Research Report

Convenience Store Customers and Sustainability

The Journey to Creating Brand Ambassadors

Building a business case for sustainability requires understanding shopper concerns and recognizing the challenges and opportunities that environmental and social issues present. This new study examines how shoppers feel about sustainability, what actions they want local convenience stores to undertake and how these actions might impact shopper loyalty toward an individual store.

The report also includes a road map that explores steps individual operators can take in terms of difficulty and impact.

Introduction

As more companies across the United States accelerate their strategic sustainability initiatives, consumers are also broadening their understanding and interest in environmental and a range of social responsibility issues.

The NACS/Coca‑Cola Retailing Research Council (NACS/CCRRC) selected the Shelton Group to conduct market research to evaluate consumer perceptions and expectations of convenience stores on sustainability-related issues and identify how retailers can deliver impactful programs, develop action plans and communicate their efforts with customers.

Convenience retailers can leverage the insights within this report to gain a better understanding of where their customers are on their sustainability journeys. To create a stronger customer connection with their brand, retailers will also find sustainability-related strategies and tactics.

This white paper includes a road map to help convenience store companies get a sense of the range of activities they can undertake, with an understanding of the difficulty of each specific action and the likely impact of that same action. (The road map appears on page 10 of this document.)

“I would definitely be interested in going to [a more environmentally friendly] convenience store as it would align with my values, but it would also be exciting to see what would feel like a more modern convenience store.”

David

Illinois

Methodology

From February 2020 to September 2020, Shelton Group on behalf of the council conducted a multiphase qualitative and quantitative study of frequent and infrequent convenience store customers. Research began with Shelton Group partner, Schlange & Co., an international sustainability consultancy, engaging with convenience stores in North America, Europe and Asia to identify more than two dozen sustainability issues and evaluating their approaches. Additional insights were gleaned from interviews with experts from convenience stores and trade organizations in Europe, as well as a survey of relevant laws, regulations and trade association commitments in North America, Europe, Japan and South Korea. The goal was to understand what is occurring in other markets that could be applied in the United States.

Shelton Group conducted fieldwork of “mobile shopping trips” in which a dedicated research app was used to observe the activities of 50 frequent convenience store visitors (selected for personal and geographic demographics, covering all nine U.S. Census regions) to understand the role sustainability played in their convenience store shopping routine. Participants shared feedback on a variety of sustainability-related topics, including visible cues and signs they used to learn about the sustainability initiatives underway at their primary convenience store.

Then Shelton Group conducted a quantitative survey that measured consumer perceptions and needs on sustainability and social responsibility in convenience stores to quantitatively map the consumers’ sustainability journey and awareness. More than 2,000 frequent and infrequent customers from a mix of regions and demographics were included in the survey. The results of the overall sample have +/- 2.2% margin of error and a 95% confidence interval.

As this research was conducted during the COVID pandemic, consumer research—especially observations of shopping trips—was done using technology to replace in-person teams. The impact of COVID is obvious in shopper interest in safety measures such as hand sanitizing stations and more.

Shoppers on the Move: Customer Frequency and Opportunities for Engagement

Convenience store customers often travel within a triangle of home, work and a “third place” like a convenience store. This did not change in 2020 despite the pressures of COVID-19, as 68% of frequent customers say they visited a store as often as or more pre-pandemic.

The behaviors of frequent customers can help retailers implement sustainability strategies within their businesses that resonate with these shoppers. Frequent customers visit their preferred convenience stores three or more times per week to purchase a variety of products, whether out of necessity or as an impulse purchase.

A majority of frequent customers (64%) are likely to promote their favorite convenience store (to family and friends) and are informed about the store’s programs and activities. When presented with social, product or environmental initiatives by convenience stores, frequent customers indicated that they were more likely than infrequent customers to have their convenience store choice influenced by the implementation of these measures.

These frequent customers are more likely to be a receptive audience for a convenience store’s sustainability efforts.

In addition, the issue of sustainability does not exist in isolation. The same shoppers who put emphasis on sustainability also have a heightened level of concern in a range of social issues including employee work conditions.

1

Home

2

Work

3

C-Store

“Wow, if convenience stores weren’t here, I don’t even honestly want to entertain that thought. C-stores are involved community partners. Our stores are a constant source of consistency and comfort in a very changing world.”

