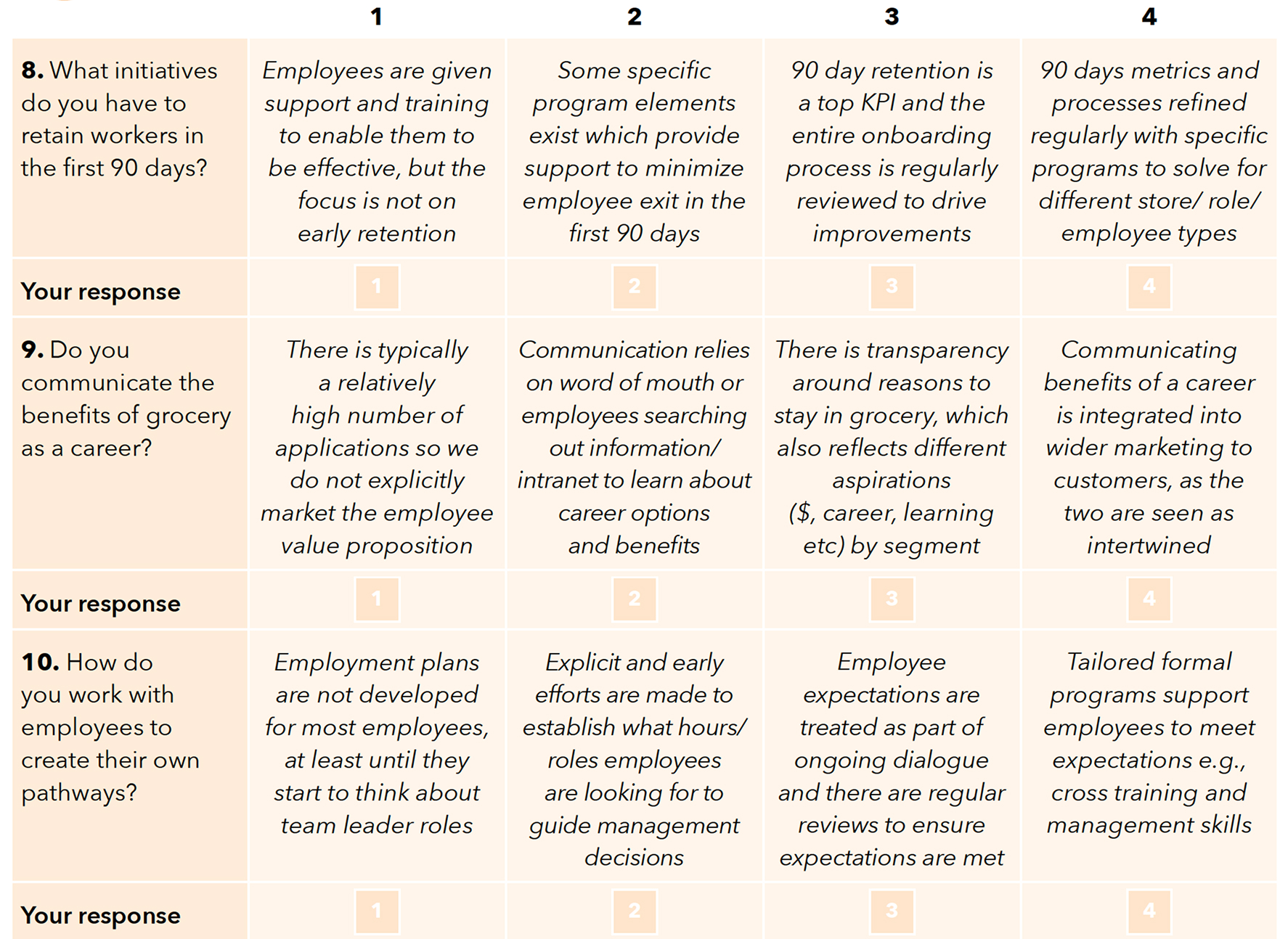

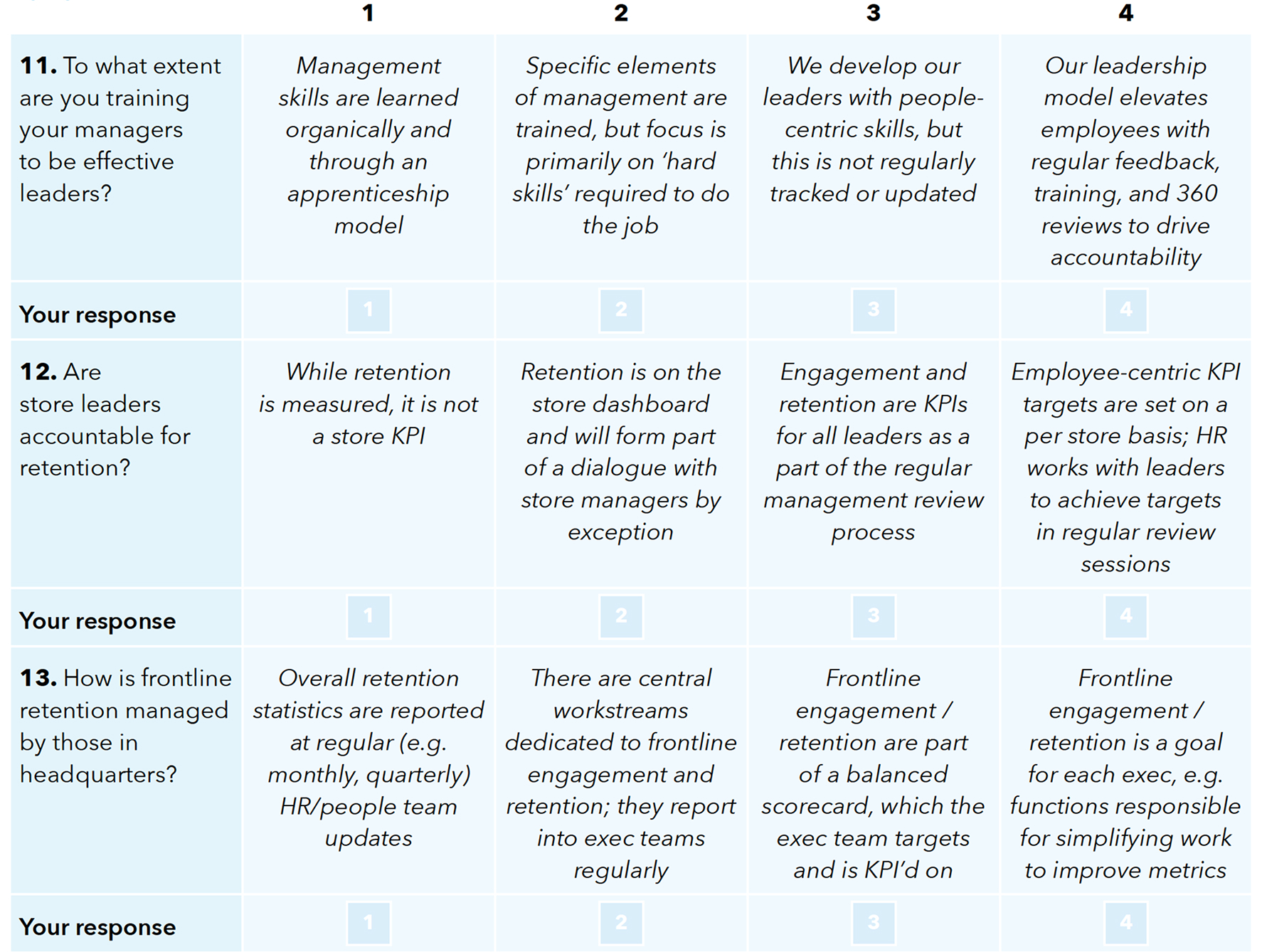

The following self-diagnostic test has been designed in order to make the takeaways of this report most relevant to you and your business.

