Research Report

Eating In: Growing Sales by Helping Customers Eat at Home More

As consumers increasingly choose to eat at home instead of a restaurant due to growing health concerns, retailers must develop ways to make the process convenient by helping them shop for and prepare meals. These food industry trends present food retailers with a new opportunity to earn a greater share of consumers’ food dollars. If they can move beyond the “product provider” role to become shoppers’ go-to meal solution provider, retailers have the potential to improve customer experience and build not only sales, but also strong customer relationships that could turn the tide on a 25-year erosion in the industry’s share of consumer food dollars.

This strategy must start with a clear understanding of how consumers experience mealtime in the 21st century. The North America Council partnered with the NPD Group, an organization that has been tracking the eating and drinking behavior of consumers every day for the past 30 years, to create a report that surveyed 2,000 households on the challenges they face when preparing dinner. Learn more about how to build trust with customers through mealtime solutions in the report below.

Index

Chapter 1: Eating At Home

The shift in consumer behavior toward eating at home more often offers food retailers a rare opportunity to increase customer loyalty by providing a larger share of their food needs. What does this behavior look like? And how big is the “size of the prize”?

Chapter 2: The Daily Meal Clock

What are consumers looking for at breakfast, lunch, and dinner? This chapter identifies how food retailers can build business around insights based on solid research—and how much they can potentially increase sales around each meal.

Chapter 3: The Seven Faces of Dinner

Dinner is the must-win opportunity because of its gateway position, but consumers approach it with different needs on different nights. Understanding the seven dinner occasions is the key to making a direct connection with shoppers’ needs.

Chapter 4: Implementing a Successful Meal Solution Program for Today’s Shoppers

Step-by-step instructions describe how retailers can build a strategic focus on meal solutions. New research on consumer engagement with counter help and dinner display options can help build programs. And potential “game-changers” can signal unmistakably that something new, different, and helpful is being offered.

Chapter 1: Eating At Home

Now is the time to come to the aid of our customers

Now is the time to come to the aid of our customers by helping them shop for and prepare meals to eat at home. Current economic conditions have amplified an interest in eating better that has been growing for years. As a result, Americans are trying to eat more meals at home. This presents food retailers with a new opportunity to earn a greater share of consumers’ food dollars.

If we can respond effectively—by finally moving beyond the “product provider” role to become our shoppers’ go-to meal solution provider—we have the potential to build not just sales but strong customer relationships that can turn the tide on a 25-year erosion in the industry’s share of consumer food dollars.

To be successful, such a strategy must start with a clear understanding of how consumers experience mealtime in the 21st century. The Coca‑Cola Retailing Research Council of North America chose to partner with The NPD Group on this project because nobody knows more about how Americans eat and drink. They have been tracking the eating and drinking behavior of consumers every day for the past 30 years. The insights presented in this report are drawn from a number of The NPD Group databases, reports, and surveys including Eating Patterns in America, Dinnertime MealScape 2009, A Look into the Future of Eating, the Cooking Skills and Habits Survey, National Eating Trends,® Snacktrack,® and a custom study conducted for the Council. The custom study surveyed 2,000 households about the challenges consumers face around preparing dinner.

One result of this investigation is the meal occasion focus described in this report, which offers retailers a new basis for customer-centric marketing and a platform for even more productive shopper marketing.

- It shifts the focus from a product category orientation to a solution orientation by looking at meals from the customer’s point of view.

- It provides a framework for connecting the daily decisions people make about what to eat with the way they shop for groceries.

- It equips retailers with information that can help them deliver greater value—from the customer’s perspective.

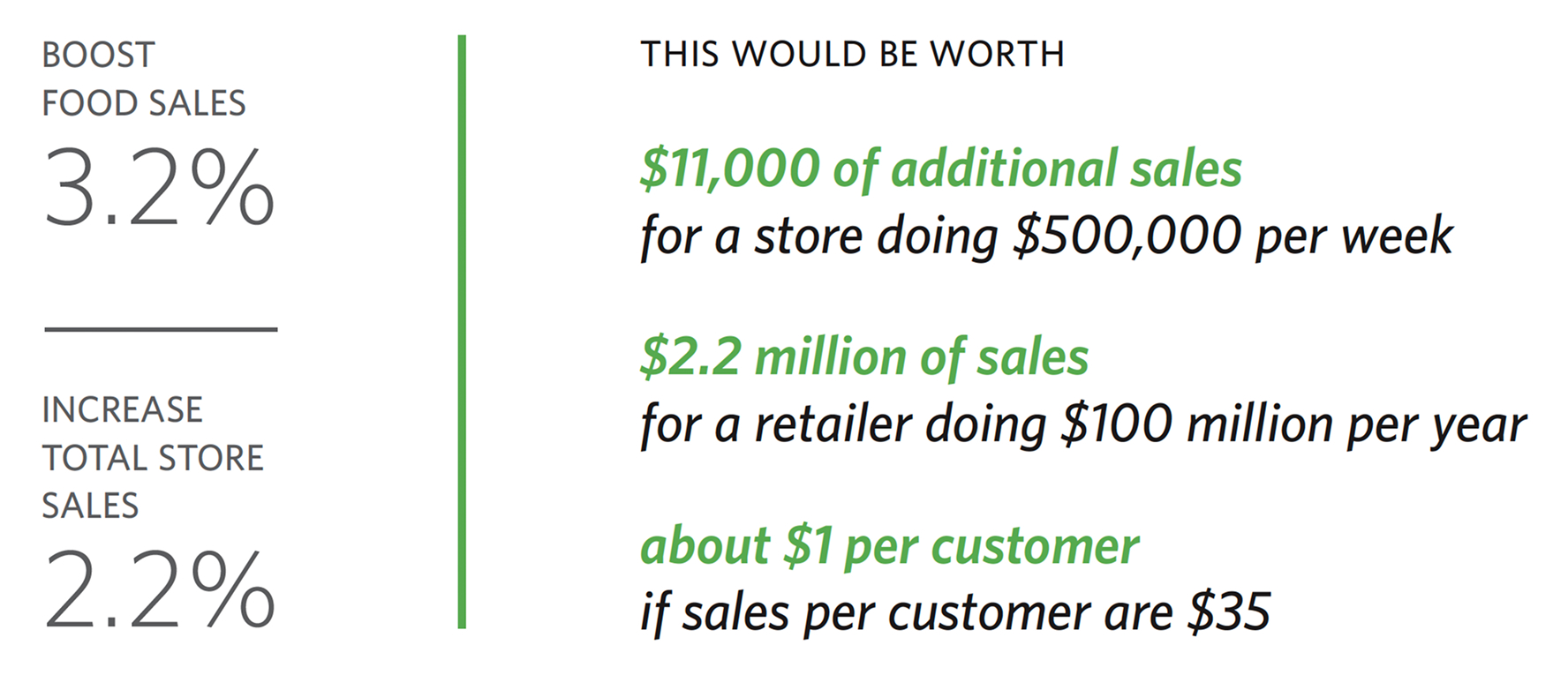

The size of the prize

The shift in consumer behavior toward eating at home offers food retailers a rare opportunity to increase customer loyalty by providing a larger share of their food needs. Successful capture of the incremental business projected to be available across breakfast, lunch, and dinner can boost a retailer’s food sales by up to 3.2%, which translates to an increase of approximately 2.2% in total store sales. (This assumes that food represents 70% of total store sales.)

This upside sales potential was calculated by The NPD Group using information from its databases on

- annual number of meals that originated at home and away from home, as well as skipped meals

- annual number of items eaten at each meal, and average price per item

- the total value of food expenditures, both at home and away from home (based on USDA statistics), as well as the dollar cost of meals prepared in the home and purchased outside the home

The NPD Group developed a range of scenarios specific to each potential source of new business for the three meal occasions. These included a reasonable percentage of away-from-home business that could be captured by the food retailer.

The scenarios generated a realistic, yet conservative estimate of 3.2% for the total upside food sales potential. This represents gains from the day’s three main meals as follows.

- breakfast 0.5%

- lunch 1.2%

- dinner 1.5%

The upside potential created by this shift in behavior is clear, but a downside exists also. If food retailers fail to take advantage of this opportunity, we will likely be playing defense for the foreseeable future.

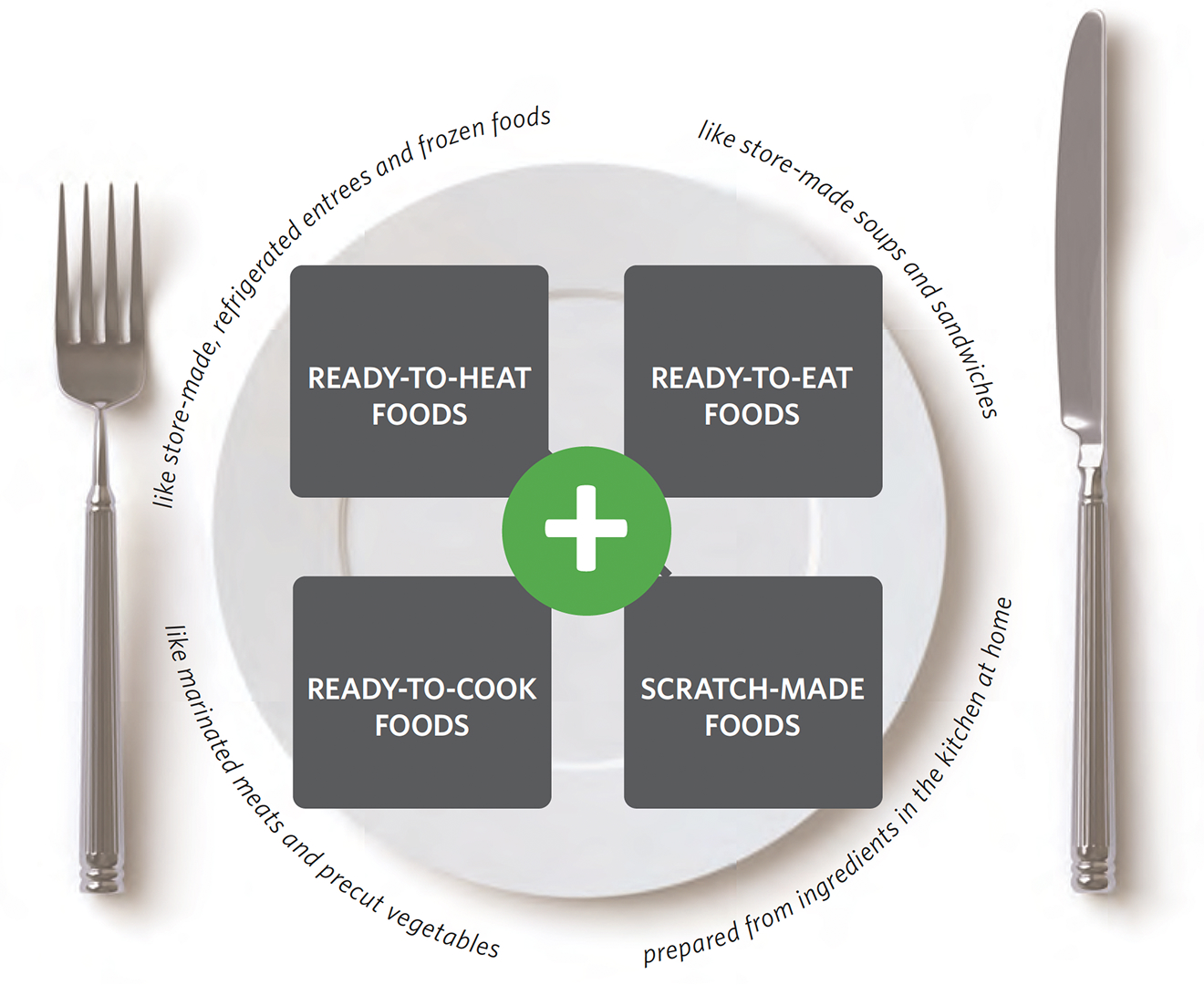

Eating at home in the 21st century

Eating at home is no longer synonymous with cooking from scratch. Today’s definition includes almost any combination of the following:

In fact, the difference between home eating and home cooking has become so blurred that when The NPD Group looked at consumer definitions of an “evening meal prepared at home,” almost 50% of consumers considered a ready-to-eat main dish to be part of a “home-prepared meal.”1 Some retailers are already capitalizing on this insight. For example, Wegman’s website offers three kinds of menu help to shoppers: take-out, speed scratch, and full scratch. Consumers consider them all home-based meals.

A number of factors also make it easier to eat at home than it used to be.

- Menus have become simpler. Fewer side dishes are being used—the proportion of dinners that include at least one side dish has steadily declined from 70% to 58%.2

- Technology is streamlining food preparation. Consumers are using microwaves, food processors, rice cookers, crockpots, and grills to cut the time spent on meal preparation. The use of crockpots and grills alone has doubled since the mid-eighties.3

- Learning is more accessible. The proliferation of how-to-cook videos—on the web and on cable channels like the Food Network—is making it easy for people to learn the basics of cooking or how to fix a dish. Today, 27% of households report using retailer websites for this and other purposes.

1 The NPD Group/CCRRC Custom Survey.

2 The NPD Group/Eating Patterns in America.

3 The NPD Group/Eating Patterns in America.

Some powerful motivators are at work

Saving Money

Money has always been a primary motivator for changing consumer behavior, and this applies to eating at home too. In fact, 69% of all meal preparers state the primary reason for preparing/cooking a meal at home is because it costs less than eating out.4 The average cost per person of an in-home meal is $2.36 vs. $6.37 from a restaurant.5

Staying Healthy

Another primary benefit of eating at home is that it is healthier: 92% of meal preparers believe that cooking meals at home is healthier than eating out.6

Saving Money

In a survey conducted by the pasta maker Barilla in 2009, 93% of 2,000 adults surveyed ranked sharing meals “the most important activity in helping them connect with their family on a regular basis.”7 Research on the benefits of family meals suggests that such a high level of interest is justified. A national study of young children’s time found that the single strongest predictor of better achievement scores and fewer behavioral problems was more mealtime at home.8 Another found that teens who frequently eat meals with their families are much less likely to smoke and use alcohol than their peers who do not have such family time.9

4 The NPD Group/Cooking Skills and Habits Survey.

5 The NPD Group/Eating Patterns in America.

6 The NPD Group/Cooking Skills and Habits Survey

7 The Barilla Family Dinner Project,™ Share the Table: A State of Dinnertime in America, A White Paper Study.

8 S.L. Hofferth, “Changes in American Children’s Time 1981–1997” (University of Michigan Institute for Social Research Center Survey, January 1999).

9 National Center on Addiction and Substance Abuse, The Importance of Family Dinners V (Columbia University, 2009).

What challenges do customers face?

“I need it to be convenient.”

When it comes to dinner, consumers focus on convenience. In fact, after taste, convenience is the primary driver for deciding what to eat for dinner. “Was easy to prepare or get” is the number one reason for what we eat (41% of all dinners).10

“I need to please a lot of people at one time.”

Serving food that everyone will eat is a stressor for the meal preparer; nobody wants to be a shortorder cook. “Serving something everyone would like” is the fourth most popular motivator for deciding what to have for dinner.11

“I need to keep expenses in line.”

Historically, consumers have not let food costs outpace their incomes.12 This remains true even in these economic times. Therefore, preparing meals that “don’t cost a lot” is the top motivation in 29% of all meals.13

10 The NPD Group/Dinnertime MealScape 2009.

11 The NPD Group/Dinnertime MealScape 2009.

12 USDA Economic Research Services.

13 The NPD Group/Dinnertime MealScape 2009.

The future holds some risks

Thinking about supermarket retailing in terms of ingredient products and prices may no longer be a wide enough net to capture the changes that are coming in eating behaviors.

- More eating at home has not meant a return to cooking from scratch. Convenience and convenient components will remain important to women, who continue to bear the overwhelming majority of responsibility for feeding the family. As an overall trend, both cooking skills and interest in cooking appear to be declining. Women who are working or simply busy often find it easier to eat out or carry in, and a number of non-supermarket businesses are capitalizing on this behavior.