Lisa

Iowa

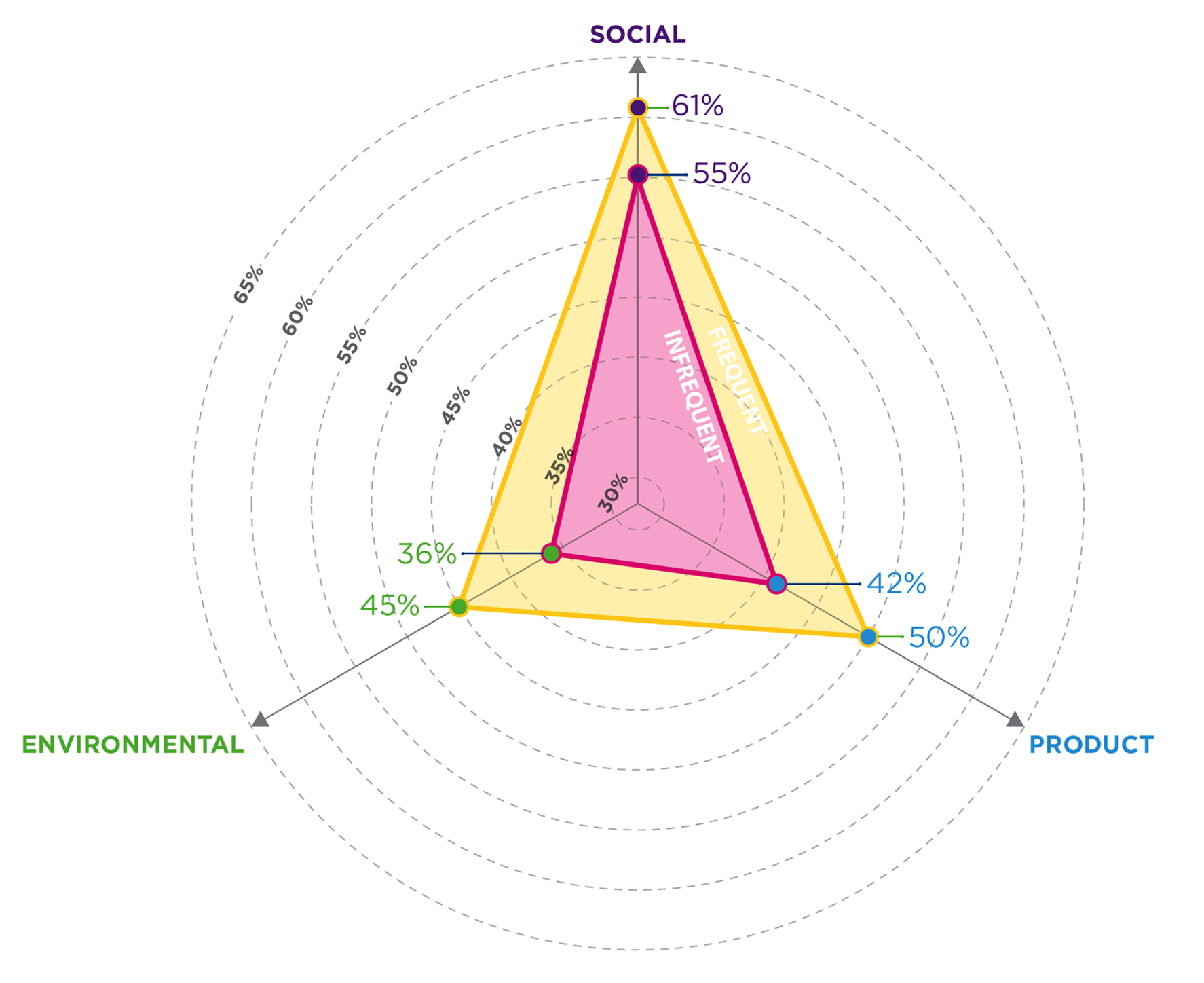

Social initiatives are most likely to have the biggest impact on all c-store customers. Frequent customers, however, care more than infrequents about the full range of social, product and environmental initiatives.

Finding Their Way: Consumers Are on Their Own Sustainability Journey

The idea of a sustainability journey has become commonplace among large companies. In recent years, corporations have accelerated their ESG efforts across every aspect of their operations and beyond, as they are encouraged by investors, legislators and other stakeholders to do well by doing good. Whether a business has robust programs in place or is still figuring out the issues that are material to them, improving sustainability performance is increasingly becoming table stakes for doing business.

Frequent convenience store customers can be divided by varying levels of their understanding of sustainability issues. Within these groups, priority “care about” issues emerge. However, these categories are not static; they represent a path upon which customers are always moving and progressing.