The next 15 questions are based on the topics covered in this report, and each have four answers worth 1, 2, 3 or 4 points, with 4 being the highest score.

Reading all four response will allow you to review your company's performance by topic, and identify likely action areas to improve retention.

You may prefer the interactive version available below.

Step 0: Diagnose the situation

Step 1: Recruit the right people

Step 2: Enhance job appeal

1. For union shops, recognizing the answers to this question falls within the bounds of your unionization CBAs.

Step 3: Articulate reasons to stay in grocery

Step 4: Invest in effective leaders

Step 5: Support your employees

Analyzing results

Scored mostly 4s?

Well done. You have fostered a leading understanding of the challenges facing retention and developed policies throughout your organization to target issues from the core. However, it is important not to lose focus and let things slip. Ensure there is accountability and incentive for ongoing improvement, and ways to monitor adherence to the tools you are providing.

Scored mostly 3s?

A strong performance overall, but there are areas you need to stretch up into best-practice to alleviate the cost of retention on your business. Identify those topic areas where you should be setting up action plans to push yourself forward.

Had a few 1s and 2s?

There are specific areas where you need a better solution to ensure you have a 360 approach to solving retention and engagement related issues. Whether this is based on setting up better processes for data capture, leadership responsibilities or policy. There is no better time to act.

About the Authors

This insight was commissioned by the Coca‑Cola Retailing Research Council and carried out by OC&C Strategy Consultants, in close collaboration with an industry panel: Southeastern Grocers, Meijer, Loblaws, Sendik’s, Wakefern, Food Lion, IGA, H.E.B., Albertsons, The Food Industry Association/FMI, Intuitive Quest.

To explore these topics further, don’t hesitate to reach out.

The Coca‑Cola Retailing Research Council

Meg Ham

Ahold / Delhaize

Susan Morris

Albertsons

Leslie Sarasin

FMI

Bill Anderson

HEB

John Ross

IGA Inc

Greg Ramier

Loblaws

Rick Keyes

Meijer

Ted Balistreri

Sendik’s Food Market

Anthony Hucker

Southeastern Grocers

Jonathan Berger

The Consumer Goods Forum

Nicholas Sumas

Village Super Market Inc

Michael Sansolo

Research Director

Since its establishment as the first of the Councils in 1978, the Coca‑Cola Retailing Research Council has been dedicated to developing practical responses to strategic challenges experienced by the supermarket industry and its operators through extensive industry research. The North America Large Store Council is composed of executives who represent a variety of retailers, from small independent operators to the nation’s largest chains. The group oversees research initiatives conducted by independent third parties on issues of strategic importance to grocers. The ultimate aim of the Large Store Council is to generate ideas and solutions by retailers, for retailers.

OC&C Strategy Consultants

OC&C Strategy Consultants is an international consulting firm, with more than 35 years experience of unpicking the most complex business challenges with simple, uncommon sense™.

Our specialists work with some of the biggest global players and national names across a broad range of Retail sub-sectors and are highly regarded for developing strategies that are creative, sometimes provocative, always practical and, above all, actionable.

David Sinclair, Partner

David.Sinclair@occstrategy.com

Deidre Sorensen, Partner

deidre.sorensen@occstrategy.com

Rebecca Henshaw, Associate Partner

Rebecca.Henshaw@occstrategy.com

Elizabeth Thompson Founder and CEO, Intuitive Quest

ethompson@intuitivequest.com

Coye Nokes, Partner

coye.nokes@occstrategy.com

Tom Charlick, Partner

Tom.Charlick@occstrategy.com

Mette Iversen, Associate Partner

Mette.Iversen@occstrategy.com