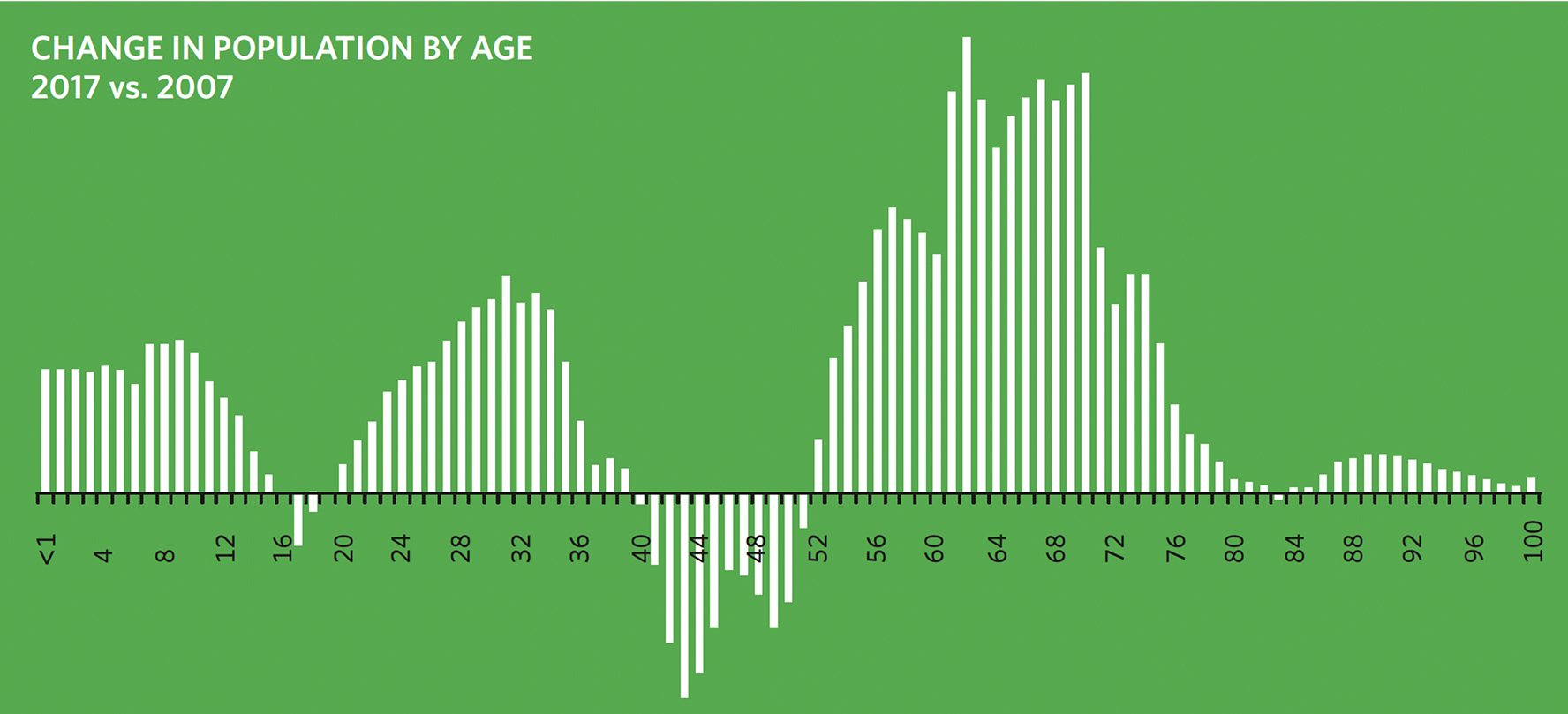

- The age groups that will be growing in American society over the next five to seven years—seniors and twenty-somethings—will be looking for more prepared meals; seniors can afford them and younger shoppers don’t have the time or skills for anything else. In fact, NPD forecasts that one of the fastest-growing behaviors during the next 10 years will be meals prepared away from home and brought home for consumption.14

14 The NPD Group/A Look into the Future of Eating.

Source: United States Census Bureau

Chapter 2: The Daily Meal Clock

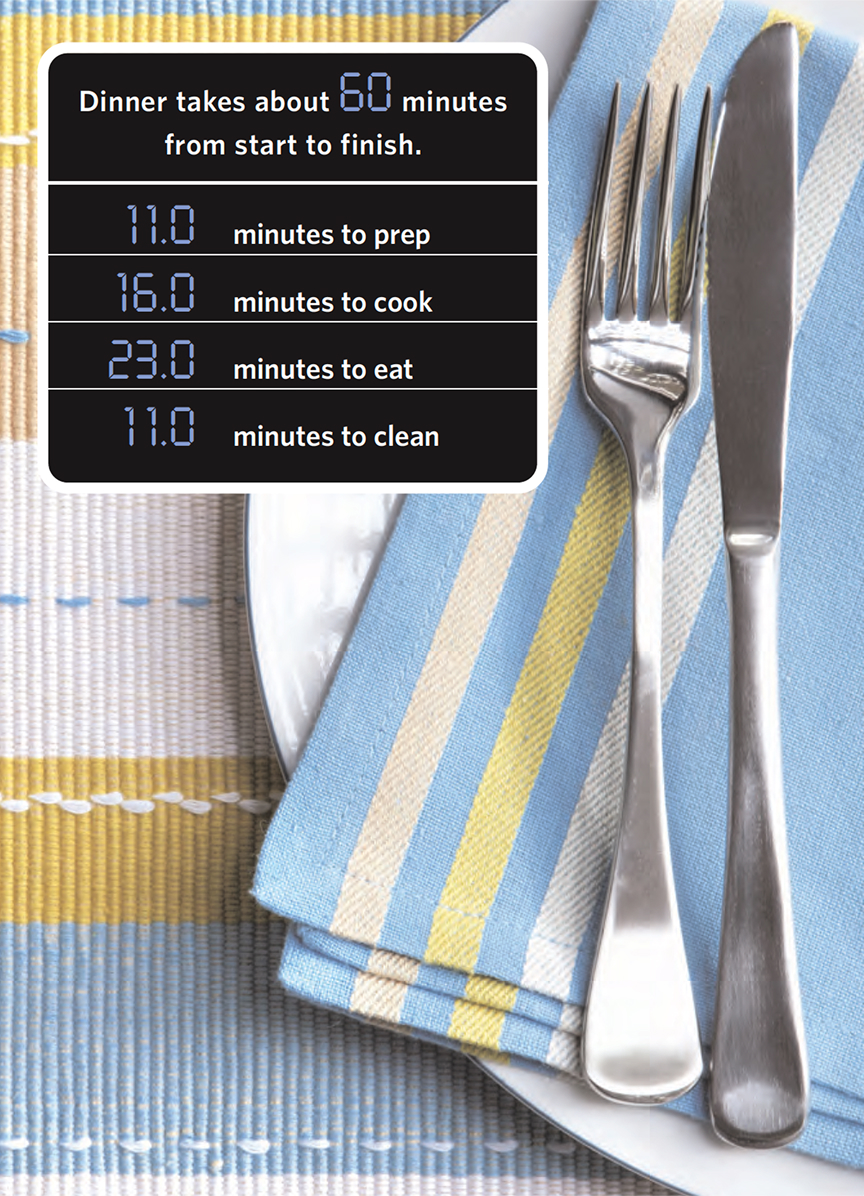

Every stage of mealtime— preparation, cooking, eating, and cleaning up—presents opportunities to assist customers.

Consumers think about eating in terms of meals, not grocery lists; so should supermarkets. Ingredients and price are only part of the story. Breakfast, lunch, and dinner are driven by different needs, priorities, and even emotions — and these needs and feelings are as important as the actual food in meeting shoppers’ needs. Looking at the daily meal clock from the shopper’s point of view brings new opportunities into view, and might even suggest ways to rearrange parts of the store.

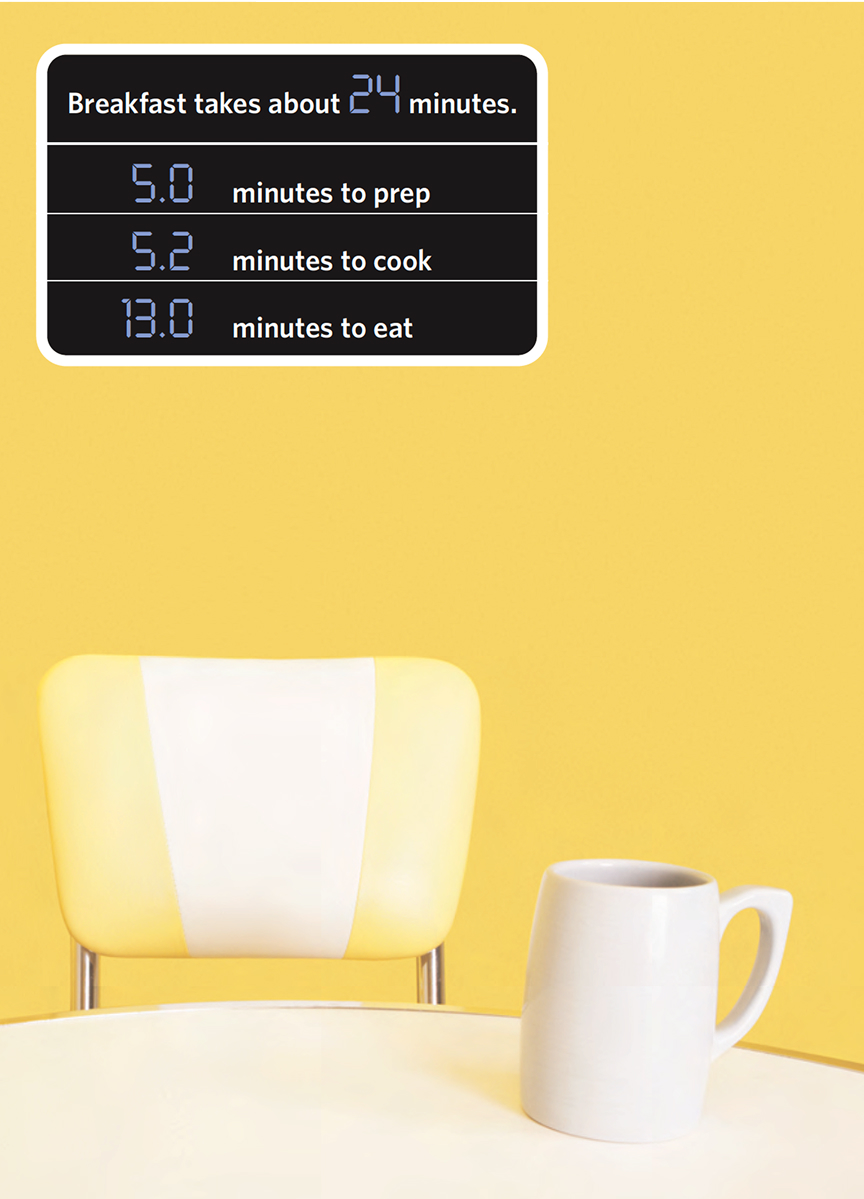

Convenience is so incredibly important to consumers that it is crucial to understand how consumers think about time in relation to meals. For them, “mealtime” starts before the pantry door is opened and it isn’t finished until the dishes are done. Every stage of mealtime — preparation, cooking, eating, and cleaning up — presents opportunities to assist customers with these tasks.

Since meal planning can be a struggle, it represents a key opportunity for expanding the conversation between food retailers and their customers. Retailers will want to pay special attention to how they currently support their customers’ meal-planning efforts and consider new approaches. Strengthening the connection between shoppers’ daily meal decisions and their less frequent shopping decisions is a major opportunity.

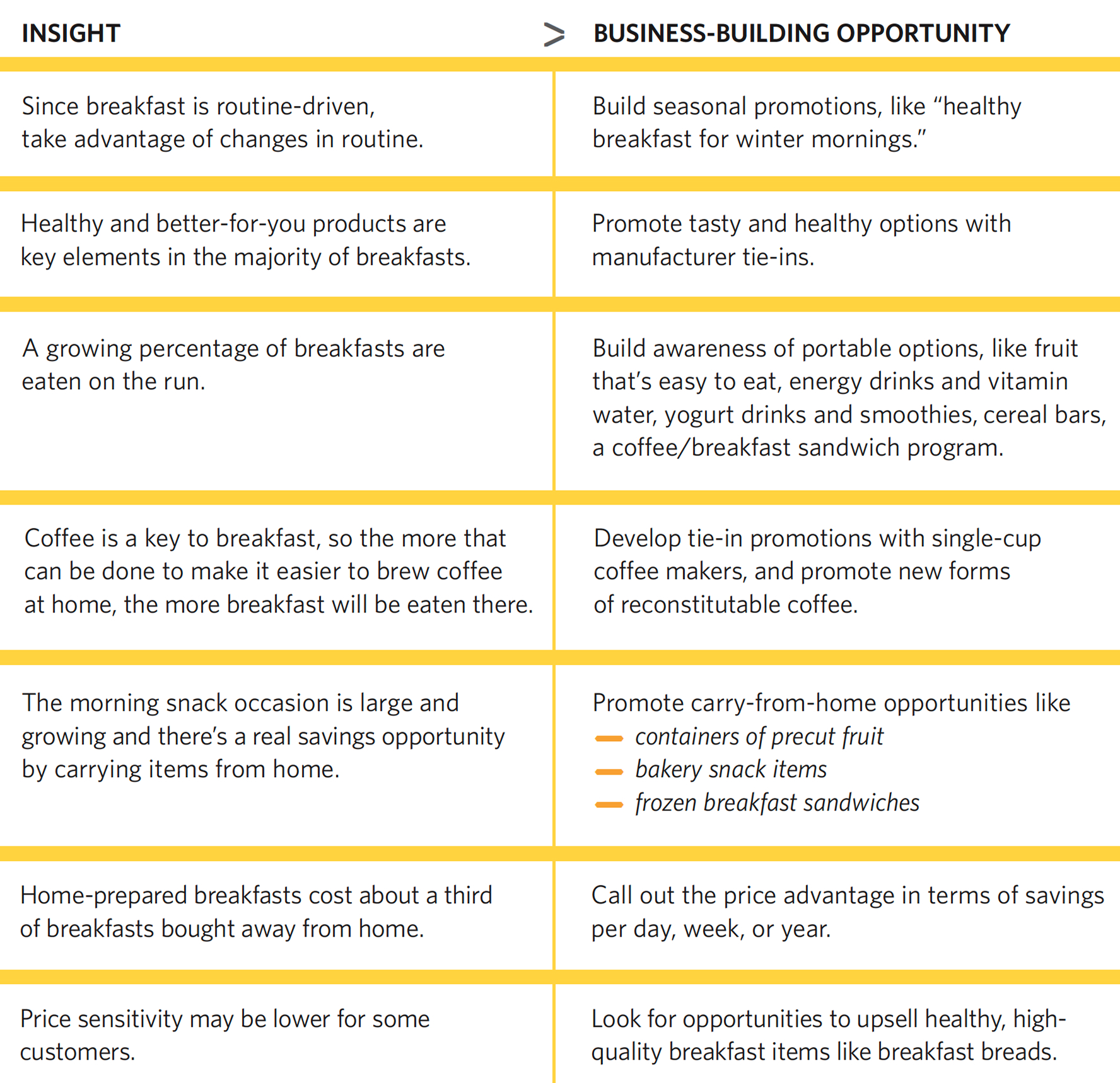

Breakfast: Routine is key

Retailers rarely focus on the breakfast occasion, even though it accounts for 8% of store sales.