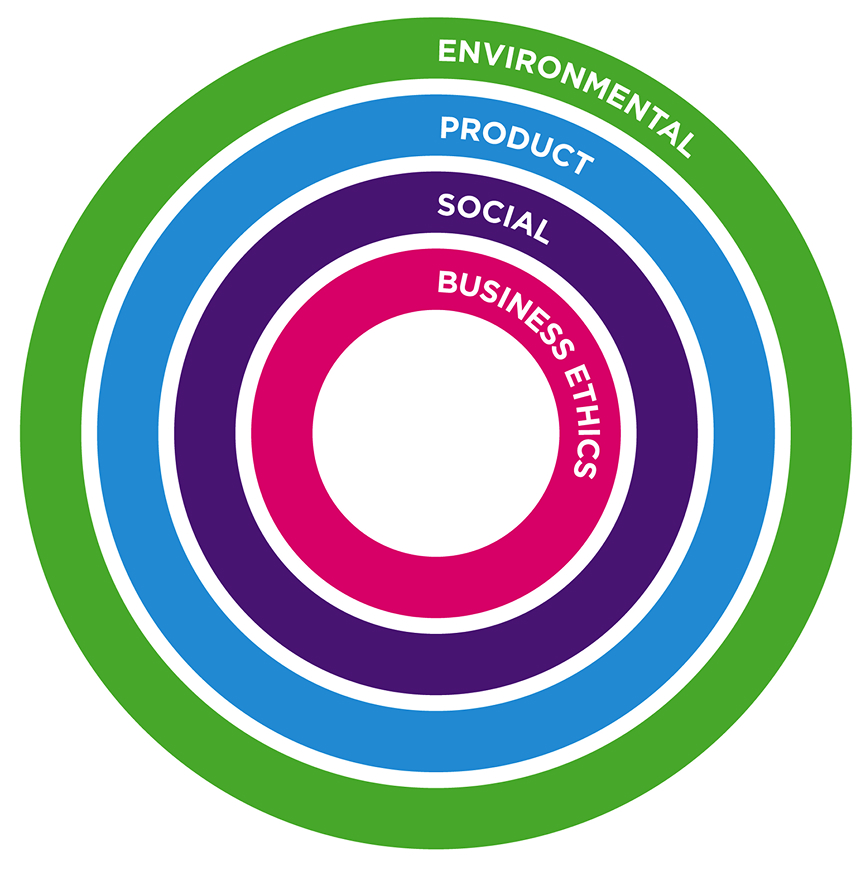

The research identified four areas of this progression path, represented visually in concentric circles. Each ring represents a different focus area across a range of sustainability issues that affect convenience store customers, such as product, social and business ethics issues.

The basic level of customer engagement with sustainability is business ethics. Most customers are at least passively engaged at this level, and they assume that stores and their parent companies are complying with the law and operating responsibly. These consumers are concerned about issues like data privacy and safety and have not begun their sustainability journey.

Convenience store customers often begin their sustainability journey with social concerns. These customers are “Beginners” and represent about 23% of frequent convenience store shoppers. Beginners want to know a convenience store is bettering the community it serves.

Customers focused on the products they purchase as they relate to environmental impacts and benefits are “Deciders.” Approximately 45% of frequent customers have progressed to this category. Deciders are driven by their purchasing behavior and care about the same social issues as Beginners.

The more advanced shoppers are “Involved” convenience store customers who often have knowledge of ESG planning and metrics. They represent the smallest segment of convenience store shoppers and look for retailers that have implemented programs to reduce their carbon footprint and conserve energy.

The Consumer Journey

The four areas in the sustainability progression path are represented visually in concentric circles. Customers in each ring care about the full range of issues it contains, including the rings within.

The impacts of COVID-19 have amplified customer values in every category, making engagement on these topics more important than ever.

Beginners

social

Deciders

product

Involved

environmental

Beginners

“Beginners” have a distinct set of concerns, all of which are centered on people. When these customers do not feel a link between a store and the community, it will detract from their loyalty. Connection with employees rises to the top of the factors that drive store choice, and great service and employee friendliness are just the start of a two-way exchange. Top issues for Beginners include diversity and inclusion, employee health and safety and philanthropy.

“Giving back to the community – I think that’s very important. The community is what makes your business, so if you don’t have your community, if you don’t have people, your business is not going to survive.”

Nikki

Maryland

Deciders

As customers get more sophisticated, they begin to look at product issues and turn their attention toward the items they purchase during each visit. These customers are “Deciders” who expect their purchases to have maximum benefit and minimal negative impacts. Approximately 45% of frequent customers have progressed to this category, and they have all the same concerns as Beginners. In other words, the Deciders care about all of the same social issues that Beginners care about, but they go a step further. Purchase behavior among Beginners is not affected by product issues, but among Deciders, it clearly is.

Just as customers think of social concerns in terms of community involvement, customers in this ring are most likely to view product issues in terms of packaging waste – its direct impacts and how it affects customers’ ability to be sustainable in their own lives. Other top issues for Deciders include food waste, nutrition and health and sustainably sourced products. Sustainability basics like recycling can have a significant impact on store reputation and purchase behavior among Deciders, both positively and negatively. Stores can attract customers by addressing product concerns, and they can also drive customers away by neglecting them.

“I wish this store carried more items in recycled materials, and it negatively impacts my view that they don’t. Ultimately it is the consumer who is most responsible, because we continue to buy.”

Samuel

Texas

Involved

The most advanced customers are focused on environmental issues, and they understand the connection between their local store, its corporate owner and the world at large. These customers are “Involved” in ESG issues and may even have some knowledge of the specialized vocabulary and metrics that entails. Involved customers want c-stores to reduce their carbon footprint at the corporate level – energy and emissions are the top issues.

Fewer customers have made it to this level than the combined inner rings, but with 32% of frequent customers Involved in environmental issues, they cannot be overlooked. Significantly, a high percentage of Deciders also expresses interest in the topics found in this ring, an indication that many of these shoppers are on the cusp of becoming Involved themselves.

“I think [my preferred c-store] already does a pretty good job of being environmentally friendly . . . I mean, that stuff is important to me – the stuff that goes on behind the scenes like that – because I feel like it just contributes to being a more professional company that cares about not only making money, but also the world that we all live in.”

Ray

Georgia

Bring Them Along: Engaging With Customers on Their Journey

Knowing who customers are and understanding where they are on their sustainability journey is key to communicating a company’s sustainability messages and initiatives.

Beginners are focused on issues related to people, such as a convenience store’s connection with its employees, great customer service and employee friendliness. Beginners are also interested in a store’s diversity and inclusion, employee health and safety and charitable efforts.

Charitable giving and sponsorships of local groups, such as schools and little league teams help establish engagement with Beginners to their local convenience store. Product-focused initiatives are not as important to Beginners but remain important to Deciders and Involved customers.

Deciders are likely to view product issues in terms of packaging waste and how it affects their own sustainability-based values. These customers also believe that convenience stores have a role to play in helping them make responsible packaging choices.

Recycling can impact store reputation and purchasing behavior among the Deciders. Recycling bins are a commonly sought sustainability feature, and stores that make them available could see an increase in customer loyalty. Convenience stores are not alone in this, however, as brand owners and consumers also share the responsibility for waste disposal and recycling.

Most Deciders and Involved customers feel moderately to strongly responsible that changes in their personal daily habits and purchasing practices can have a positive impact on the environment. These consumers feel that if they change their buying habits, retailers will adapt and stock fewer products that negatively impact the environment or community health. Beginners are also engaging on this front, with half saying they feel a sense of personal accountability for the environment.

Environmental initiatives are most relevant to Involved customers but also have the lowest impact on store choice, although many consumers say that specific environmental initiatives can impact their shopping behavior. Sustainability initiatives in this area have less of a direct impact on consumers, and it’s often understood that environmental initiatives are managed at the corporate level.

Involved consumers link environmental issues to energy use and low carbon emissions. Initiatives such as LED lighting, energy-efficient coolers and renewable energy sourcing can impact their purchasing behavior.

Among Beginners, Deciders and Involved customers, social initiatives resonate the most. When asked an open-ended question about what would inspire them to recommend their store to their social circles, frequent responses related to personal interactions with employees. This relationship is not a one-way street, however, and frequent customers expect a convenience store to take care of its employees, a concern heightened throughout the COVID-19 pandemic.

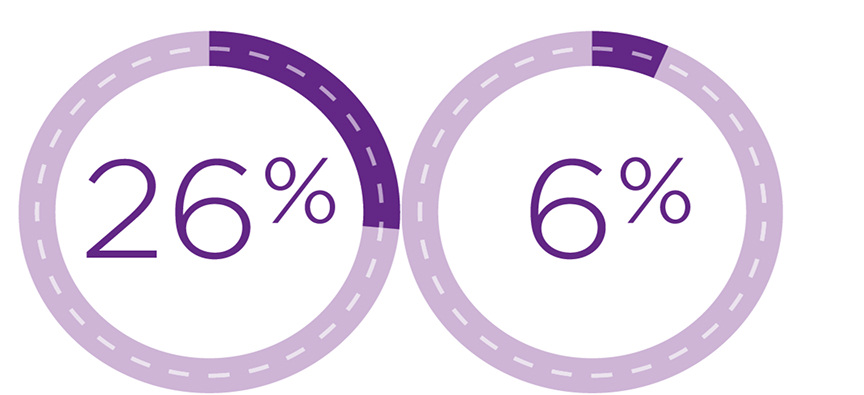

Frequent Customer Awareness Levels

Social

26% don’t know if their store has social initiatives

6% know that their store does not have initiatives Environmental 42% don’t know if their store has environmental initiatives 10% know that their store does not have initiatives