Despite a rapid increase in breakfast meals purchased at restaurants, most — 76%15 — are still eaten at home using products from the supermarket. In fact, products used for breakfast at home (from cereal to frozen baked goods) account for about 8% of store sales — and that’s before the opportunity to sell “coffee and a breakfast sandwich.” But in spite of such a big contribution to the top line, retailers rarely focus on the breakfast occasion. This by itself may indicate an overlooked business-building opportunity.

15 The NPD Group/Eating Patterns in America.

What are consumers looking for?

An easily repeatable routine

Most consumers look at breakfast as part of a ritual for getting started in the morning. It’s the only meal when eating the same food every day is not only common but acceptable. Coffee is an important part of this routine, whether made at home as part of the ceremony of waking up or bought on the way to work. Winning a place in the home-based breakfast routine is the prize — because once you do, the sales repeat.

A healthy start

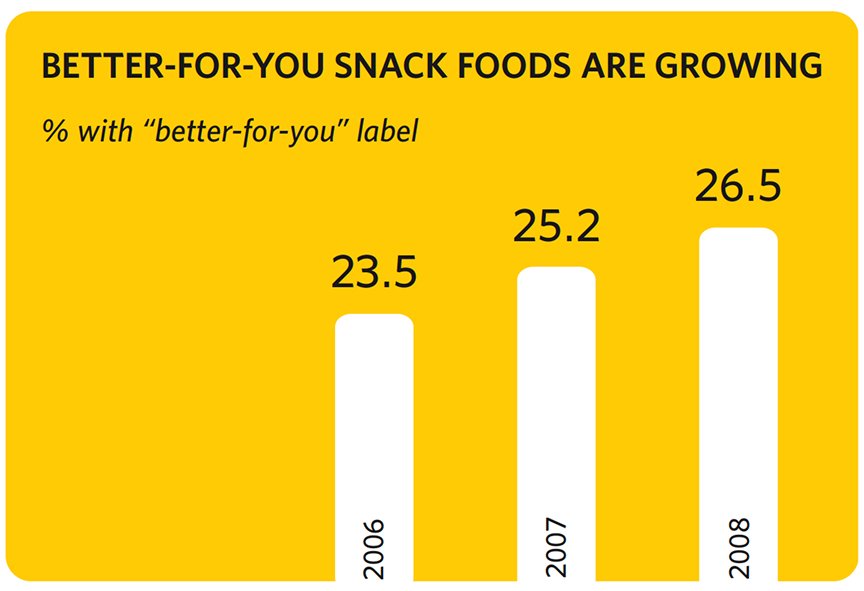

At breakfast, consumers have the greatest control over what they eat and set the highest priority on healthy food. As the day goes on and other needs compete for attention, “healthy” moves steadily down the list of priorities. By lunchtime (when speed rules) it’s in the middle of the pack, and by dinnertime (when convenience is all-important) it’s closer to the bottom. Because of this health orientation, better-for-you products account for more than 50% of all breakfasts. Today, hot cereals and yogurts are among the fastest-growing breakfast foods.

Bright spots

Two particularly bright spots for food retailers stand out among breakfast trends.

Breakfast-on-the-run

There is clearly a growing demand for portable breakfasts—those that can be carried from home and eaten in the car. Over time, consumers have –tripled the number of breakfast meals carried from home.16 This opens up the opportunity to increase sales of breakfast items that travel, like fruit and yogurt. –quadrupled the annual number of breakfasts they purchase at a restaurant and consume in their cars.17 This highlights opportunities to promote breakfast items that can be consumed while driving, like coffee and sandwiches.

Mid-morning snacking

Morning snacking is also growing,18 and snacks naturally cost less when sourced from the supermarket instead of a convenience store or lunch shop. The occasion is primarily about maintaining energy level, but a growing proportion of these snacks are “better for you.”

16 The NPD Group/Eating Patterns in America.

17 The NPD Group/Eating Patterns in America.

18 The NPD Group/Snacktrack Service.

Source: The NPD Group/Snacktrack Service

Marketing opportunity

Satisfying the “it’s about me” emotions

While breakfast may be routine, it is also the most individual of meal occasions. In fact, ritualistic may be a better word. For some, the beginning of the morning is a time of reflection and an opportunity to get the day started right by doing something good for themselves. Think of the time spent in making a good cup of coffee in the kitchen. People may enjoy watching the news or reading the morning paper. Along with coffee, perhaps they have yogurt or hot cereal. Breakfast can be the only time of day when there’s no pressure to use that time for anyone but “me.” The emotion here is individualistic, a little bit indulgent, and unlike the rest of the day, there’s also the feeling of freedom that comes from a great deal of personal choice.

The breakfast prize

Most of the increase in retailer business will come from switching food purchased from other outlets, leveraging the growth of eating on the run, and reducing the number of skipped breakfasts. Capturing some portion of the mid-morning snack occasion is another opportunity. Reaching those who bring breakfast home from restaurants is a distant third.

Breakfast presents an opportunity for a $500,000 per week supermarket to increase overall sales by more than $1,800 per week.

This is the smallest potential for the three meals, primarily because of the relatively low cost of this meal and the fact that most breakfasts already originate at home. However, since breakfast is about routine, changes in behavior may be long-lasting.

Lunch: The double opportunity

From the shopper's perspective, supermarkets can fill both at-home and away-fromhome lunch needs.

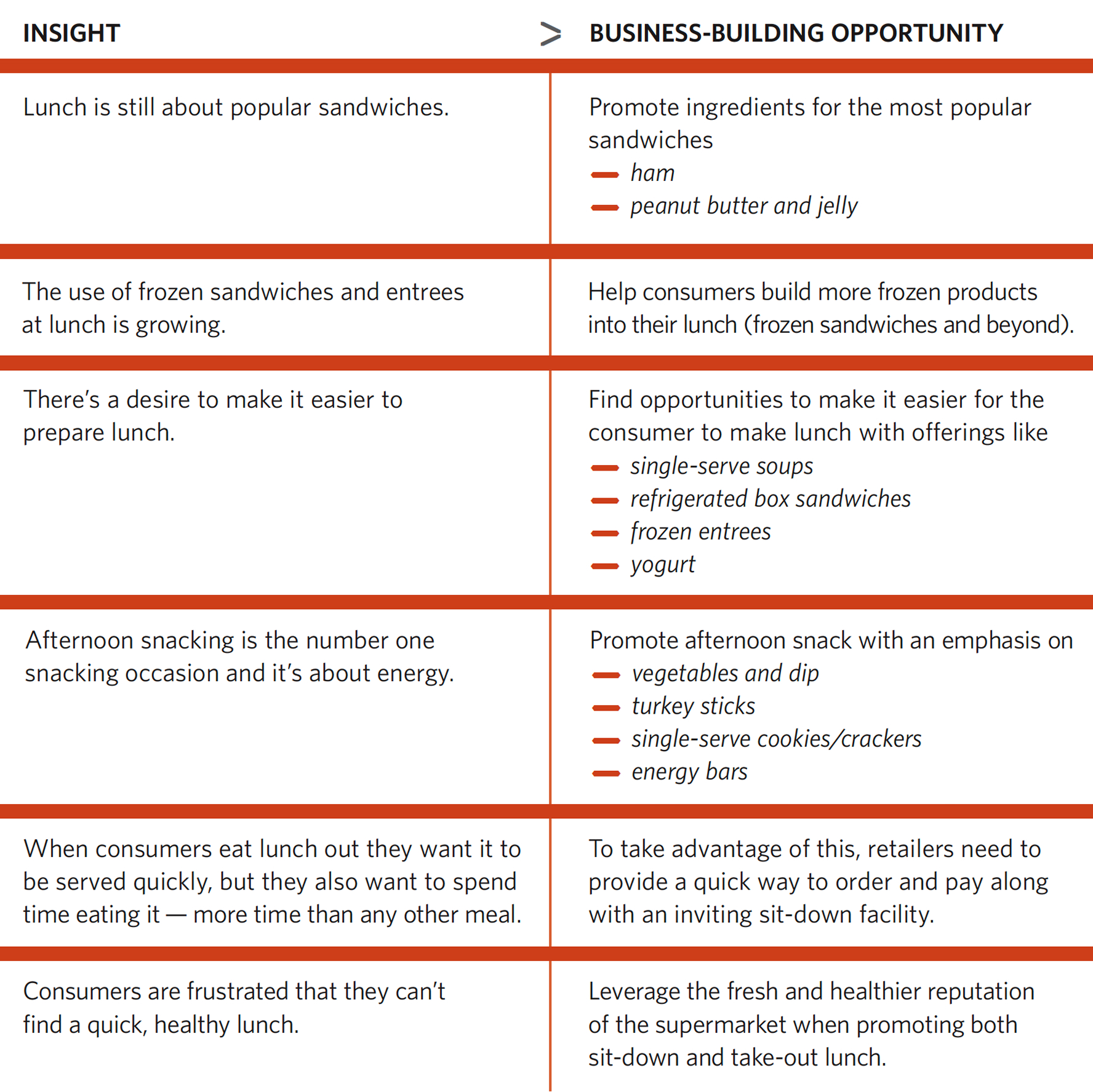

Lunch is the meal most often eaten away from home—but it’s also the meal with the greatest potential for emphasizing the cost advantages of sourcing from the supermarket. Lunch also gives retailers the chance to tap the potential for building sales around both at-home and away-fromhome occasions (including in-store). From the shopper’s perspective, supermarkets can fill both needs.

What are consumers looking for?

Wherever it’s eaten, lunch is about speed, taste, and convenience. There is also a growing interest in health. Here’s how consumers describe the challenge of finding a “good-for-you” lunch.

Wanted a frozen option without the high sodium and preservatives for brown bagging.

Not easy to find things that are healthy and easy to fix.

Don’t have much time so it has to be quick and also a little good for you.

Making sandwiches and salads every day can turn into a tiresome chore.

At home

Lunch preparers would like to cut down on the mess at home. These are things they suggested:

- Quicker and more convenient access to their favorite sandwiches. (“Homemade sandwiches are tasty, but they take time to make and clean up after.”)

- Quality pre-made popular sandwiches that don’t contain too many preservatives and don’t cost too much.

- A broader choice of frozen sandwiches that would deliver variety and good taste at a reasonable price.

- The chance to bring lunch home to eat, so they can avoid the mess and fuss.

Away from home

Lunch customers want speed and value away from home.

For in-store lunch customers, speed and service are vital in order to be competitive. Make it easier to get in and get out—in as many ways as possible, from ordering to picking up to paying. Success stories already abound. Festival offers an online daily lunch menu and online ordering for quick in-store pickup, and Stop & Shop uses kiosks and self-checkouts for faster and easier transactions. Some retailers are also adding grab-and-go, soup bars, fountains, and sit-down facilities. Transaction times can be sped up by providing separate registers for lunch service or self-service checkouts.

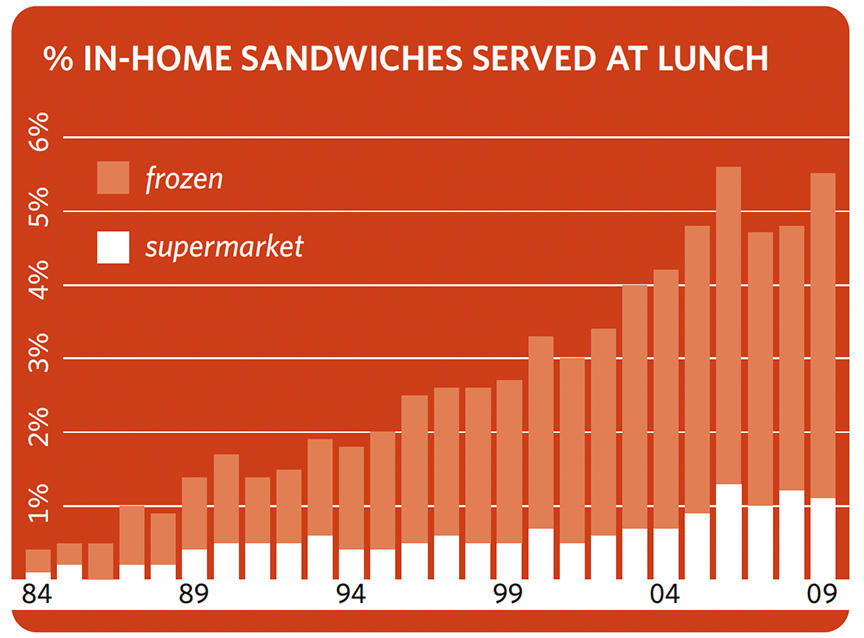

Sandwiches

Sandwiches continue to be important, and consumers are looking for more convenient ways to get them. Consumers have quadrupled their consumption of frozen and ready-to-eat sandwiches in the past 25 years.21 They are also bringing more supermarket sandwiches home to eat. Consumers are always updating their sandwich preferences. While ham has remained the number one sandwich ingredient for years, contemporary trends have changed everything else about it: the bread, the cheese, the condiments, even the ham varieties.

21 The NPD Group/Eating Patterns in America.

Source: The NPD Group/National Eating Trends Service

Marketing opportunity

“Satisficing”

At lunch, people feel there always has to be a trade-off— giving up health for taste, taste for speed, or speed for health. This leads to a combination of satisfaction and sacrifice referred to as “satisficing.” Can food retailers find ways to give customers the feeling of getting more of what they want? Whereas the emotion of the breakfast occasion is largely positive, the emotion of the lunch occasion is more complicated because of these trade-offs. Food retailers need to understand the concept of satisficing and help customers get as much as they can of what they want—taste and health, for instance, and quickly. Lunch also has an interesting split personality— sometimes it’s solitary and sometimes it’s social. And people spend more time eating lunch than any other meal.

Supermarkets have an opportunity to leverage their halo for healthy food at lunch.

- Tie produce items into lunch.

- Stress the deli as a source of fresh, wholesome sandwich ingredients.

- Healthy frozen entrees can often be a mainstay of the new brown-bag lunch.

The lunch prize

The lunch opportunity is bigger than breakfast primarily because so many lunches originate away from home. Its full potential can only be realized when the food retailer has a solid food service offering at lunch, probably built around sandwiches and speed.

Seizing lunch opportunities at a $500,000 per week supermarket can increase overall sales by more than $4,100 per week.

The largest gains come from capturing lunches that would otherwise be skipped—perhaps up to 6% of lunch occasions. The other top sources of new business are food brought home from a restaurant, eaten at a restaurant, or carried from home.

Dinner: The must-win opportunity

Sales for other meals are likely to follow if dinner shoppers come to the store.

Dinner is the must-win opportunity because it’s the largest—but also because it’s a gateway to other meals. Dinner is more likely to drive a consumer’s choice of shopping venues than breakfast and lunch, so sales for those other meals are likely to follow if dinner shoppers come to the store.

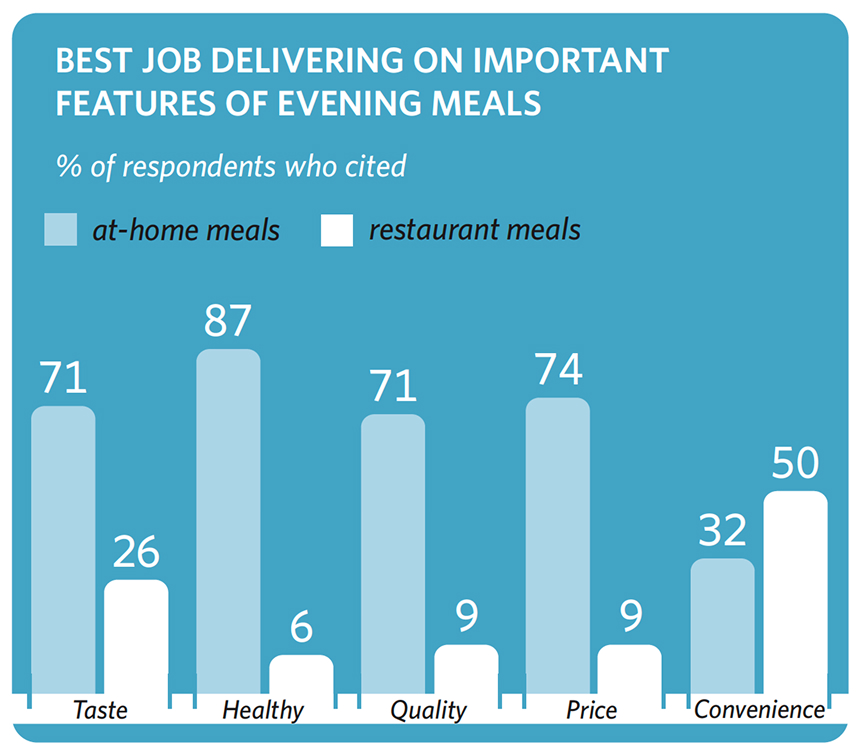

What are consumers looking for?