Environmental

42% don’t know if their store has environmental initiatives

10% know that their store does not have initiatives

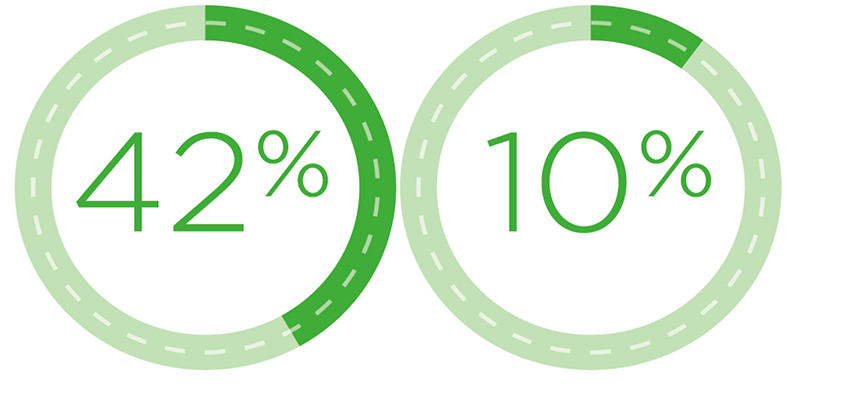

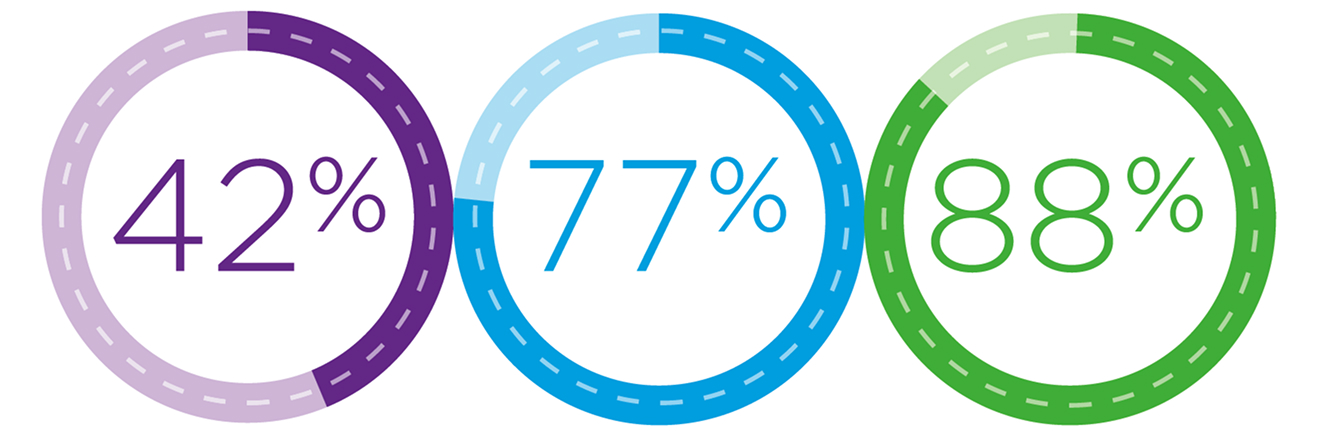

42% Beginners

77% Deciders

88% Involved

Say a company’s participation in community and social issues, including nonprofit partnerships and donations, has a moderate to very strong impact on purchase intent

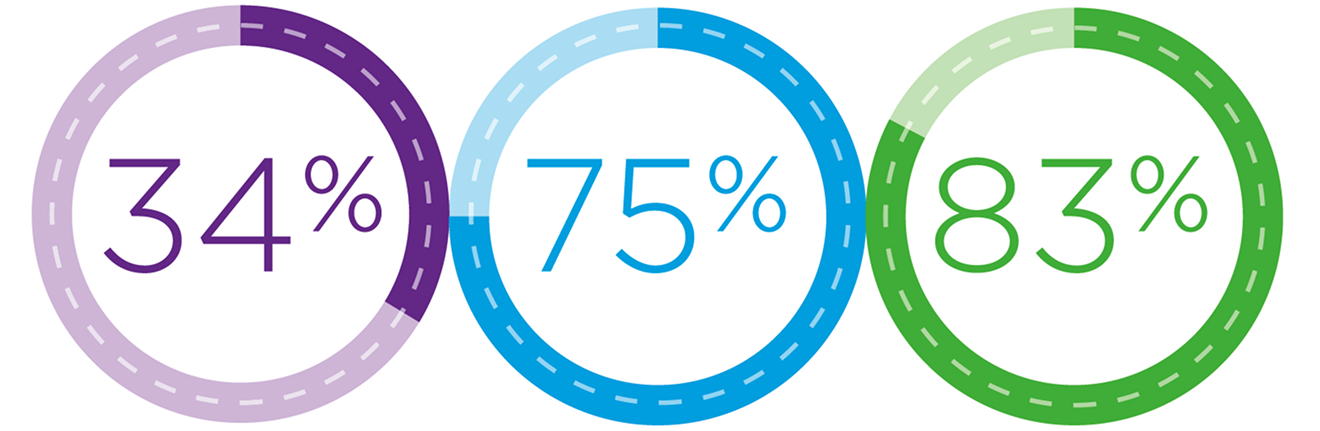

34% Beginners

75% Deciders

83% Involved

Say a company’s environmental reputation, as it relates to products, has a moderate to very strong impact on purchase intent

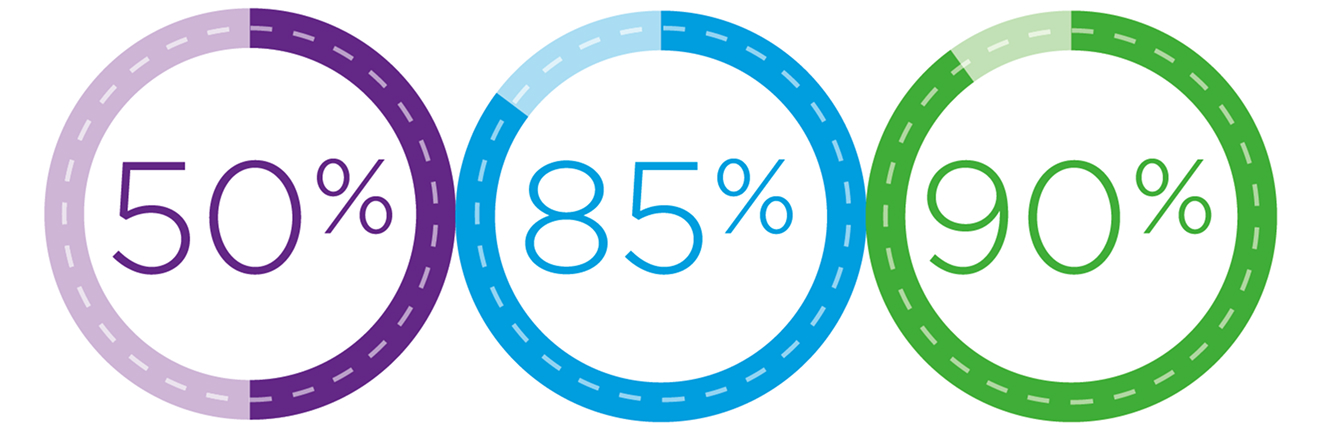

50% Beginners

85% Deciders

90% Involved

Feel moderately to very strongly responsible to change their daily habits and purchase practices to positively impact the environment.

“This store lacks any seeable effort of energy efficiency. One simple change would be energy efficient coolers. The lights aren’t LED either. I feel this is a simple yet tremendous change that could be made . . . I again have a negative view of this store viewing it from an environmental perspective.”

Mikella

Kentucky

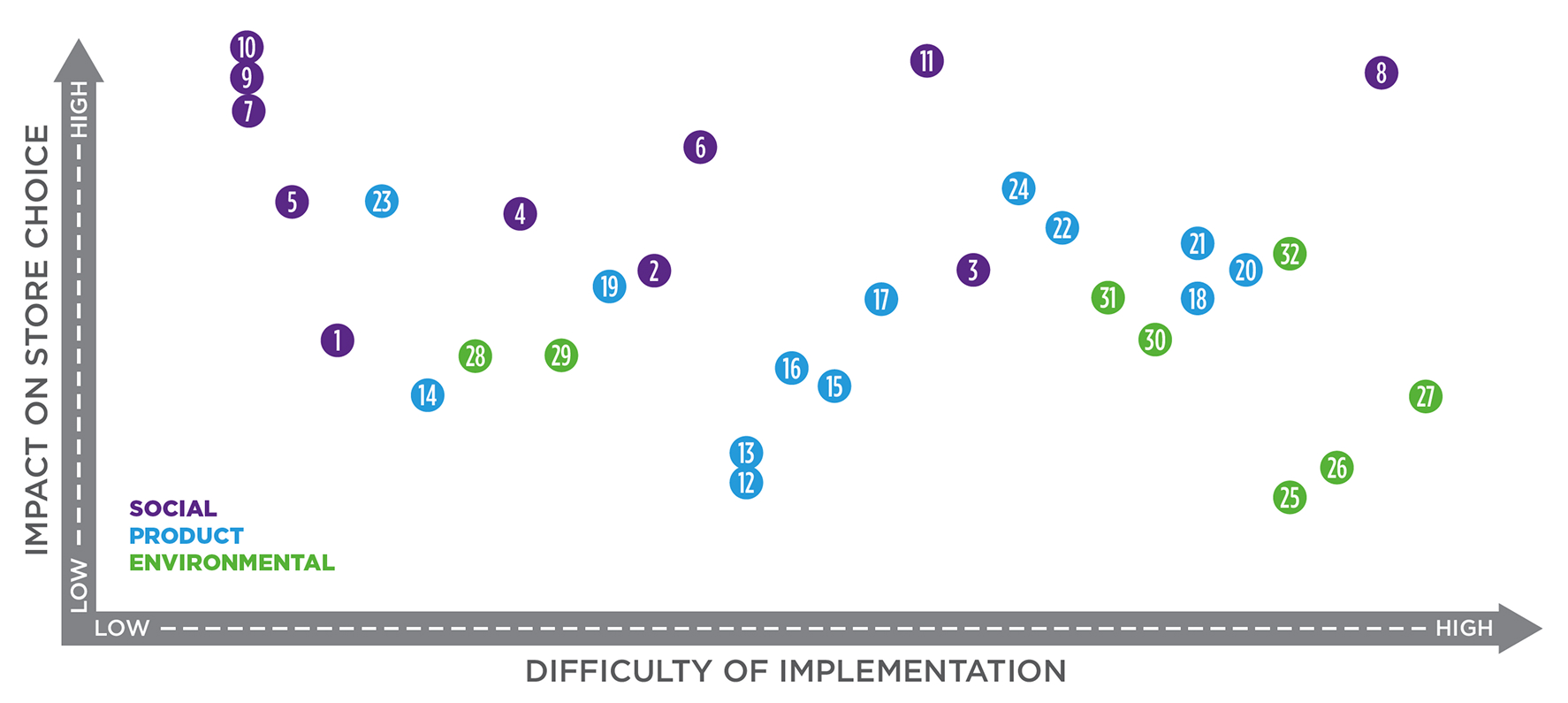

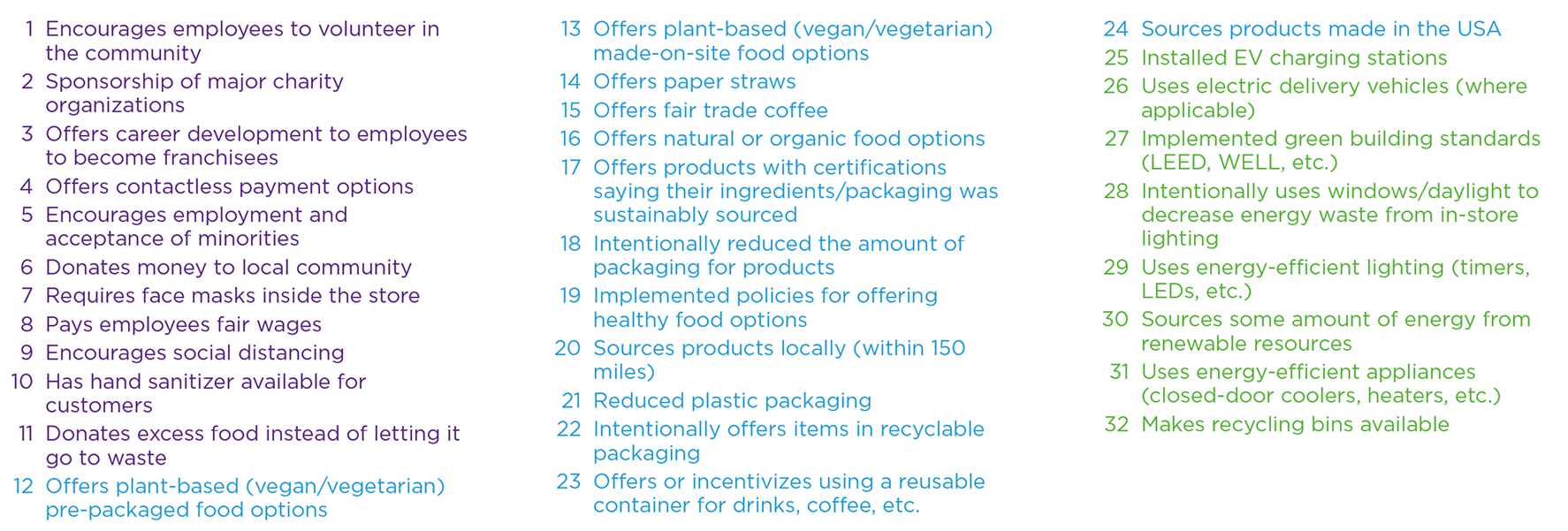

Taking Strategic Steps: A Road Map for Creating Store Promoters

There is an identifiable progression for each type of frequent convenience store customers. While there is no one-size-fits-all approach that will work for the entire convenience retail industry, initiatives in the social, product and environmental categories could influence store choice and shopping frequency.

The chart below compares the impact on store choice to the difficulty of implementation for sustainability initiatives, and the actions that retailers can pursue.

C-store owners are asking:

- What will make the biggest impact?

- What is easiest to do?

Beginners, Deciders and Involved consumers can be brand promoters, but the range of sustainability issues that they care about could make it difficult and costly for a retailer to engage all these shoppers at the same time.

A strategic and prioritized approach that touches on social, product and environmental categories could help fast-track sustainability programs in stores.

To help retailers determine the best path for their stores, there are two questions to consider:

- How will each initiative impact frequent customer store choice?

- How difficult or costly is each initiative?

To answer the first question, customers surveyed for this report identified initiatives that would affect their choice of store. The answer to the second question relies on a qualitative assessment of the ease of implementation for the average-sized convenience store. Mapping these answers against each other on an X/Y axis unlocks a roadmap for action, ranging from low impact and low cost to high impact and high cost.

Quick Wins: Top Priorities for Immediate Results

Impact: High | Difficulty:

Low Some initiatives can be quickly implemented and have an immediate impact on frequent customers.

With COVID-19 top of mind in 2020, nearly two-thirds of all consumers said that providing hand sanitizer, requiring masks and encouraging social distancing had a moderate to very strong impact on where they chose to shop.

Other high-impact quick wins focused on connections within the community. Diverse hiring practices that represent local populations can show a company’s commitment to the community, for example.

Encouraging employee volunteerism and monetary donations to local charities and groups also help communicate to customers that their neighborhood is stronger with support from their local convenience store.

Steps to Keep Employees and Customers Heathy and Safe:

- Provide employees with adequate protection.

- Add signage to communicate cleaning practices and other processes for their protection.

- Encourage social distancing with floor stickers.