After taste, the phrase that best summarizes what consumers are looking for at dinner is “something convenient”—something that’s quick and easy to prepare, cook, and clean up. This is a key reason that menus have become simpler and the definition of an “eat-at-home” evening meal has expanded to include the full range of options: ready-to-eat, ready-to-heat, ready-to-cook, and scratch ingredients. The challenge with convenience is that it is the one dimension on which restaurants outpace at-home evening meals. This is a concern. But the good news is that at-home wins all the rest: taste, health, quality, and price.

Source: The NPD Group/CCRRC Custom Survey

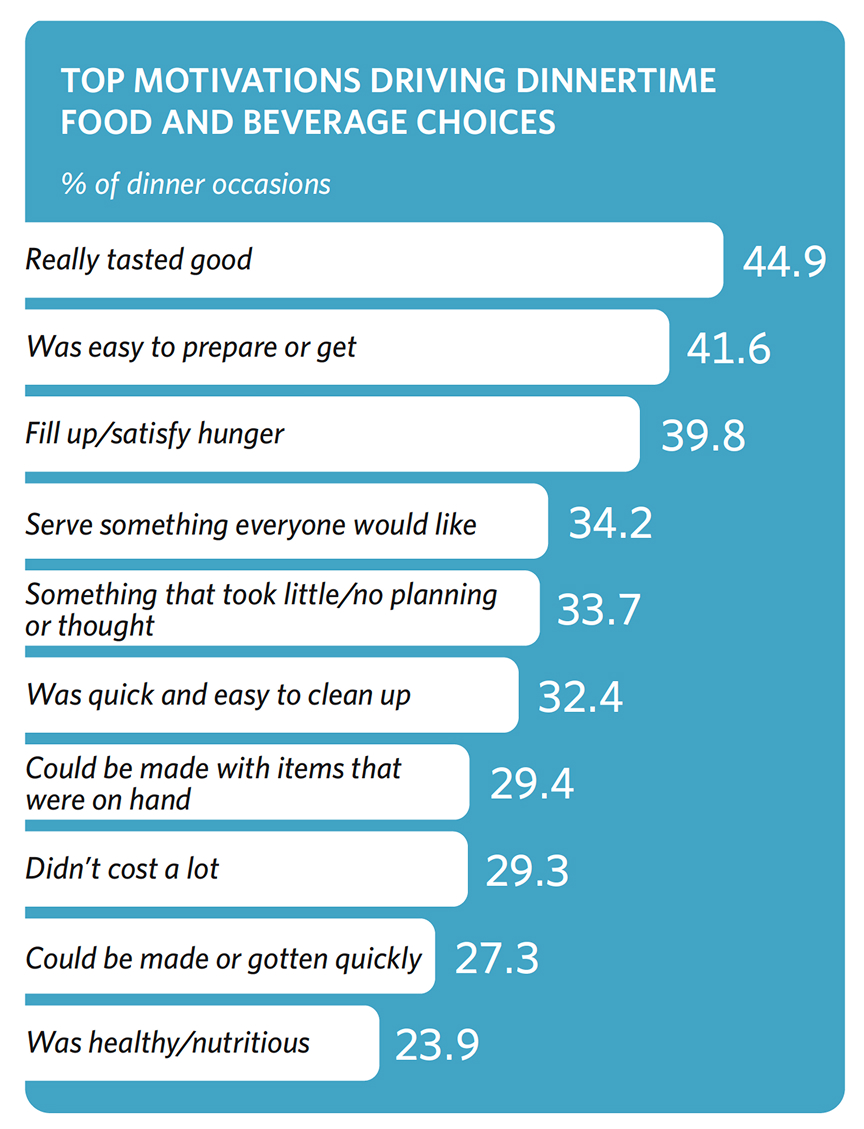

Looking more closely at the top 10 motivations that drive dinnertime food and beverage choices offers more insight into what consumers are looking for from dinner.

Good taste is always important, but after that comes a desire for a meal that is

- convenient on several dimensions

- it takes no extra thought to plan

- it’s easy to make or get

- it’s quick and easy to clean up

- pleasing to the family (everyone likes it and it will satisfy their hunger)

- inexpensive to serve

These motivations can serve as themes for promotions and communications aimed at showing the benefits of dinner at home.

Source: The NPD Group/Dinnertime MealScape 2009

Reasons for not fixing dinner

49%

Too tired

39%

Feel like going out

32%

Home too late

27%

Too busy

Source: The NPD Group/Cooking Skills and Habits Survey

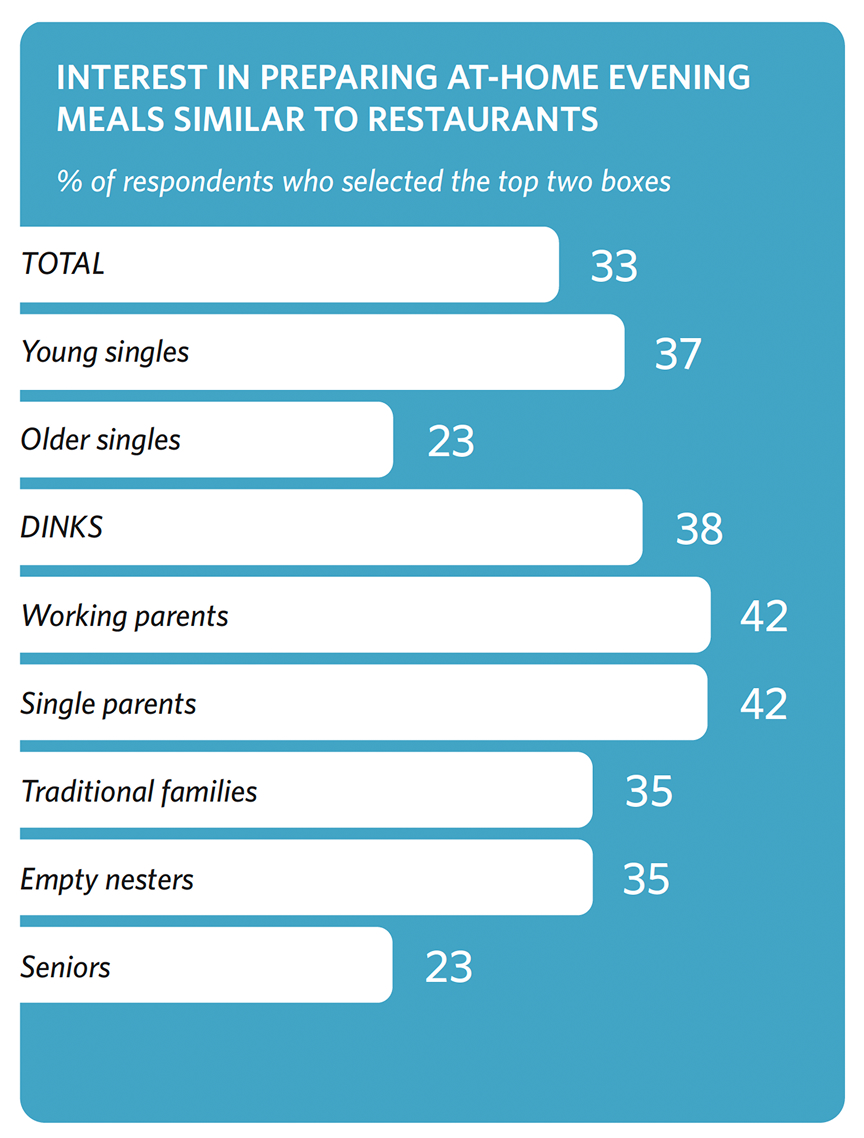

The term “restaurant quality” communicates a positive message that retailers can use to showcase meals that households can be proud to serve on occasions like birthdays, but also when they just want something special.

Source: The NPD Group/CCRRC Custom Survey

It also turns out that about one-third of consumers have an interest in preparing dinners similar to those served at restaurants. This resonates most strongly among working and single parents, and younger consumers.

Linking “what to eat” with ”what to buy”

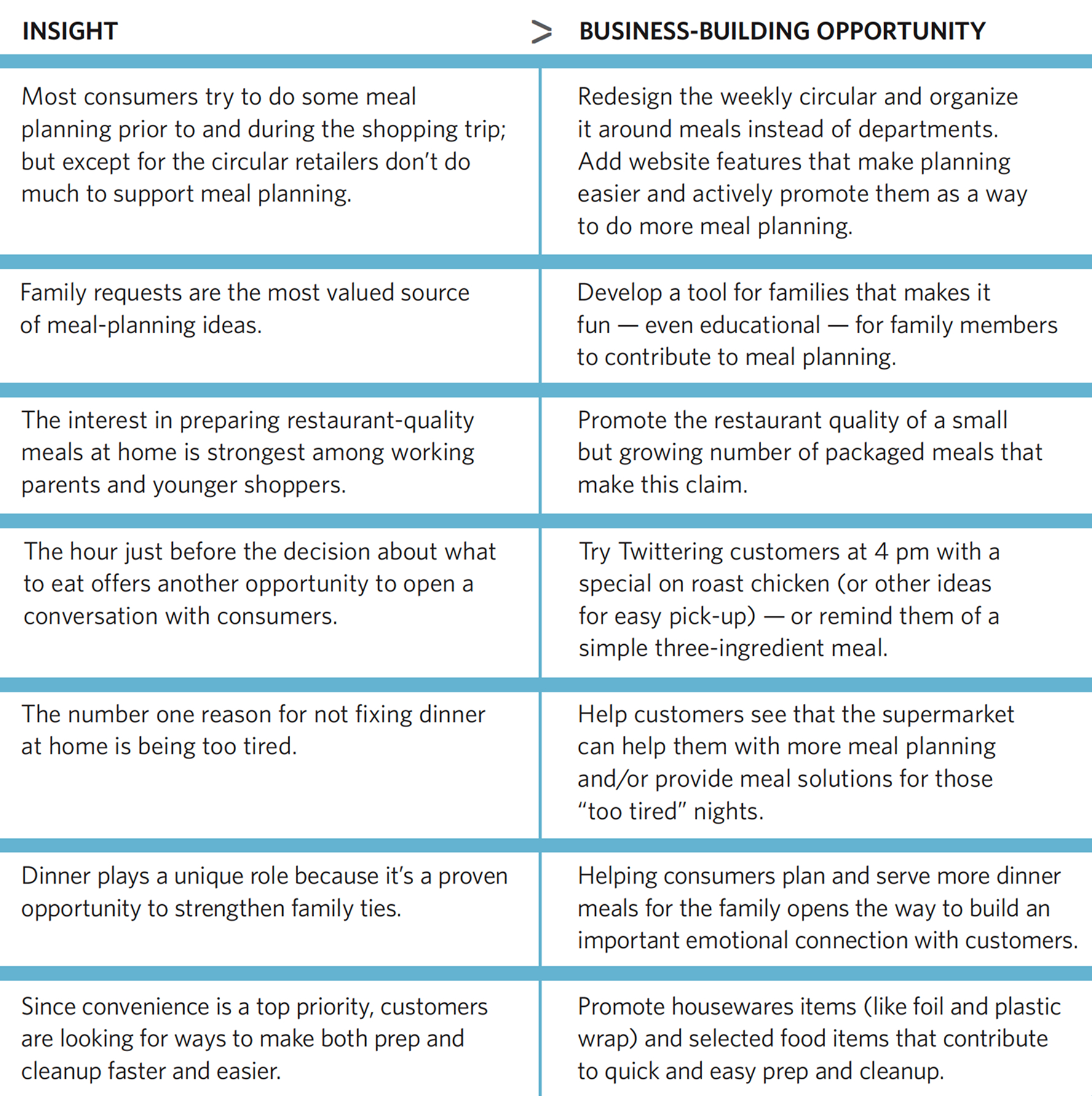

Influencing what’s for dinner is a key opportunity for food retailers to encourage more dinners at home

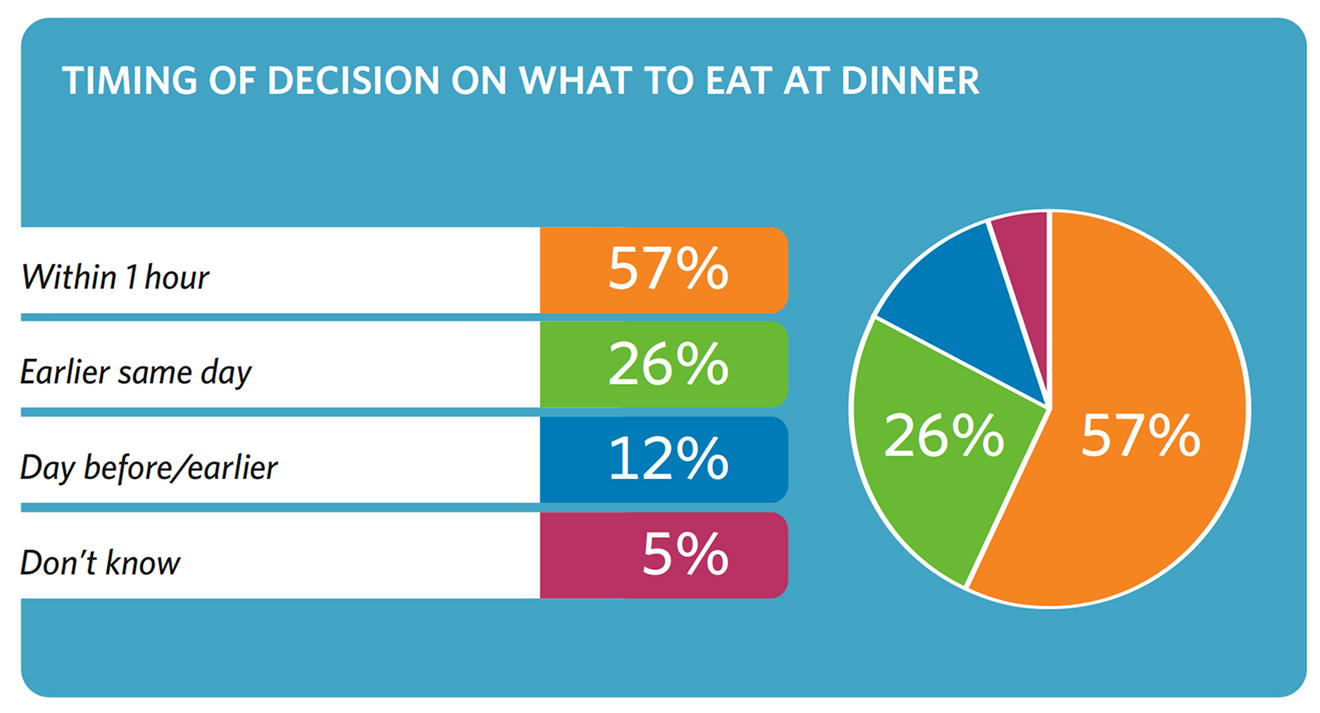

Two separate but closely related decisions impact what goes on the table for the dinner meal—what to eat and what to buy—but they are not made at the same time.

The final decision on what to eat tends to be last-minute for most dinners, reflecting both the “facts on the ground” and the absence of planning for the meal.