- Provide hand sanitizer for customers and employees.

- Offer contactless payments.

- Offer or incentivize reusable containers when it doesn’t compromise community health.

More Quick Wins: Smaller Steps in Your Sustainability Journey

Impact: Low to Medium | Difficulty: Low

There are opportunities to enhance initial sustainability efforts and subsequently increase store and brand loyalty.

Starting with energy consumption, nearly half of the Beginners (47%) say they would promote a store if they know it uses energy-efficient lighting, and that number reaches 65% among Involved consumers.

Using technologies such as on/off timers, LED bulbs and making use of natural lighting provide a tangible benefit to a store’s energy efficiency performance and help reduce utility costs. Promoting these efforts through in-store signage, social media, and a company’s website and mobile app communicate the store’s sustainability story to customers and future promoters.

Product certifications also resonate with shoppers. More than half of Beginners and 65% of Involved customers say that offering products with sustainability certifications like Fair Trade coffee on packaging would drive them to be store promoters.

Next-Level Work: Increased Difficulty for Increased Rewards

Impact: High | Difficulty: Medium to High

More than half of all consumers say that offering products with recyclable or reduced packaging waste has a moderate to very strong impact on where they shop. In addition, more than half of consumers also express concern over disposing of packaging when there are no recycling bins available at a convenience store.

- Steps to support consumers’ recycling efforts:

- Offer products in recyclable packaging

- Offer mug/refillable cups and mug programs

- Implement food waste programs

- Provide recycling bins inside the store and at the pump

More than 70% of Americans feel moderately to strongly responsible to change their daily choices to positively impact the environment (source: Eco Pulse® Wave 13 2020), and 80% of Americans believe that recycling is the bare minimum they can do for the environment (source: Recycling Pulse 2020). The research suggests that consumers are looking for leadership and support from their local convenience store to help them on their sustainability journey.

Many of these initiatives come with significant costs or other challenges. Readers can find relevant material from NACS to augment store-specific assessments to help guide any retailers’ strategic planning on addressing these issues.

Steps to Support Consumers’ Responsibility Efforts:

- Offer products in recyclable packaging.

- Explore options to source more local products.

- Give preference to products made in the U.S..