Source: The NPD Group/Dinnertime MealScape 2005

Since almost 60% of decisions on what to serve are made within an hour of the meal and another 26% are made the same day, consumers need to have the necessary ingredients at home or they will likely fall back on the option of bringing home a prepared meal. Last-minute decisions often don’t favor meals prepared at home because it’s just easier to go out or carry in when it’s affordable. Clearly, however, the odds tip in favor of the supermarket if there has been enough advance planning that the necessary food is on hand.

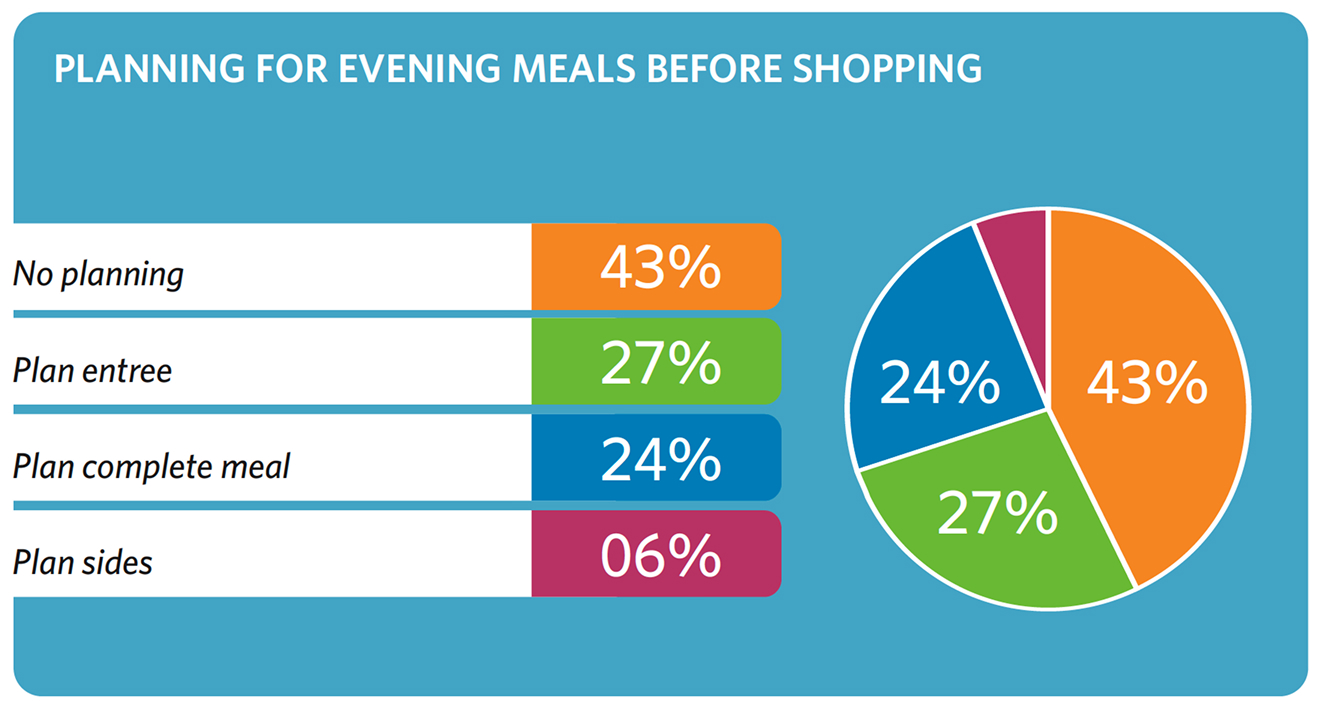

Most consumers do some evening meal planning before they go grocery shopping—which offers retailers the opportunity to provide planning assistance to their customers by helping them more easily develop a meal or shopping list. Advance-planning households are more likely to have meals or meal ingredients on hand when they get to “decision time” late in the afternoon.

The decision about what to eat is mostly made within an hour of the meal.

The decision about what to buy is made earlier, sometimes days earlier.

Source: The NPD Group/CCRRC Custom Survey

Only 24% of meals are completely planned before the shopping trip. Consumers who do any meal planning before shopping typically plan about three and a half dinners, or half the week’s evening meals. The good news for food retailers is that recent studies have shown that consumers are trying to do more preplanning and they are looking for help.

Help can be supplied in many ways, including using a meal focus in the circular, training butchers and counter personnel on building meals, and even leveraging planning tools on the website.

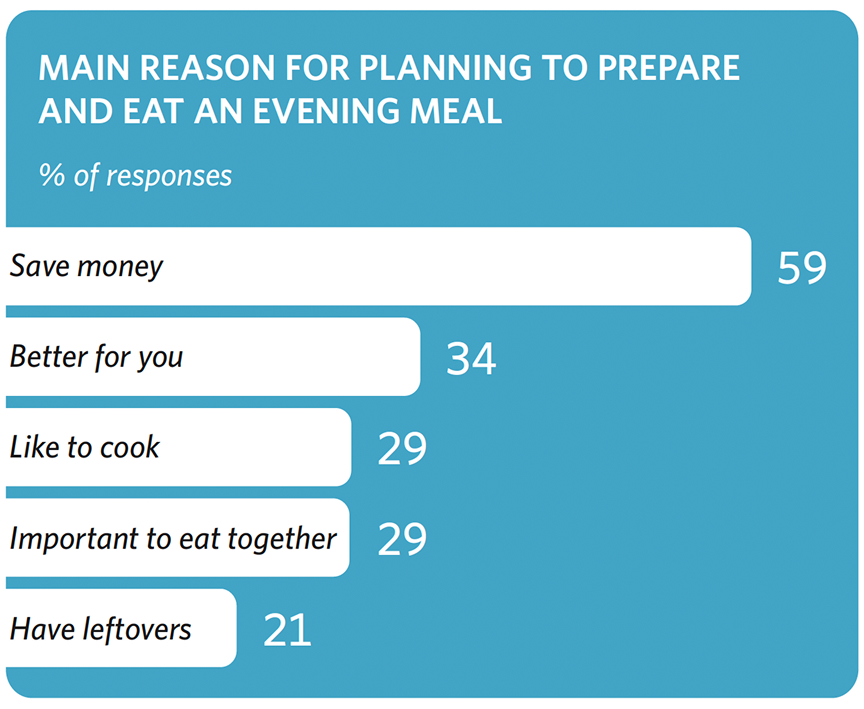

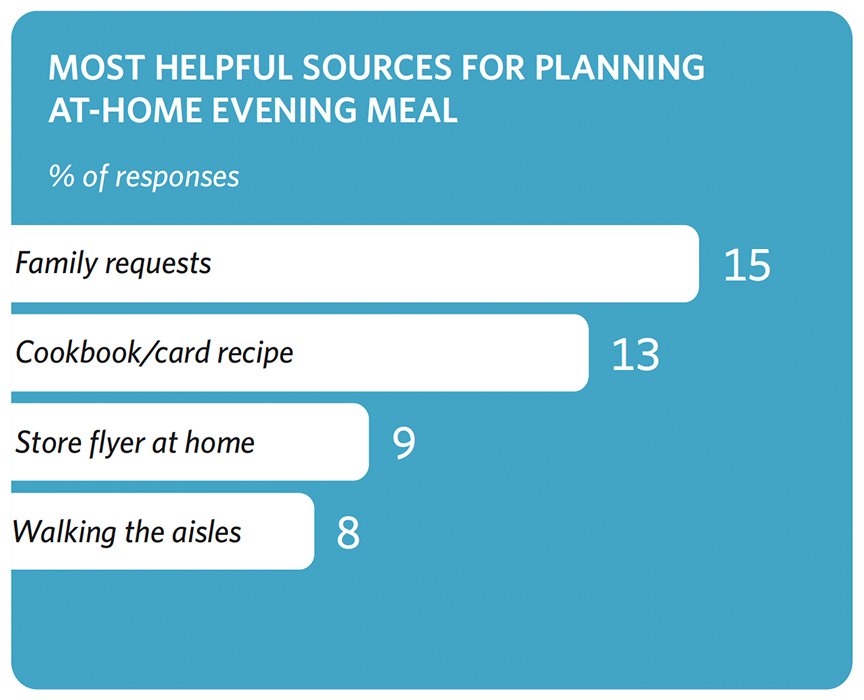

To better understand how food retailers can make it easier for their shoppers, the custom survey that was part of the larger study looked at the reason/motivation behind planning the dinner meal and the information sources that consumers felt were most helpful.

Source: The NPD Group/CCRRC Custom Survey

What influences the planning? Saving money is the primary motivation—59% cited this as the main reason for planning to prepare and eat an evening meal at home. Family requests are the most important source of information for shoppers. The weekly circular, when available at home, is the third most useful source of information.

Retailers may want to readjust their marketing and services in light of this information. Some may be paying a lot of attention to the store circular while mom is paying attention to family likes and dislikes. Thus it may be more helpful and worthwhile to offer ways to include family members in marketing efforts.

Source: The NPD Group/CCRRC Custom Survey

While planning is more common among traditional families—an important group—the research shows that these customers appear to be less reachable through merchandising efforts in the aisles. Part of the reason may be that they are often rushed, or accompanied by small children.

Seniors typically don’t do much preplanning, probably because they have more time. They are more reachable through traditional merchandising.

Retailers can also use technology to assist with meal planning. For example, retail websites that track purchase history from loyalty data can identify previously bought items that are on sale, and suggest recipes that include those items. They can even tailor these suggestions to the household’s dietary needs.

Marketing opportunity

The “taking charge” emotions

Dinner is like putting together a puzzle, because it involves so much more organization and planning than other meals —and these decisions can be driven by everything from family favorites to saving time and money. Part of it may be about getting everybody to eat the same thing; dinner is not like breakfast where everyone can have an individual favorite. For many households this is the time for strengthening family ties. Usually, someone “owns” dinner for the whole family. This ownership can be a task or a privilege or both. The owner of dinner often feels responsible for a lot, from the family’s health to its food spending, and from deciding what everyone will eat to figuring out how quickly the meal can be prepared and cleaned up after. Making any of these tasks more convenient is a huge help.

The dinner prize

The size of this opportunity reflects the cost of the meal and the opportunity to win back away-from-home business. As with lunch, this estimate assumes that the food retailer has developed a solid food service offering for dinner that can complement the sale of traditional items.

Dinner holds the greatest potential to increase food retailer sales; for a $500,000 per week store there’s an upside sales potential of more than $5,100 per week.

The majority of the sales potential for dinner comes from winning meals currently brought home from a restaurant—perhaps up to 15% of these occasions. The other main contributor to growth is winning meals now eaten at restaurants, potentially capturing 5% of these occasions.

Chapter 3: The Seven Faces of Dinner

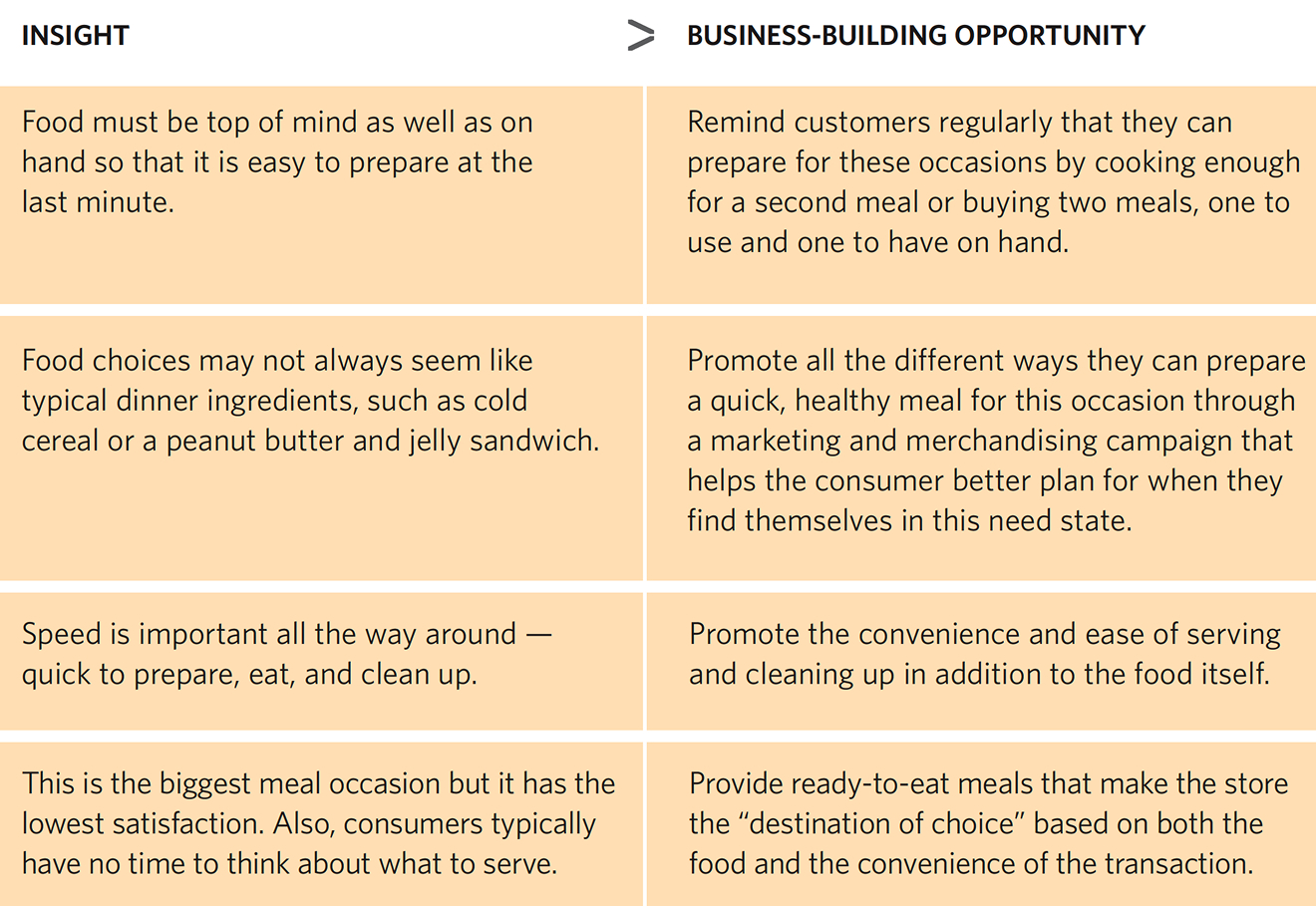

To thoroughly explore dinner opportunities, The NPD Group’s Dinnertime MealScape 2009 followed a need-state perspective to examine the landscape from the consumer’s point of view. The review looked at the needs that influence people when they make decisions about dinner, and how those needs combine around specific meal occasions. This is in contrast to the traditional demographic approach, which divides consumers into groups according to household characteristics and assumes that the needs of each group are generally homogeneous.

Recognizing that these different dinner occasions exist and understanding the needs behind them will help retailers connect more directly with what’s influencing shoppers, both logically and emotionally, and better prepare them to deliver on the value that customers seek. These insights provide a solid new foundation for developing business-building strategies that are aligned with consumer needs.

The seven dinner occasions identified by The NPD Group are listed below in order of the frequency with which they occur in the overall population. The Last-minute No-brainer occasion is the most common at 21%, and Hearty Fuel is the least frequent at 9.4%. Retailers are encouraged to survey their own customers to determine which dinner occasions should be their top priorities.

- Last-minute no-brainers

- Thrifty repeats

- Tasty creations

- Nourishing fare

- Kids’ delights

- Family entertaining

- Hearty fuel

A number of the relationships between and among these occasions suggest different ways to use them together.

- Two are lonely nights (Last-minute No-brainers and Thrifty Repeats). Eating leftovers or foods such as ramen or cereal by yourself makes up nearly 40% of all dinner occasions! Such a large proportion of low-satisfaction meal occasions represents a huge opportunity for retailers.

- Two focus specifically on kids (Kids’ Delights and Family Entertaining); both require food that kids will like.

- Two concentrate on adult needs and desires: Nourishing Fare focuses on health, and Hearty Fuel focuses on abundant, familiar foods.

- One —Tasty Creations —focuses on experimentation and seems a bit like date night for adults without children.

- Three of them—Kids’ Delights, Family Entertaining, and Nourishing Fare —seem like the forerunners of many a Thrifty Repeat night.

It’s also helpful to recognize that some dinner occasions are more common on weekday nights, while others happen more frequently on the weekend.

The descriptions that follow identify the demographic groups among whom a given occasion is more common. This will help retailers do a preliminary match with their target customers, but keep in mind that all consumers experience these occasions to one degree or another — whether they are young singles, families, empty nesters, seniors, or others.

Last-minute no-brainers

Shorthand

No thought needed.

What does it look like?

You’re hungry, you need something fast, and it has to be easy to get or make at the last minute. No time for thinking, no planning. The goal is to satisfy hunger without much effort. These meals are simple, often smaller than usual, and based on what’s at hand. Ramen or cold cereal might even do the trick.

Who’s at the table?

More likely adult-only (often eating alone) or kid-only occasions.

What’s the mood?

Eaters are not likely to be enjoying the meal, and more likely to be rushed, disinterested, lazy, or occasionally grouchy than on other meal occasions.

When is it served?

Occasions skew toward weekdays.

Marketing opportunity

Believe it or not, this lonely occasion is the most common dinner experience across the overall population —it represents one in five (almost 21%) and is more common among younger singles with low to medium incomes.

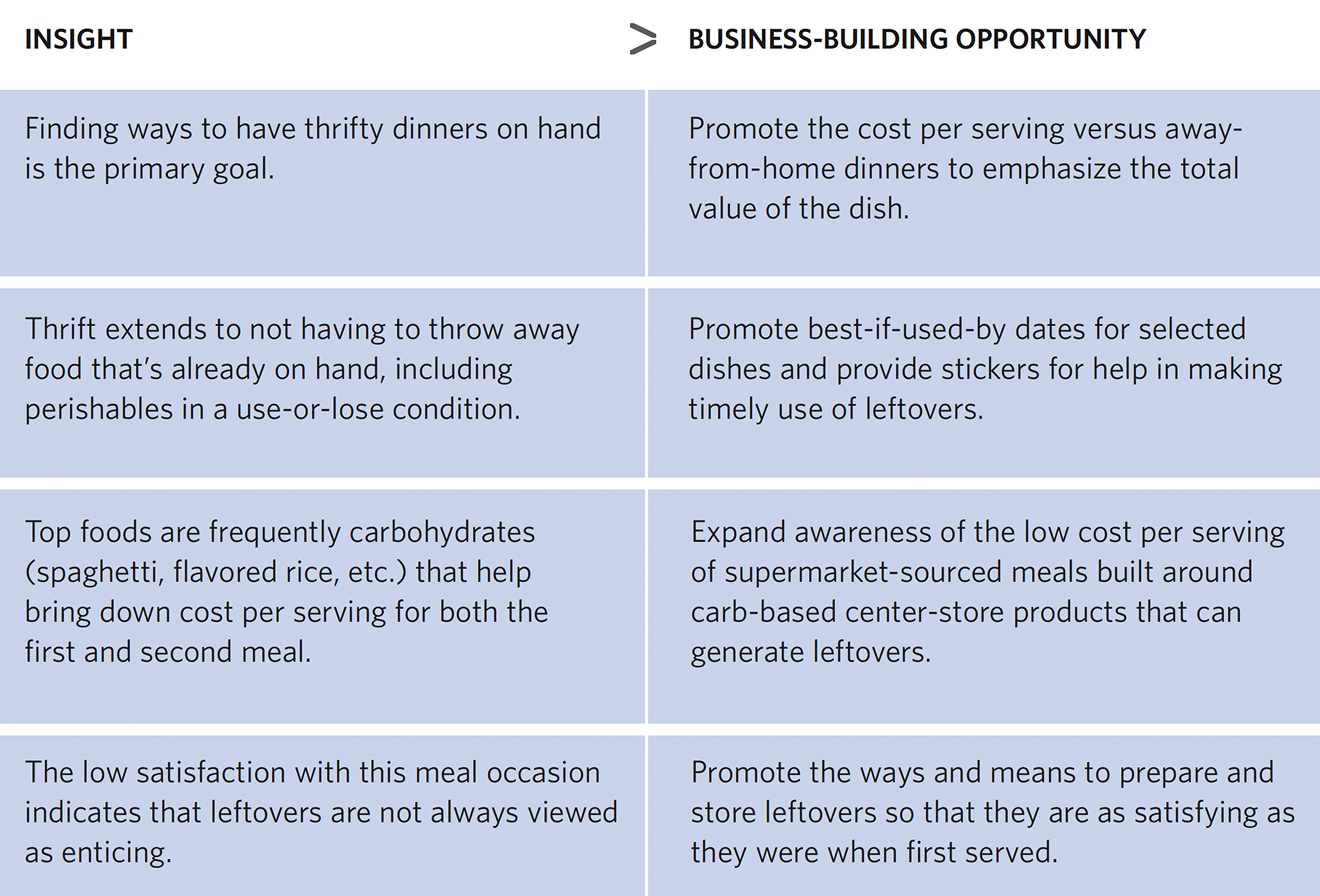

Thrifty repeats

Shorthand

Didn’t cost a lot.

What does it look like?

Using leftovers is a big driver, and so is using items before they spoil, so Thrifty Repeats are assembled from what’s on hand. Since you don’t buy anything extra for these meals, they feel like they didn’t cost much.

Who’s at the table?

More likely adult eat-alone occasions, like Last-minute No-brainers.

What’s the mood?

The eaters’ rating of their experience and mood is more likely to be ”just satisfied, no more” and lonely, stressed, and bored.

When is it served?

Occasions skew toward weekdays.

Marketing opportunity

The second-ranked dinner occasion is more common among younger consumers (low to moderate income) living and eating alone, though other groups participate occasionally.

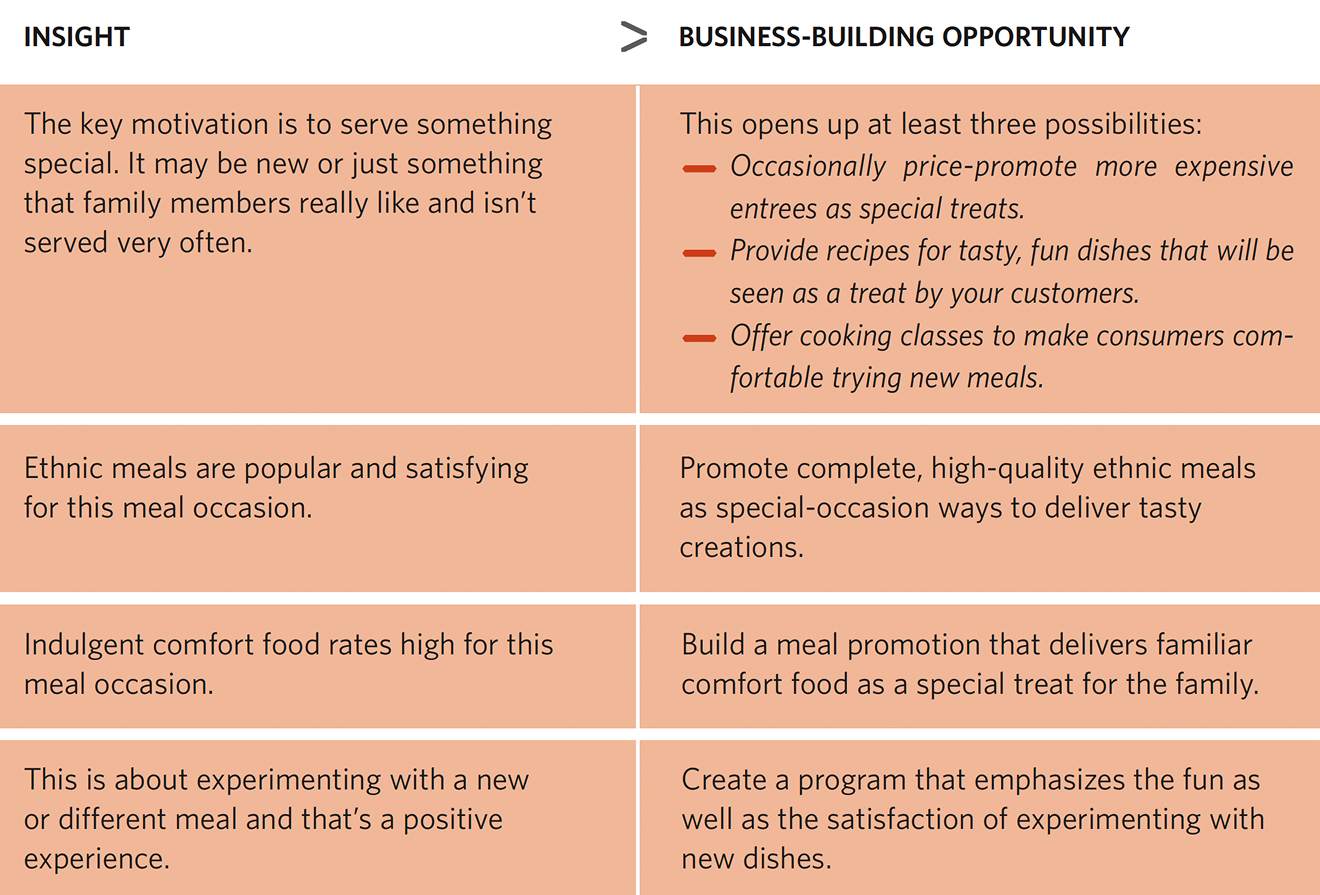

Tasty creations

Shorthand

Nurture and experiment.

What does it look like?

Nurturing relationships and experimentation are the needs driving Tasty Creations. People want to try something new or different, satisfy a craving for a favorite food, reward themselves by indulging a specific taste, or experiment. Whatever, it’s going to look and taste great and be fun to eat or drink.

Who’s at the table?

Mostly adults alone or with a guest, young couples (before children), and empty nesters. This occasion has a higher likelihood of being sourced away from home.

What’s the mood?

Excited!

When is it served?

Occasions skew toward Friday, Saturday, and Sunday.

Marketing opportunity

The third most popular dinner occasion is more common among single younger consumers (18–34), dual-income no-children households, Asians, and black (non-Hispanic) households. It is less common among working women, traditional families, and seniors.

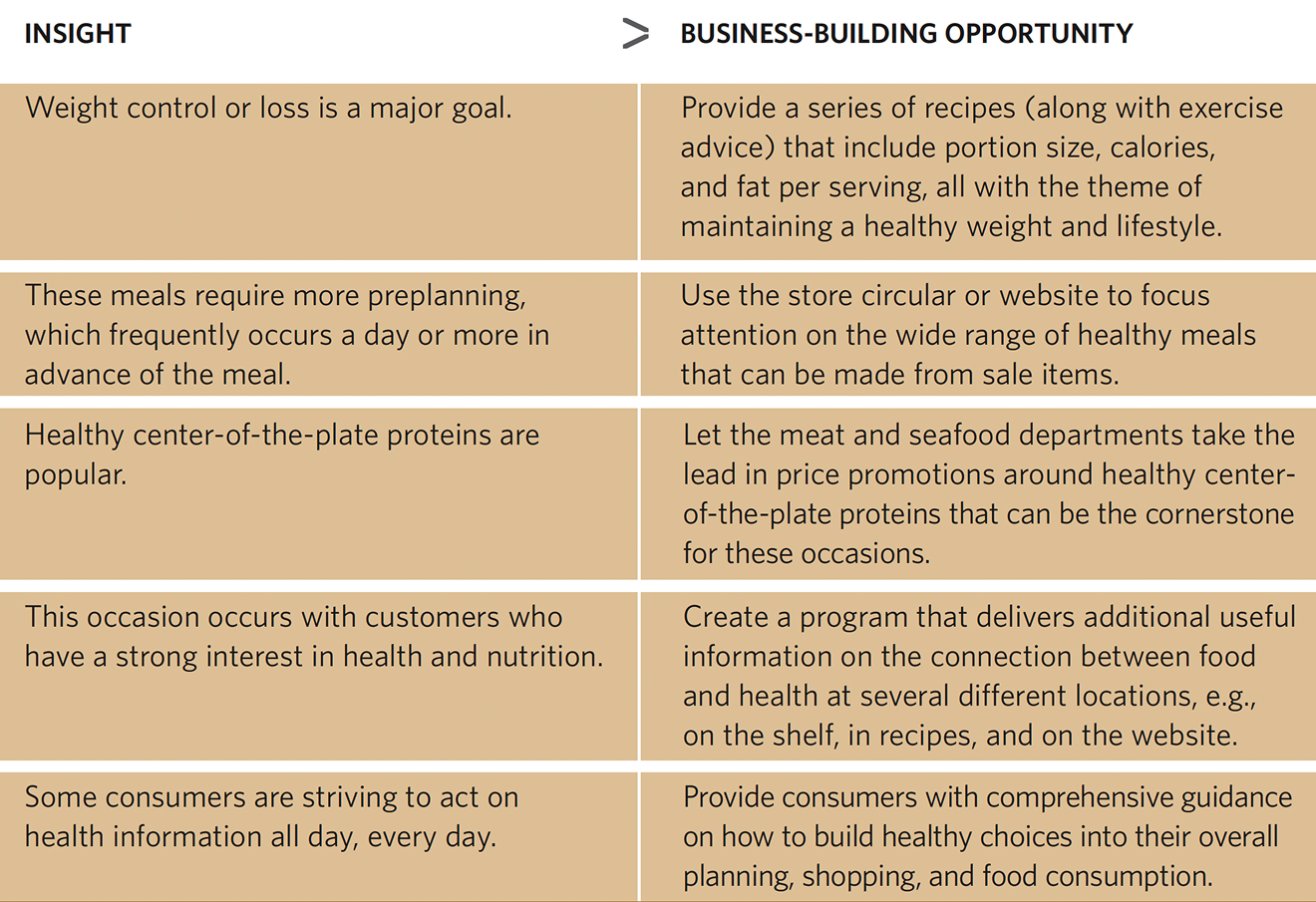

Nourishing fare

Shorthand

Healthy and nourishing.

What does it look like?

Diet/medical conditions and general interest in nutrition and health are top drivers. Supporting weight loss goals or helping to maintain a healthy weight is often important. People tend to think about specific nutrients and fat, sugar, and fiber content when they build these meals. Salads, veggies/fruit, and lean proteins are popular components.

Who’s at the table?

Mostly adults who are serious about nutrition.

What’s the mood?

Confident and/or creative. People are feeling good about serving/eating something healthy.

When is it served?

Throughout the week.

Marketing opportunity

The fourth biggest dinner occasion is more common among older adults (over 55), non-Hispanic blacks, 1- or 2-person households, and working professionals. It occurs less frequently among working women (especially single parents) and traditional families (especially low to middle income).