- Implement food waste programs.

- Offer recycling bins inside the store or at the pump.

Rounding Out the Story: Harder Initiatives for the Whole Package

Impact: Low | Difficulty: Medium to High

The research identified initiatives that can be part of a long-term sustainability strategy and contribute to a convenience store’s brand halo (i.e., an overall sense of trust among consumers) by communicating the benefits to employees and customers.

For example, electric vehicle charging infrastructure carries significant costs. Long term, EV charging communicates a brand’s sustainability story and delivers visual cues to consumers, but it may not have an initial impact on changing consumer behaviors.

Beyond infrastructure, convenience retailers also have an opportunity to look at the sustainability attributes of the products they sell and identify whether they can offer healthier and sustainably sourced options such as plant-based, vegan or vegetarian options.

In 2020, 50% of consumers said they were looking for greener products. Consumers not looking for greener products said they would prefer to buy them, but were frustrated by higher costs and availability. Stocking more sustainable products and communicating these efforts to consumers is a potential opportunity for retailers.

Approximately one-third of frequent customers say electric vehicle chargers are important, but only 7% drive an electric vehicle themselves.

Steps to Invest in Sustainable Store Infrastructure:

- Install electric vehicle chargers.

- Source electricity from renewable energy sources or purchase Renewable Energy Credits (RECs).

- Convert store vehicles or fleet to hybrids or electric.

- Adopt green standards such as LEED or WELL.

Routes to Engagement: Reaching Customers Where They Are

“Doing good” is not enough to turn a frequent customer into a store promoter. To take that final step, convenience retailers must tell their story and communicate their positive community efforts and programs, including their sustainability and social responsibility initiatives.

Convenience store customers have different needs and concerns when it comes to sustainability, which creates an opportunity for retailers to lead education and communications within their community. Talking with customers in their preferred channels, for example, will help ensure that the right messages create a connection to their brand.

In-store signage, flyers, standees and other traditional print collateral are great ways to communicate programs and initiatives. While quickness and ease of purchase are top motivators for store choice, frequent and infrequent customers report having ample time inside the store to notice advertising and absorb messages.

Many convenience retailers engage in transactional communications with their customers, with more than half of frequent customers saying that they participate in loyalty programs via a mobile app. Strategic emails and in-app communications are an opportunity to reach consumers in channels where they are already looking for added value.

Social media and a robust online presence will help retailers reach consumers who are actively seeking sustainability information. Approximately 63% of frequent shoppers point to online searches as their primary source for this type of information, and many say they follow their local convenience store on social media. Facebook provides the most organic connections with customers, although retailers may need to evaluate whether to invest in paid advertising to reach more audiences and amplify their core messages.

Some tips about tone:

- Avoid greenwashing by making sure that claims are credible and initiatives are impactful.

- Keep stories simple and avoid jargon. Most consumers don’t understand the complexities of “sustainability,” even if they care about many of the issues it covers. Set the context and tell them why sustainability initiatives matter.

- Collaborate with customers – sustainability is about “we,” and c-stores have an opportunity to lead.

Conclusion

As convenience stores advance their sustainability strategies, customers are on a parallel sustainability journey, advancing their sophistication, understanding and engagement with environmental and social responsibility.

Frequent customers are likely to have their purchase decisions swayed by their chosen convenience store’s sustainability efforts, or lack thereof. Creating store promoters and retaining loyal customers hinges on having the right initiatives in place and communicating them in way that motivates action.

Customers are connected to their local convenience store in a deeply personal way, and community engagement and sustainable operations are vital to turn them into promoters for their chosen “third place.”

About the Authors

NACS Coca‑Cola Retailing Research Council

Carlos Arenas

OXXO

Paul Casadont

ExtraMile

Melanie Isbill

RaceTrac Petroleum, Inc.

Timothy Rupp

Speedway

Kevin Smartt

Kwik Chek Food Stores, Inc.

Rodrigo Zavala

Puma Energy

Henry Armour

NACS

Jay Erikson

Parkland Fuel Group

Kevin Lewis

Alimentation Couche-Tard

Emily Sheetz

Sheetz

Jay Soupene

Casey’s General Stores

Michael Sansolo

Research Director

Andrea Brecka

Shell Canada

Brian Ferguson

Pilot Travel Centers

Chuck Maggelet

Maverik

Michael Sherlock

Wawa

Lori Buss Stillman

NACS

Who We Are

The NACS Coca‑Cola Retailing Research Council is composed of convenience industry leaders from around the world. It conducts studies on issues that help retailers respond to the changing marketplace. The unique value of these studies rests with the fact that retailers define the objective and scope of each project and “own” the process through the release of the study and its dissemination to the broader retail community.

Our Mission

To identify big issues facing convenience retailers, do research that uncovers ways to deal with them, and then encourage retailers to use these new ideas to improve their business.

Shelton Group

Shelton Group is the nation’s leading marketing communications agency focused in sustainability and corporate social responsibility. We deliver thought-leading research, results-oriented marketing campaigns, emotionally compelling stories and user-friendly designs – all intended to help companies gain a market advantage as they work to create a more sustainable future. We connect the dots between what we see in our proprietary market trending data and real-life communications experience, using strategies, messaging and designs to create a future reality in which sustainability is ordinary. Learn more at sheltongrp.com.