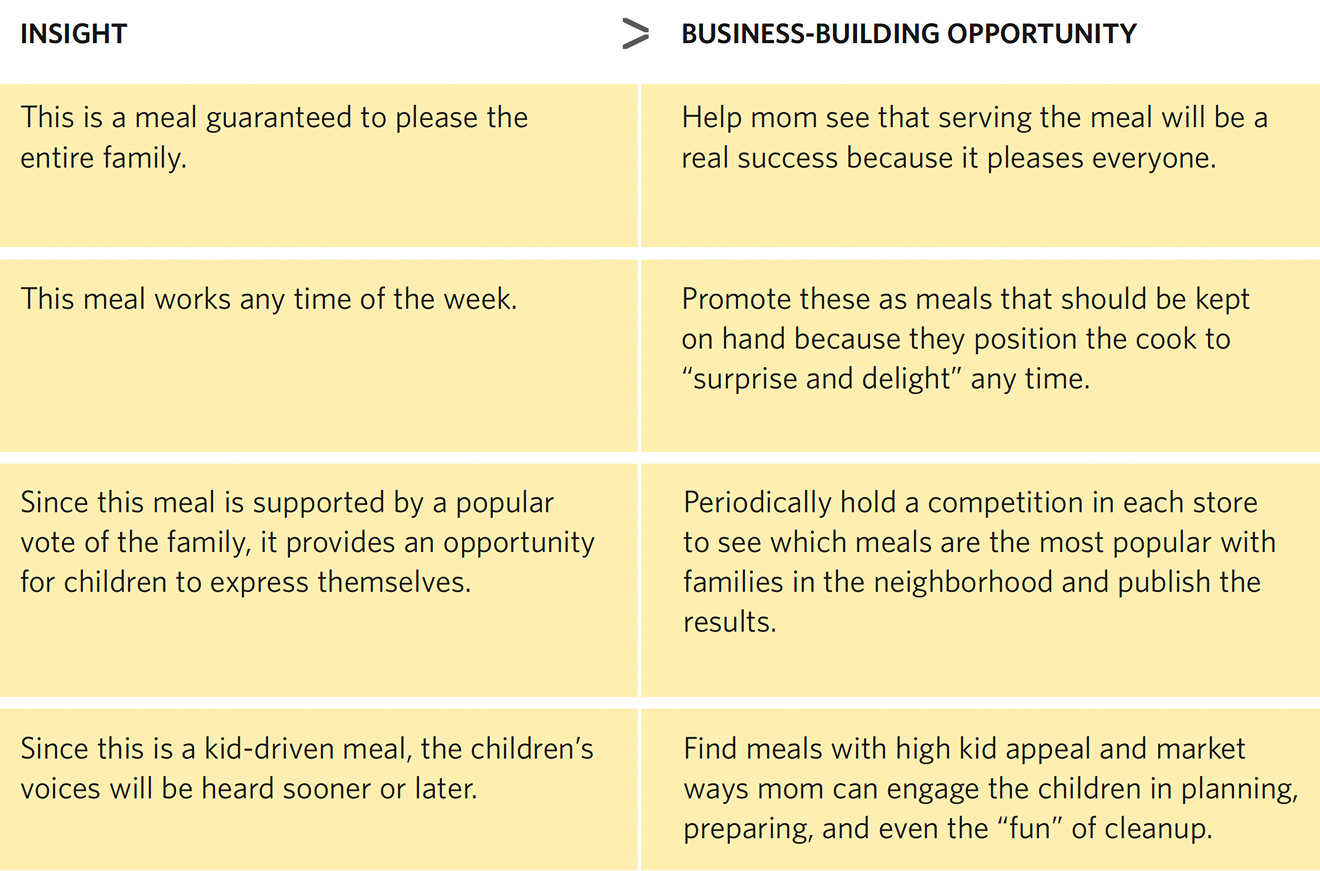

Kids’ delights

Shorthand

A meal everybody likes, especially the kids.

What does it look like?

This one’s a slam dunk for mom, something the kids are likely to ask for and everyone enjoys. It’s a quick, pleasing fill-up, a comforting favorite that’s in the regular meal rotation.

Who’s at the table?

Kids and parents, often together but sometimes not. This one works for households whose members need to eat at different times. It’s also a good opportunity to make lots so there’s enough for another meal.

What’s the mood?

Energized.

When is it served?

Anytime. There’s no difference between weekday and weekend nights

Marketing opportunity

The fifth-ranked need state for dinner meals occurs in families who have children (especially those with children under 12), regardless of income levels and family structure (traditional, dual-income, single-parent).

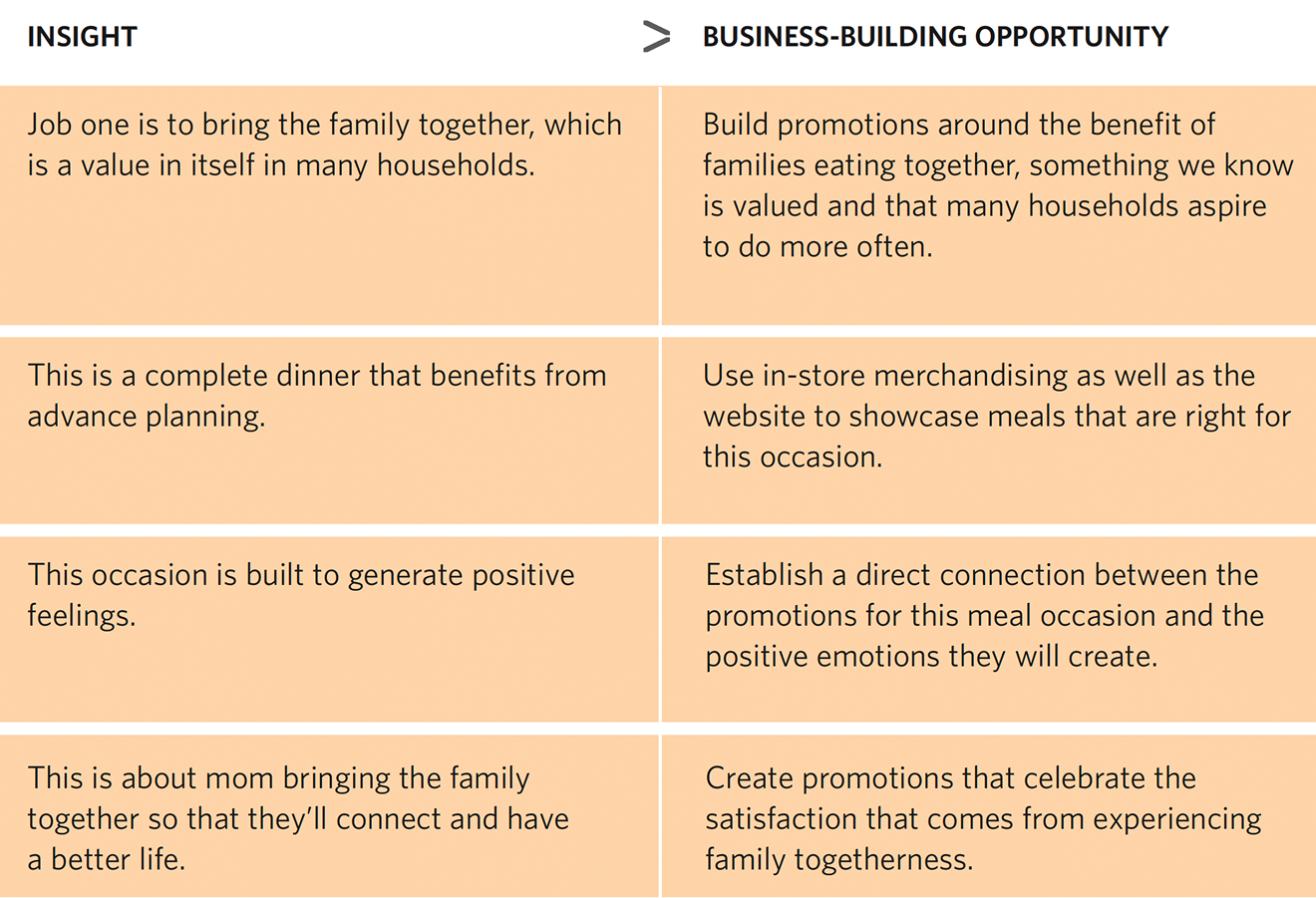

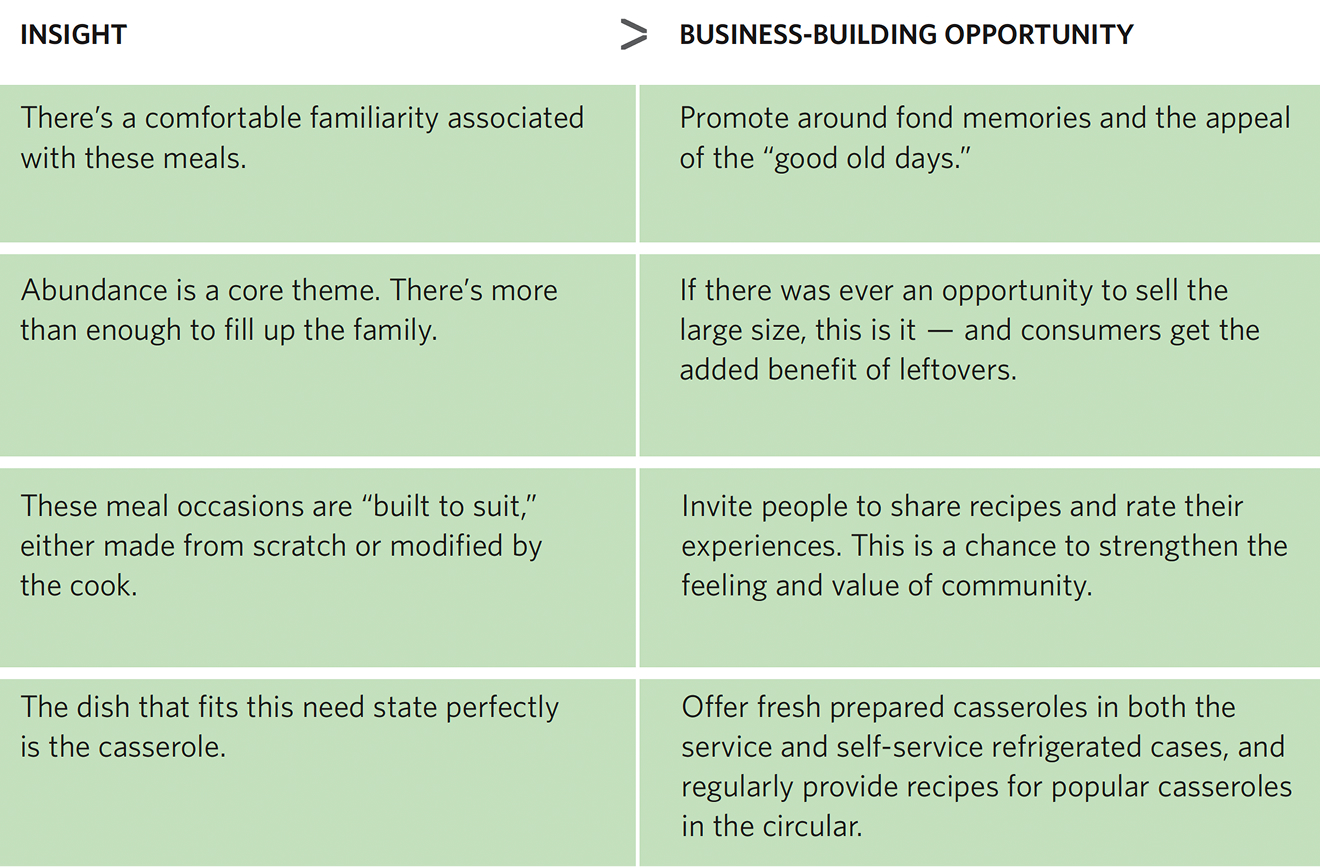

Family entertaining

Shorthand

Bring together family with comfortable favorite foods.

What does it look like?

The top drivers are nurturing the feeling and benefits of family, quick and easy fill-ups, and comforting favorites. For this occasion, people choose foods and recipes that will bring people together, show them you care, and provide a little fun. The cooking experience also is enjoyable, and often large portions are made to have extras for another time.

Who’s at the table?

Adults and kids.

What’s the mood?

Talkative, happy, energized, relaxed, peaceful, confident, content.

When is it served?

Mostly on weekends.

Marketing opportunity

While this is one of the smaller occasions, it packs a lot of positive energy, particularly for households with four or more members and those with kids. It is less popular among households without children — singles, empty nesters, and seniors 65+.

Hearty Fuel

Shorthand

Hot and hearty.

What does it look like?

It’s hot, hearty, and made fresh or “doctored” to feel as if it were made to order. This meal works for households with members who eat at different times, and it can be made in large portions to have extras for another time. Most of the time, these meals are made completely or partly at home.

Who’s at the table?

Two or more adults are more likely; it’s less likely to be a kid-only meal.

What’s the mood?

More likely to be creative, content, happy, calm.

When is it served?

Across the week.

Marketing opportunity

This is the smallest need state, representing only 9.4% of dinner occasions, but it’s all about doing more at home. It’s more popular among older middle-income households (empty nesters and seniors — especially those over 75), and dual-income no-children households. It’s less so among singles, two-working-parent households, and traditional families.

Chapter 4: Implementing a successful meal solution program for today’s shoppers

Food retailers have been working on meal solutions for years, but until now they haven’t had a comprehensive fact-based foundation on which to build a strategy.

This report presents comprehensive behavior-based insights into how consumers are approaching their meals and what they want to accomplish beyond just “refueling.” It also lays out the motivations behind the different meal occasions that make up dinner for North American households. The findings and opportunities discussed in Chapters 2 and 3 provide, for the first time, the essential building blocks for a meal solution strategy.

The study establishes that there are significant upside sales-building opportunities in breakfast and lunch, but the biggest dollar opportunities are in the dinner occasion. It also lays the groundwork for moving beyond just “selling more units” to delivering new value in the form of meal solutions that encourage more shopper visits and purchases. New opportunities extend the range of customer services from making it quicker and easier for customers to plan meals, to doing more of the actual preparation.

Growing interest in meal solutions is evident from the efforts some food retailers have initiated recently, such as

- posting lists of frequently purchased holiday meal ingredients in the store, along with where they can be found in the aisles

- printing shopping lists in the circular to help customers organize what they want to buy

- displaying all the ingredients needed for dinner in one location

- devoting promotional space to regular displays of ready-to-heat, ready-to-eat, and ready-to-cook products

- offering specialized meal planning services — sometimes even at a fee

The information in this report provides the guidance for building even more productive meal solution programs in the future.

Building your own dinner program

The seven dinner meal occasions offer a clearly defined set of options that retailers can use to build a strategy aligned with their target customers’ most important priorities. To begin, discover what meal occasions are most common among your customers, which are most important to them, and what kinds of help they want. Then work within your company to understand what actions can be taken to make it easier for your customers to eat more dinner meals at home, and to identify where you can “own” an important part of this new and growing dimension of customer service.

What do your customers expect and trust you to be able to do?

What are your company’s capabilities? What’s practical?

Is it worth the effort? Evaluate whether the size of the prize is big enough to justify making this a priority.

Taking it further

Three additional findings from the study can help retailers shape their plans.

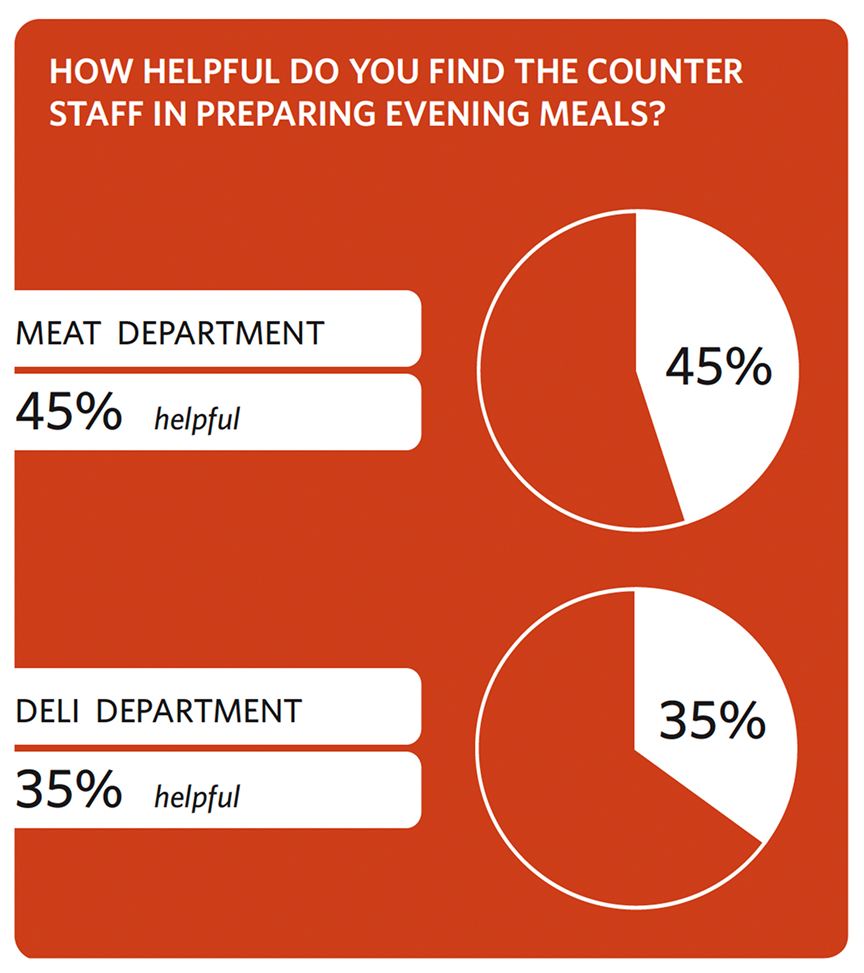

Customers are asking counter personnel in the meat and deli department for help with meal planning and purchase decisions, and there are opportunities to do more in this area.

Customer reactions to different ways of merchandising meals reveal both what they are looking for and how challenging it is to build acceptance for new display methods.

Potential game-changers are emerging — ideas that can generate enough new value for shoppers to make it obvious that something new, different, and helpful is being offered.

Help from counter personnel

The custom survey conducted for this project looked at how much shoppers are relying on counter personnel in the meat and deli departments for help in planning and shopping for the evening meal. While there has been a long-term trend toward more self-service in these departments, customers — particularly those who have less experience preparing and serving meals at home —are continuously faced with questions about not only what to buy, but how much to buy and how to use it.

About a quarter of the shoppers surveyed turned to counter personnel for help in planning evening meals.

- 26% relied on advice from meat department personnel

- 20% turned to deli counter personnel for help

The question then turns to how helpful these store associates were to customers in need of advice.

Source: The NPD Group/CCRRC Custom Survey

Since less than half the shoppers received sufficient help, there’s clearly an upside opportunity for retailers who want to make these exchanges more valuable. This can be done through training and by scheduling knowledgeable staff at times when their advice can lead to increased sales and customer satisfaction.

Some retailers are already promoting the friendliness and knowledge of their “butchers.” A significant number of shoppers clearly appreciate this, and it can result in increasing traffic, higher sales, stronger store loyalty, and an enhanced store brand by better connecting with your customers.

What kinds of information are consumers seeking from these staff members? It turns out that help in finding sale items and “the best value” is the most common assistance requested. This points to training opportunities; it also suggests that the signs calling out weekly specials in the meat and deli departments are not helping shoppers find the products and values they’re looking for.

Customers also showed interest in advice on how to plan and prepare meals.

- Meat department personnel were asked about differences between various cuts of meat, cooking methods and time requirements, and the quantity needed to feed a certain number of people.

- Deli department personnel were asked about the quantities needed to serve a certain number of people, the taste of different products, and how long they would keep.

This customer service will be even more effective when product offerings and staff training are focused on a high-priority dinner occasion selected from the seven options presented in the previous chapter.

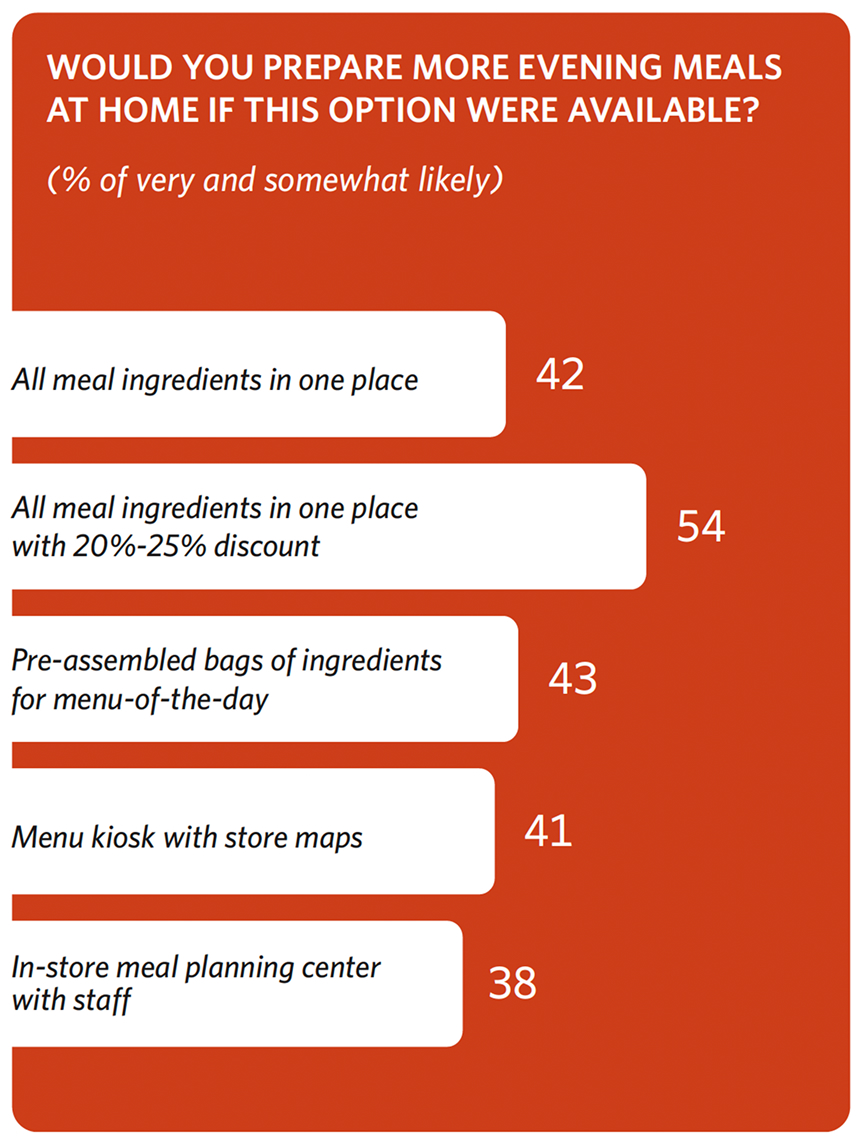

Dinner display option responses

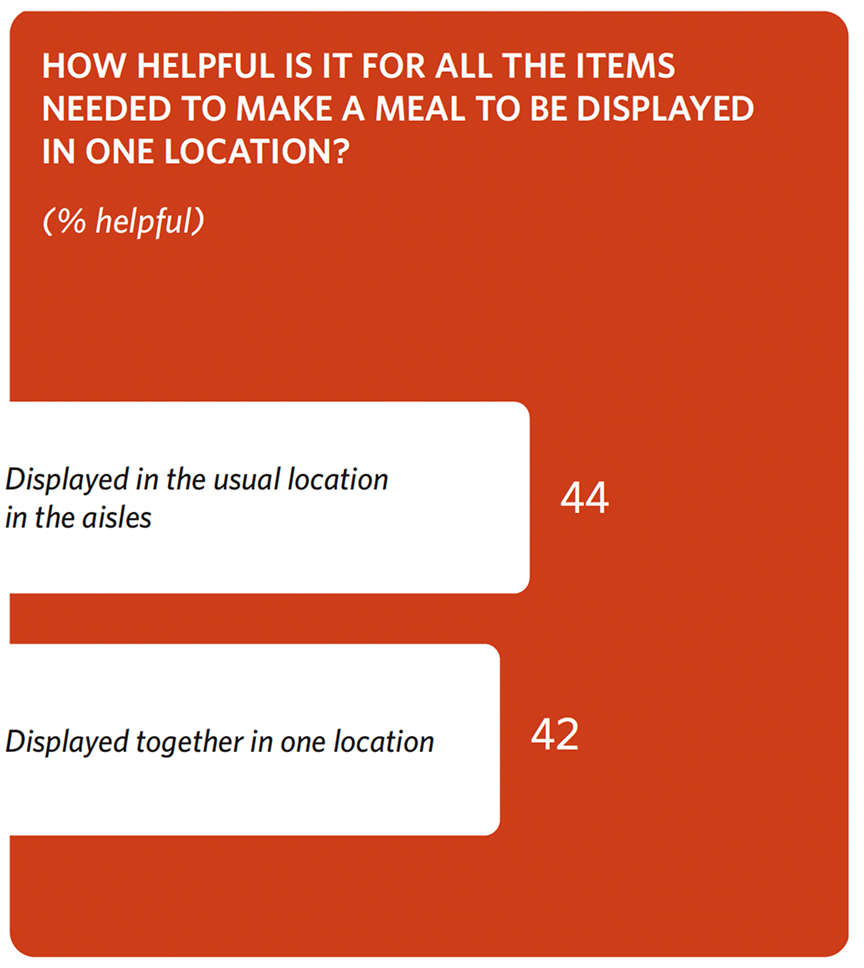

Retailers have been experimenting with different ways to make it easier for customers to purchase all the items needed to make a meal. To learn about shopper reaction to different options, the custom survey looked at how likely shoppers would be to serve more dinners at home if their store used one of several different display methods to help them build a meal.

While all these options made it more likely that customers would prepare dinners at home, the action with the greatest impact involved putting all the items together in one place and offering a significant discount. A number of retailers are doing this today, using different executions and different price points, such as a meal for 4 under $15. Market observations suggest, however, that even these displays often don’t attract a lot of attention and can be difficult for customers to understand and use to their advantage. More work needs to be done to find the best ways to communicate these value-adding displays.

Three other display options essentially tied for second place —building pre-assembled shopping bags that include all the items for a meal, displaying all the ingredients in one location, and offering a menu kiosk with store maps that show product locations.

Somewhat surprisingly, the staffed, in-store meal planning center was ranked lowest among the four options, suggesting that many customers shop in a self-service mode.

Some additional insight into the challenge of displaying meal solutions can be found in what shoppers said about the helpfulness of displaying meal components together.

It looks like many customers don’t place much value on displaying all meal items together, perhaps because it is not a problem for them to find the items they need in the aisles.

Source: The NPD Group/CCRRC Custom Survey

Source: The NPD Group/CCRRC Custom Survey

Potential game-changers

Recognizing that many customers will be slow to engage (and even resist trying) retailer meal solution programs, The NPD Group and Council members brainstormed potential game-changers —ways for retailers to break through the clutter and make it obvious to shoppers that something new, different, and helpful is being offered.

Each of the game-changers can be powerful in its own right but will be more powerful if implemented to deliver against specific meal occasions. This will allow the retailer to target specific customer segments and more effectively advertise the offer.

Meal solution demonstrations

Goal: To make it easier and more exciting for customers to try new meal solutions while increasing manufacturer involvement in the delivery of this service.

Today, most demonstration programs are product-specific. This proposal instead focuses on building the total meal and in the process highlighting the important ways that building that meal at home benefits the customer.

This game-changer can work with all seven of the dinner meal occasions but will be particularly effective for Tasty Creations and Family Entertaining.

Most manufacturers have plenty of ideas about how their product or products fit into a total meal. To execute this game-changing idea:

- Identify the store’s top-priority meal occasions — those that meet the needs of the retailer’s target shoppers and are consistent with the retailer’s overall go-to-market strategy.

- Share this strategic meal-building focus with the manufacturing community, along with specific information about the requirements for creating a successful demonstration.

- Evaluate manufacturer recommendations against the strategy and retailer execution needs.

- Eliminate those that don’t fit, and communicate the reasons to the manufacturer. Prioritize the recommendations that fit the strategy and set a schedule for the demonstrations.

- Include incentives for customer feedback after each demonstration (to enable continuous improvement in execution) and after the customer builds the meal at home (to verify that their needs are being met).

Home Depot-like classes

Goal: To provide customers with a recognizable and convenient way to sharpen their cooking skills in a welcoming environment.

This game-changing idea is about food retailers establishing themselves as the place to go for consumers who are interested in learning to prepare different kinds of meals.

Classes can be designed for all the dinner meal occasions, but the high information requirements around Nourishing Fare make it a logical place to start.

Taking best practices from The Home Depot leads to specific ideas:

- Survey customers to find out what they would like to learn about meal preparation and how they define both a satisfactory and an exceptional learning experience.

- Evaluate the responses to identify the target customers’ top-priority needs and build classes for each of these needs.

- Conduct pilot classes to test the preliminary approach to each area of need in order to learn more about consumer expectations.

- Involve a select group of loyal customers —people who already like and trust the retailer, and who express interest in being part of the pilot.

- Take this opportunity to explore alternative business models for the classes.

- Complete the design of the first set of classes and develop a marketing program to introduce them to customers.

Convenient pick-up for fresh prepared food

Goal: To offer customers the speed and convenience they’ve come to expect when purchasing carry-out meals.

This idea is about neutralizing the supermarket’s major vulnerability in the area of fresh, prepared, ready-to-eat food: the inconvenience of having to go into the store.

This game-changer should be particularly effective for the Last-minute No-brainer and Tasty Creations dinner occasions.

The ultimate solution would be to modify the current building to include drive-through, drive-up, or deliver-to-the-car capabilities, or even to establish a permanent remote site near the street on the outer edge of the parking lot where consumers can easily pick up prepared meals.

The idea could be tested on a temporary basis before making any capital investment. A Friday night pizza pick-up program is one example. Another possibility is to use a tent or a specialized trailer and tie it into holidays or special occasions to take advantage of peak demand.

The Coca‑Cola Retailing Research Council

The Coca‑Cola Retailing Research Council of North America was created by The Coca‑Cola Company to address issues of strategic importance to the North American supermarket industry. The Council is responsible for identifying and framing the strategic issues to be addressed. The process allows for retaining consulting resources to conduct the research and analysis associated with the identified issue, to direct and guide the conduct of that research and analysis, and to ensure that the results are reported and presented to the supermarket industry in a way that is useful and actionable.

The Council consists of supermarket industry executives who carry out the responsibilities and tasks associated with the mandate described above. The current Council includes:

Jonathan Berger, General Manager, The Americas, CIES

Paul Boyer, Vice Chairman and Co-CEO, Meijer, Inc.

Shelley Broader, Formerly President and CEO, Sweetbay Supermarket

Malcolm Calhoun, Vice President and General Manager, Calhoun Enterprises, Inc.

Pat Curran, Retired Executive Vice President, People Division, Wal-Mart Stores, Inc.

Oscar Gonzalez, Chief Operating Officer, Northgate Gonzalez Markets

Mike Jackson, Retired President and COO, SUPERVALU

Calvin Mayne, Chief Operating Officer, Dorothy Lane Market

Archie McGregor, Owner, IGA Plus

Rodney McMullen, President and COO, The Kroger Co.

Martin Otto, CFO and Senior Vice President, Grocery Procurement & Merchandising, H.E. Butt Grocery Company

Marc Poulin, President of Operations, Sobeys Quebec

Michael Sansolo, President, Sansolo Solutions

Don Sussman, Executive Vice President, Supply Chain Development and Sourcing, AHOLD USA

Ken Waller, Executive Vice President, Hy-Vee, Inc.

Acknowledgements

The Council would like to acknowledge the tremendous contribution made by The NPD Group team and especially Joe Derochowski. Thanks also to Susan Lindsay and the production team for their assistance in executing this report, and to Bill Bishop of Willard Bishop Consulting for his guidance and facilitation throughout the project.

All trademarks and registered trademarks that appear in this publication are the property of their respective owners.

- Research report title goes here

- Research report title goes here

- Research report title goes here

- Blog post title goes right here

- Blog post title goes right here

- Blog post title goes right here

- Blog post title goes right here